Bitget Daily Digest(October 30)|Tether becomes the world's 17th largest holder of US Treasuries; SEC to rule today on Nasdaq Ethereum Trust staking proposal; Alternative for Germany proposes including Bitcoin in national strategic reserves.

Today's Outlook

- From October 30 to 31, 2025, the HODL Summit Dubai will take place in Dubai, UAE, focusing on blockchain, cryptocurrencies, and digital transformation.

- From October 29 to 31, 2025, the Dakar Bitcoin Days III conference continues in Dakar, Senegal, addressing Bitcoin’s impact on financial inclusion and society in African countries.

- The US SEC is set to make a decision today regarding Nasdaq’s Ethereum Trust staking proposal.

Macro & Hot Topics

- Tether’s CEO announced that the company currently holds $135 billion in US Treasuries, making it the 17th largest holder globally.

- Mastercard is in late-stage acquisition talks with Zerohash, with the deal valued at an estimated $1.5-2 billion, signaling a major push into stablecoins and foundational Web3 infrastructure.

- A YZi Labs report showed that BNB’s historical supply burn has exceeded 62 million tokens, about 31.8% of the total supply, with 137 million currently in circulation.

- MicroStrategy founder Michael Saylor predicts Bitcoin could reach $150,000 by year-end and may target $1 million in the future.

Market Performance

- BTC and ETH experienced slight declines over the past 4 hours, with market sentiment remaining cautious. The past 24 hours saw $51.36 million in liquidations, mainly long positions.

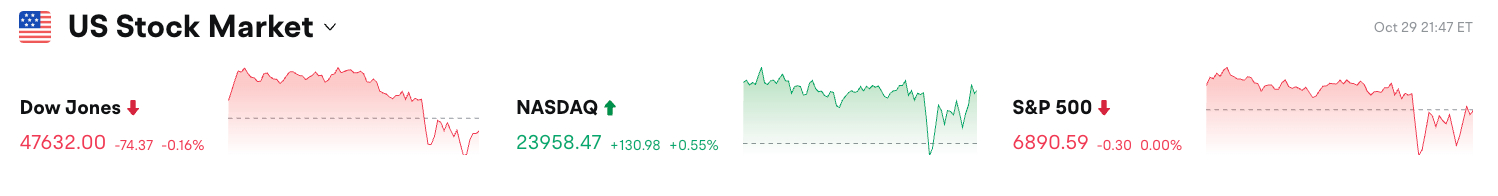

- US stocks closed mixed: the Nasdaq rose 0.55%, the Dow Jones fell 0.16%, and the S&P 500 remained flat, as markets focus on Powell’s comments.

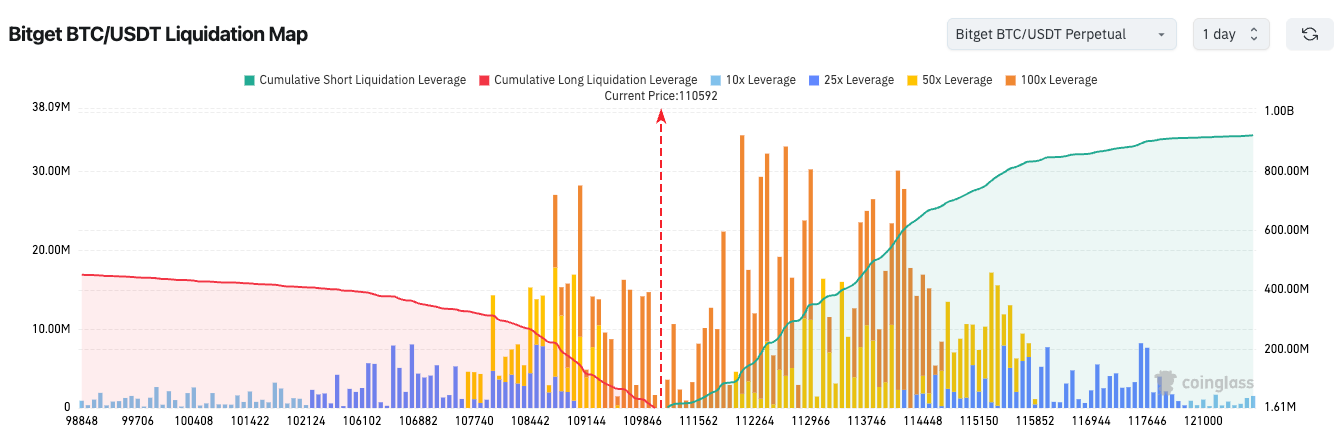

3.The Bitget BTC/USDT liquidation heatmap shows the current price at 110,576; intensive high-leverage liquidations are concentrated in the 110,000–115,000 range. A breakout or breakdown could trigger significant volatility.

