News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 30)|Tether becomes the world's 17th largest holder of US Treasuries; SEC to rule today on Nasdaq Ethereum Trust staking proposal; Alternative for Germany proposes including Bitcoin in national strategic reserves.2Bloomberg: $263 million in political donations ready as the crypto industry ramps up for the US midterm elections3Solana Maintains 3-Year Support, Eyes $280 Resistance for Next Key Breakout

African payment giant Flutterwave taps Polygon blockchain for cross-border payments

Coinjournal·2025/10/30 22:09

Uphold relaunches XRP rewards debit card in the US with up to 10% back for users

Coinjournal·2025/10/30 22:09

Garden Finance exploit: over $5.5M stolen, 10% white hat bounty announced

Coinjournal·2025/10/30 22:09

Jiuzi Holdings taps SOLV Foundation for its $1B Bitcoin investment plan

Coinjournal·2025/10/30 22:09

Hedera Powers New Verifiable AI Agent Governance System for Governments and Enterprises

CryptoNewsFlash·2025/10/30 22:00

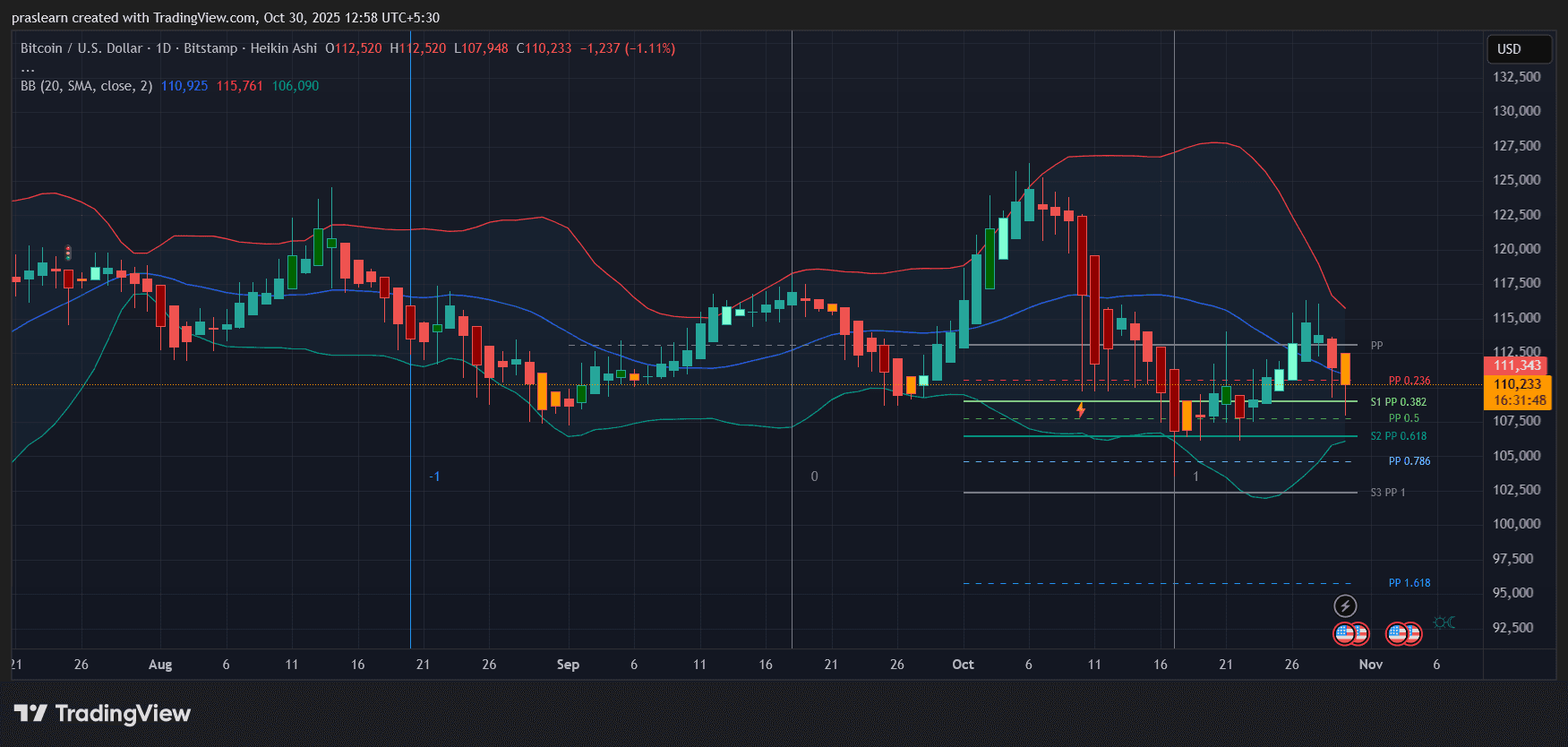

Will the Fed’s Rate Cut Spark a New Bitcoin Rally?

Cryptoticker·2025/10/30 21:54

SpaceX Moves $31 Million in Bitcoin

Cryptoticker·2025/10/30 21:54

Ozak AI Climbs, Alpha Pepe Expands, and BlockDAG’s Dual-Mining Design Shakes Up New Crypto Presales

Coinlineup·2025/10/30 21:18

Why the Upcoming Whitelist for Zero Knowledge Proof (ZKP) Is Drawing Attention from AI Developers

Coinlineup·2025/10/30 21:18

ECB Maintains Interest Rates Amid Economic Challenges

Coinlineup·2025/10/30 21:18

Flash

- 22:14Nasdaq futures open up 1.1%, driven by Apple and AmazonChainCatcher news, according to Golden Ten Data, Nasdaq futures opened up 1.1%, driven by after-hours gains in Apple (AAPL.O) and Amazon (AMZN.O).

- 22:13The timing of stopping balance sheet reduction sends a signal; the federal funds rate remains the Federal Reserve's preferred tool.Jinse Finance reported that the Federal Reserve decided to halt its balance sheet reduction after a decline in bank reserves, indicating that officials are increasingly relying on the federal funds rate as the primary tool for implementing monetary policy and assessing liquidity conditions in the financial system. The Federal Reserve announced on Wednesday that it will stop reducing its holdings of U.S. Treasuries starting December 1. Previously, short-term money market rates had remained elevated for several consecutive weeks. Although the Federal Reserve stated it will continue to reduce its holdings of mortgage-backed securities and reinvest maturing funds into Treasury bills, it did not announce any additional liquidity measures to ease financing cost pressures.

- 22:13CME "FedWatch": The probability of the Federal Reserve cutting rates by 25 basis points in December is 74.7%According to Jinse Finance, CME "FedWatch" shows that the probability of the Federal Reserve cutting interest rates by 25 basis points in December is 74.7%, while the probability of keeping rates unchanged is 25.3%. The probability of a cumulative 25 basis point rate cut by January next year is 57.7%, the probability of keeping rates unchanged is 16.6%, and the probability of a cumulative 50 basis point rate cut is 25.6%.