Will the Fed’s Rate Cut Spark a New Bitcoin Rally?

The Federal Reserve’s latest quarter-point rate cut has reignited speculation about a potential shift in market sentiment. For Bitcoin price , a macro-sensitive asset that thrives on liquidity and lower yields, this decision could mark the early stages of a new upward cycle — but the charts tell a more complex story.

Bitcoin News: What Exactly Changed After the Fed’s Decision?

The Fed lowered its benchmark rate by 25 basis points to a range of 3.75%–4%, its second consecutive cut in as many months. The move signals a clear pivot from fighting inflation toward supporting employment. The central bank also announced it would stop reducing its balance sheet starting December 1, effectively pausing its quantitative tightening campaign.

That’s a big deal for risk assets like Bitcoin . Historically, every Fed pivot toward easier money — from 2019 to 2020 and again in 2023 — injected new liquidity into the system. Lower yields reduce the attractiveness of bonds, pushing capital toward higher-risk assets such as tech stocks and crypto. But this time, the Fed’s hands are tied: inflation remains above target, and the economy is sending mixed signals.

Bitcoin Price Prediction: How Is Bitcoin News Reacting on the Chart?

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

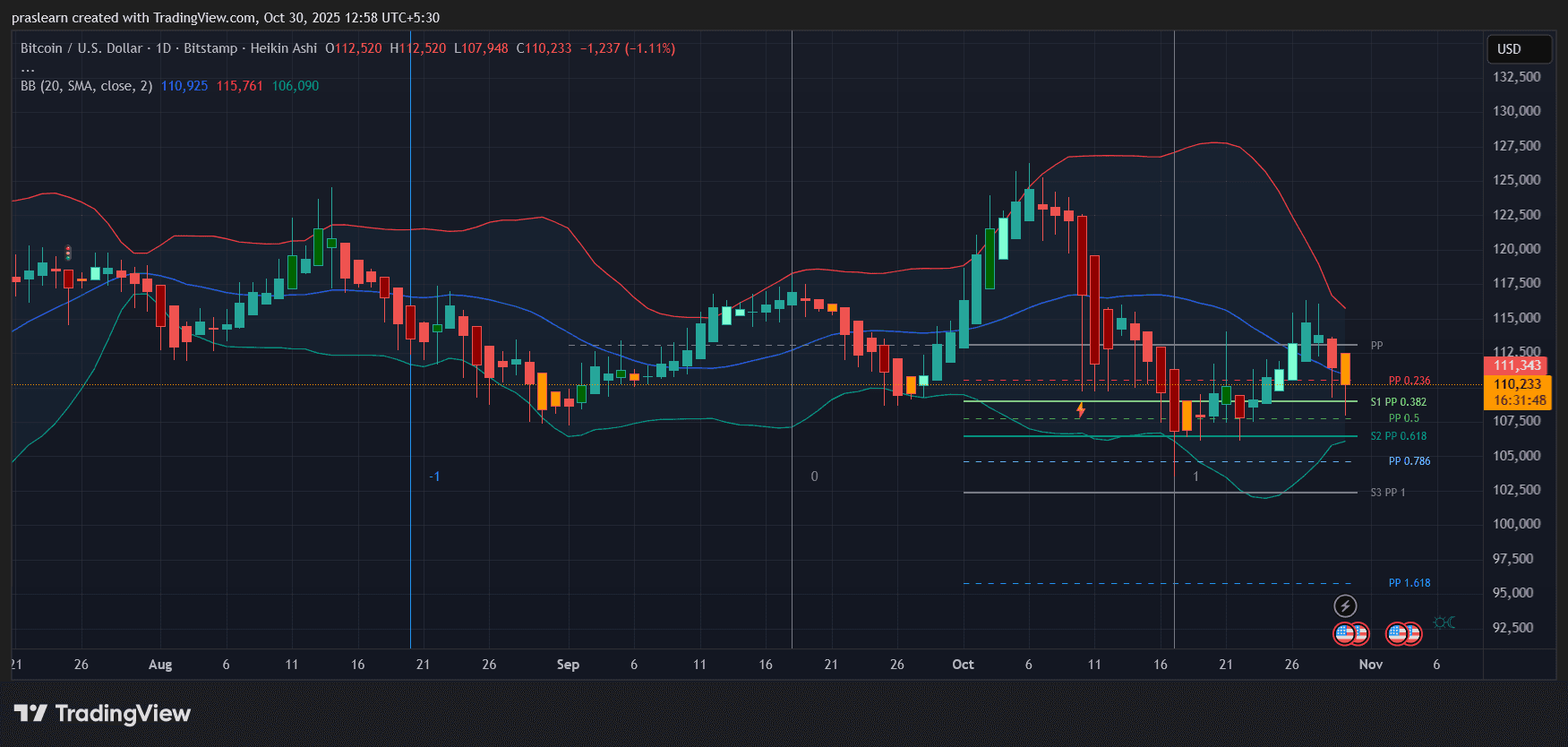

Bitcoin price is currently trading near 110,200 USD after pulling back from the 112,500 zone. On the daily Heikin Ashi chart, the price is hovering just below the midline of the Bollinger Bands, with visible resistance near the upper band at 115,700.

The 20-day simple moving average (SMA) sits close to 110,900 — acting as a pivot area. The recent candles show indecision, reflecting traders waiting for post-Fed clarity. The Fibonacci retracement levels drawn from the recent October high to the local low show key resistance at 0.236 (around 111,300) and a support cluster between 0.382 (108,700) and 0.5 (107,000).

This means Bitcoin’s short-term momentum depends on whether bulls can reclaim and hold above 111,500. A clean breakout above that level could trigger a move toward 115,000–117,000, while a rejection risks a slide back toward the lower Bollinger band around 106,000.

Does the Macro Shift Favor Bitcoin News?

In theory, yes. Rate cuts and an end to balance-sheet reduction typically boost liquidity and reduce the cost of leverage — both key ingredients for a crypto uptrend. The Fed’s decision also signals anxiety about the labor market, implying that policymakers may keep monetary conditions loose into early 2026.