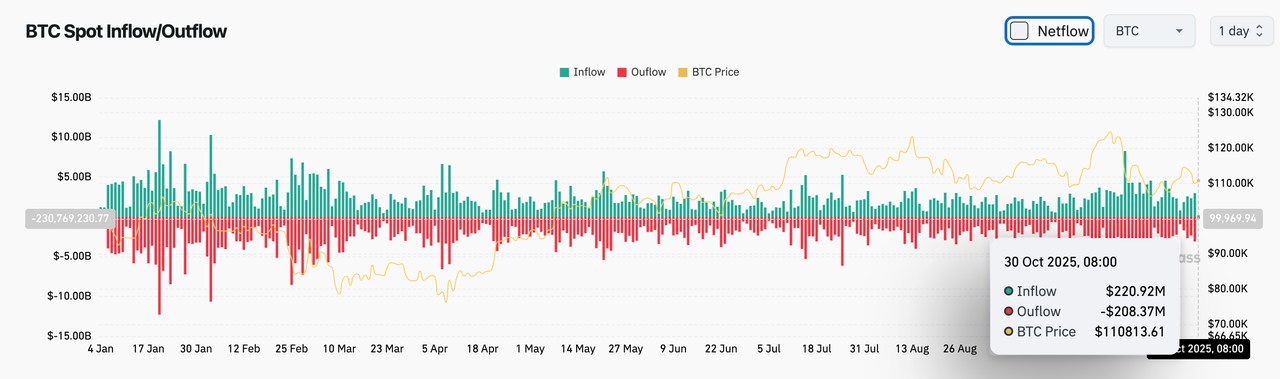

4.In the last 24 hours, BTC spot saw $220 million inflows and $208 million outflows, for a net inflow of $12 million.

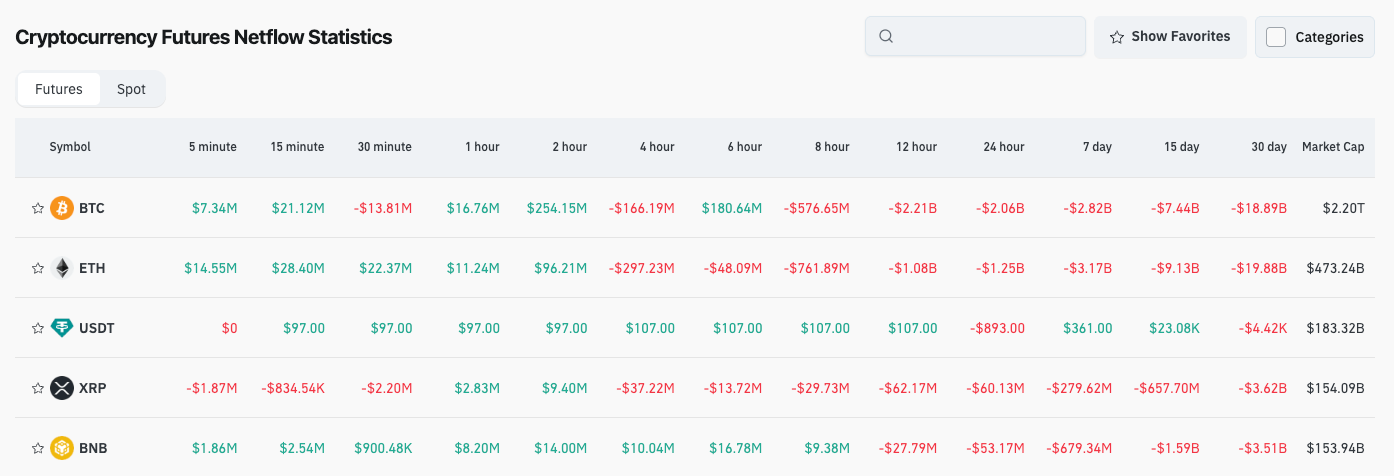

5.Over the past 24 hours, BTC, ETH, XRP, BNB futures trading saw leading net outflows, suggesting potential trading opportunities.

