News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

TEN Protocol redefines Ethereum’s privacy with ‘compute in confidence’ approach

CryptoSlate·2025/12/23 02:48

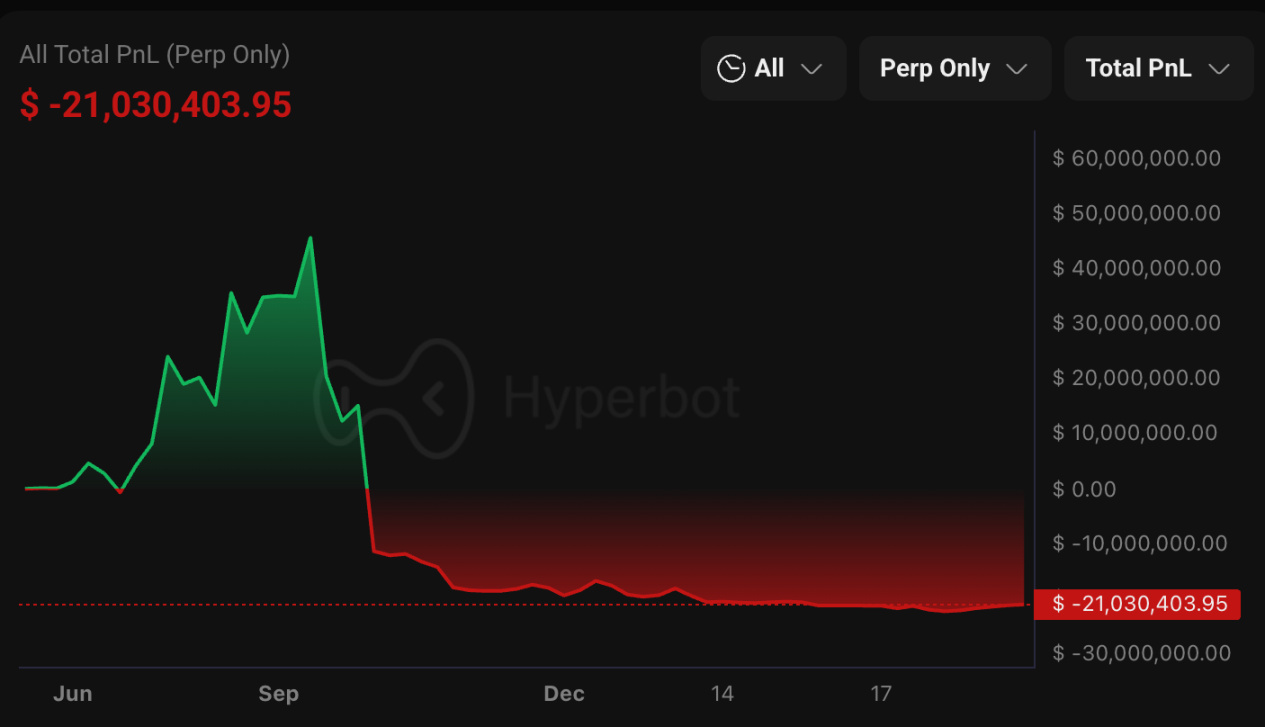

2025 Crypto Blood and Tears List: Hundreds of Millions of Dollars in "Tuition Fees" Paid by 10 Whales

ForesightNews·2025/12/23 02:37

SEC’s “Two Years to On-Chain” Prediction: Tokenized Reconstruction of the DTCC Clearing System

Odaily星球日报·2025/12/23 02:12

Ripple made a crack in the wall, but Swift tore down the entire wall.

ForesightNews·2025/12/23 01:42

Solana Mobile ended Saga security patches, exposing owners to a critical wallet risk you can’t ignore

CryptoSlate·2025/12/22 23:30

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

CryptoSlate·2025/12/22 13:00

Flash

03:17

Cathie Wood: AI will create jobs rather than take them awayForesight News reported that Ark Invest founder Cathie Wood stated, "AI will create jobs rather than take them away. AI will not kill jobs; it simply greatly reduces the cost of entrepreneurship. Learning AI and 'intuitive coding' may be the fastest way to achieve entrepreneurial dreams."

03:00

Matrixport: Due to its high volatility, high exposure, and certain political sensitivities, bitcoin is currently difficult to be widely included as an official reserve asset.Foresight News reported that Matrixport tweeted, "Gold prices have repeatedly reached new highs, achieving nearly 80% excess returns relative to bitcoin over the past year, with a particularly outstanding performance during this period. From a macro perspective, the weakening of the US dollar, diversified asset allocation, and the demand for store-of-value assets remain several main themes in the current market. However, in this round of the market, excess returns have been more concentrated in traditional hedging assets such as gold, driven by falling interest rates, declining inflation, and rising market expectations that the Federal Reserve will turn more dovish in 2026." Similar preferences can also be observed at the central bank level. Although BlackRock has continuously reinforced the narrative of bitcoin as 'digital gold' in recent years, central banks of various countries still mainly allocate gold as their reserve asset. Due to bitcoin's high volatility, high exposure, and certain political sensitivities, it is currently difficult to be widely included in official reserve assets. In the medium to long term, the direction of US policy remains the most critical uncertainty: in theory, a Trump administration might choose to revalue gold, sell part of its gold reserves, or marginally diversify some reserves into bitcoin. The probability of such scenarios occurring in the short term is not high, but it cannot be ruled out that in 2026 the market may amplify this possibility, turning it into a new focus of discussion."

02:55

IMF: The Salvadoran government has agreed at the policy level to no longer actively increase its BTC holdingsForesight News reported that the International Monetary Fund (IMF) issued a statement saying it will continue negotiations regarding El Salvador's bitcoin project and the sale of the government electronic wallet Chivo, noting that significant progress has been made in these discussions. The IMF stated that the El Salvadoran government has agreed at the policy level to no longer actively increase its BTC holdings and is advancing the phase-out of the Chivo wallet. However, the official El Salvador Bitcoin Office claims it is still "purchasing 1 BTC daily" and announced on December 22 that its holdings had increased to 7,509 BTC. The IMF requires El Salvador to fully comply with the agreement by the end of 2025 at the latest.

News