That backdrop has historically aligned with Bitcoin rallies. The 2019–2020 Fed pivot preceded Bitcoin’s explosive bull run to $65K. However, the difference this time is inflation persistence and fiscal uncertainty under the Trump administration’s renewed policies. Tariffs continue to pressure consumer prices, limiting how aggressive the Fed can be. That tension could cap Bitcoin’s upside if real rates remain elevated or if investors fear renewed tightening later.

What Do Technical Indicators Suggest?

Bollinger Bands are starting to widen again after a period of compression — an early signal of rising volatility. The lower band has flattened near 106,000, indicating potential support stability. Meanwhile, Heikin Ashi candles have transitioned from deep red to smaller-bodied candles, suggesting that selling momentum is slowing but not yet reversed.

If Bitcoin price holds the 110,000 psychological level and the 0.382 Fibonacci pivot, a recovery toward 115,000 is likely. On the flip side, a break below 107,000 could trigger another flush toward 102,000, where the next major Fibonacci level (0.786) sits.

What This Means for Traders

Here’s the thing: the Fed’s rate cut has changed the liquidity outlook, but Bitcoin’s technical setup isn’t screaming “rally” yet. Traders should watch for:

- A daily close above 111,500 to confirm bullish continuation.

- Strengthening volume on green candles as a sign of renewed conviction.

- The lower Bollinger band around 106,000 as a make-or-break support.

If these conditions align, Bitcoin price could enter a recovery phase toward 120,000 in November. But if macro data — especially inflation — surprises on the upside, markets may call the Fed’s bluff, pushing yields higher and draining crypto liquidity again.

Bitcoin Price Prediction: A Rally on Pause, Not Yet Ignited

The Fed’s pivot is a potential catalyst, not a guarantee. $BTC price reaction will depend on whether traders believe the Fed can engineer a soft landing without reigniting inflation.

For now, Bitcoin’s structure suggests consolidation before any meaningful rally. A short-term rebound to 115,000 is possible, but sustained momentum will require a clear macro follow-through — likely another rate cut or stronger confirmation that the Fed’s easing cycle is real.

In short, the spark is there. Whether it becomes a rally depends on how fast liquidity returns to risk markets — and how confidently Bitcoin news can reclaim its lost technical ground.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TBC's UTXO Smart Contracts: Turing-Complete Architecture Leading the DEFI Revolution and Cross-Chain Evolution

The UTXO smart contract of TBC is not a simple modification of bitcoin, but rather an upgrade that, through a reconstruction of technical philosophy, transforms UTXO from a static value container into a dynamic financial engine.

Bitcoin risks ‘20%-30%’ drop as crypto markets liquidate $1.1B in 24 hours

Why is Zcash’s ZEC the only crypto pumping right now?

XRP price keeps losing ground despite upcoming Ripple Swell event