News Highlights

- Germany’s main opposition party, Alternative for Germany (AfD), submitted a motion to the Bundestag calling for Bitcoin to be included as a national strategic reserve asset and opposing excessive regulation.

- The chairman of Hong Kong’s SFC stated new guidelines would be issued for the financial handling of digital assets and is studying the issue of listed companies holding Bitcoin.

- Singapore’s DBS and Goldman Sachs completed their first interbank OTC crypto options trade, involving BTC and ETH.

- US lawmakers warn that “Trump’s push to channel retirement savings into crypto” could have disastrous consequences.

Project Updates

- Ondo Finance expands tokenized securities services to BNB Chain and partners with Bitget Wallet, enabling global investors to participate in US stocks and ETFs via Web3 wallets.

- Helius launches “Orb,” a Solana blockchain explorer featuring AI-powered explanations and transaction heatmaps.

- Infinit partners with Virtual Protocol to provide DeFi AI infrastructure for over 17,000 AI agents, driving deeper integration of AI and blockchain.

- GoPlus Security forms a strategic alliance with Brevis Network to jointly develop “security oracles” for the Web3 space.

- Telegram’s founder announces the launch of Cocoon, a decentralized AI computing network.

- MegaETH's public sale has now raised $954 million, with subscriptions exceeding the target by 19.1 times.

- Bitget Wallet is integrating deeply with NFT projects on BNB Chain, enabling cross-chain NFT trading functionality.

- Animoca Brands announces the acquisition of Aerodrome Finance and confirms purchase and staking of AERO tokens.

- MetaMask unveils upcoming features to support Bitcoin and Solana mainnets, accelerating its multi-chain wallet upgrade.

- Sui AI Incubator Surge selects Adapt, a multi-agent protocol, as its first incubated project, accelerating the construction of its AI ecosystem.

Disclaimer: This report is AI-generated and has undergone manual fact-checking. It is for informational purposes only and does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Update: Ondo Opens Wall Street Opportunities to 3.4 Million International Investors Through BNB Chain

- Ondo Global Markets tokenized over 100 U.S. stocks/ETFs on BNB Chain, expanding blockchain access to Wall Street assets for 3.4M global users. - Partnership with PancakeSwap enhances liquidity via low-fee, high-speed trading, supporting $1.8B in real-world assets (RWAs) and $670M in Ethereum on-chain volume. - Addresses non-U.S. investor barriers in Asia/Latin America by enabling 24/7 access to U.S. markets, bypassing traditional brokerage hurdles and high fees. - BNB Chain's RWA adoption gains momentum

Timor-Leste Joining ASEAN: Great Opportunities, Major Reforms Required

- Timor-Leste joined ASEAN as its 11th member on October 26, 2025, marking a historic milestone for regional integration and stability. - Leaders emphasized economic opportunities via ASEAN's $3.8 trillion market but warned of urgent domestic reforms to address inequality and governance gaps. - The summit highlighted expanded regional cooperation through initiatives like the FIFA-ASEAN Cup and India's security collaboration, amid global geopolitical tensions. - Civil society stressed that ASEAN membership

Solana News Today: Solana's Upward Momentum Hangs in the Balance: Institutional Excitement Faces Off Against Technical Warning Signs

- Solana's price surged above $204 amid rising institutional adoption, including Gemini's SOL rewards card and Hong Kong's first Solana ETFs. - TVL reached $11.83 billion as Bitwise launched a U.S. spot ETP staking 100% assets, while Western Union's USDPT stablecoin highlights Solana's financial infrastructure potential. - Technical indicators show mixed signals: bullish RSI and long-to-short ratio contrast with bearish on-chain data like declining long-term holdings and negative CMF. - Analysts warn a $19

Regulatory Advantages Drive USDC Ahead of Tether in Stablecoin Expansion

- USD stablecoin market cap hit $303.5B in 2024, doubling since January as demand grows for dollar-backed digital assets amid regulatory shifts. - USDC (Circle) outpaced Tether's USDT by 59% growth post-US election, driven by Trump's GENIUS Act favoring domestic stablecoin issuers. - Tether plans US subsidiary under ex-Trump adviser to align with regulations, while Circle gains compliance edge under stricter US oversight. - USDC's market cap surged from $48B to $76B since Trump's inauguration, reflecting r