News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.17)|Trump Denies Powell Dismissal Rumors; $ETH Rallies, Market Rises; Major $APE Token Unlock Today2Tokenization on Solana Is Booming, What’s Next for SOL Price?3Cardano’s Charles Hoskinson Calls Out Robin’s Scam Claims—ADA Aiming for $1

XRP, ADA Inclusion in Strategic Reserve Criticized; Critics Raise Insider Trading Claims

Bitcoin.com·2025/03/03 22:11

Litecoin, SOL and XRP Price Drop Ahead of Trump “Big Announcement”

Trump’s latest post teased, “TOMORROW NIGHT WILL BE BIG. I WILL TELL IT LIKE IT IS!”

Cryptotimes·2025/03/03 19:44

Sologenic’s SOLO Token Poised for 135% Surge, Eyes Next Target at $0.87451

Cryptonewsland·2025/03/03 19:11

Breaking the Trendline: Bitcoin’s Route to $109K

Cryptonewsland·2025/03/03 19:11

From $2.70 to $3.50? XRP’s Next Bullish Move

Cryptonewsland·2025/03/03 19:11

Bitcoin Price Prediction: BTC Price to Surpass $100K BEFORE or AFTER the Crypto Summit?

Cryptoticker·2025/03/03 17:11

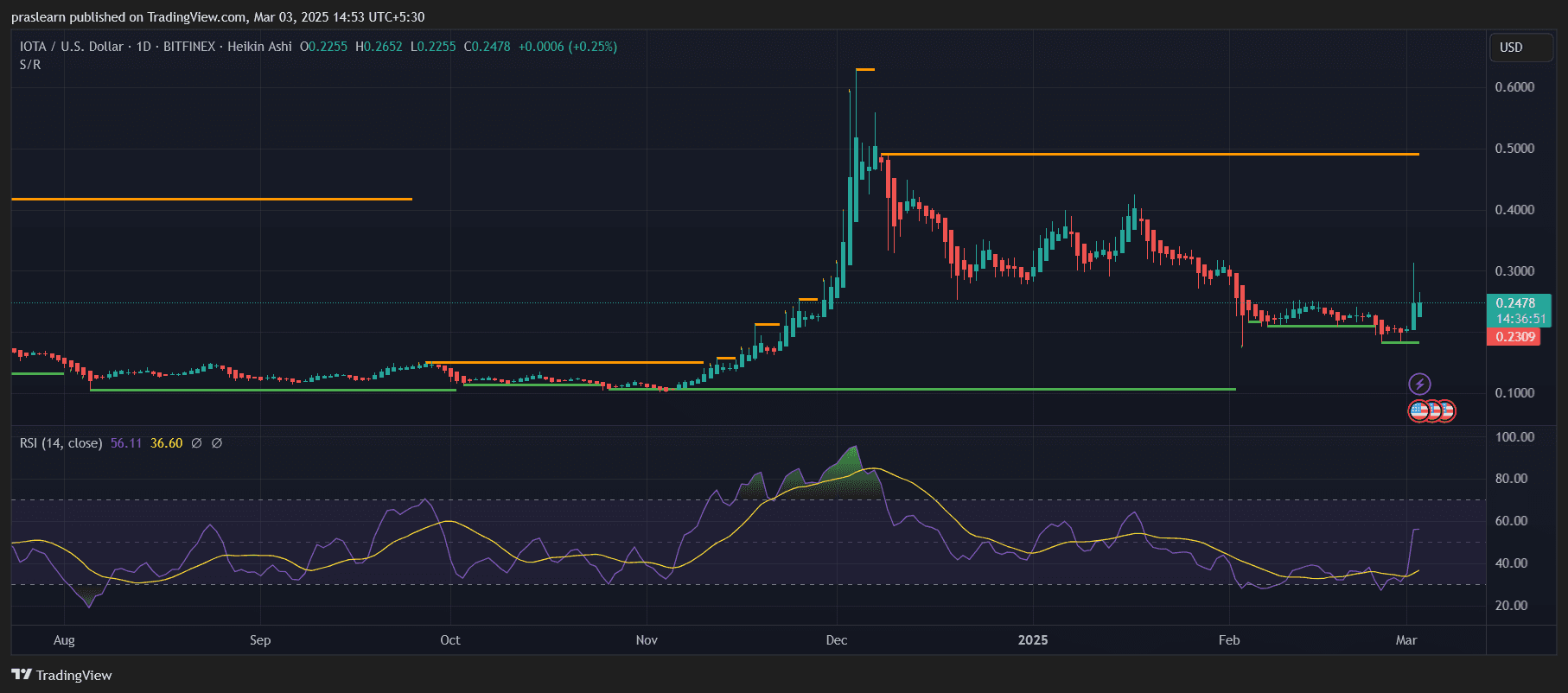

IOTA Price Prediction: Is This the Start of a Major Reversal?

Cryptoticker·2025/03/03 17:11

Aave Price Prediction: Is the Correction Over or More Pain Ahead?

Cryptoticker·2025/03/03 17:11

XRP Gains Momentum with Crypto Strategic Reserve – On the Verge of a 2020 BTC-Style Breakout?

CoinsProbe·2025/03/03 16:33

CRO Gains Momentum Following Key Breakout: Is AVAX Gearing Up For A Similar Move?

CoinsProbe·2025/03/03 16:33

Flash

- 06:43Wells Fargo: U.S. Importers Forced to Bear Trump Tariff Costs, Early Signs of Passing on to Consumers EmergeAccording to a report by Jinse Finance, Wells Fargo economists Sarah House and Nicole Cervi pointed out that the rise in U.S. import prices indicates that foreign exporters are not bearing the higher tariff costs. Data released on Thursday showed that non-fuel import prices rose 1.2% year-on-year in June. They emphasized that import price data does not include tariffs, so if exporters were absorbing the higher tariff costs imposed by Trump on goods, import prices should have fallen accordingly. They warned, "Since import prices have not declined, domestic companies are being forced to bear the higher tariff costs and have begun to pass them on to consumers."

- 06:43BTC and ETH Options with a Notional Value of $5.81 Billion Set to Expire and Settle TodayAccording to a report by Jinse Finance, data from Greeks.live shows that 41,000 BTC options are set to expire and settle today, with a Put Call Ratio of 0.78, a max pain point at $114,000, and a notional value of $4.93 billion. Meanwhile, 240,000 ETH options will also expire and settle today, with a Put Call Ratio of 1.0, a max pain point at $2,950, and a notional value of $880 million.

- 06:38Greeks.live: Nearly $6 Billion in Options Expire This Week, Including 41,000 BTC OptionsOdaily Planet Daily News: Greeks.live macro researcher Adam released data showing that on July 18, 41,000 BTC options will expire, with a Put Call Ratio of 0.78, a max pain point at $114,000, and a notional value of $4.93 billion. Meanwhile, 240,000 ETH options will expire, with a Put Call Ratio of 1.0, a max pain point at $2,950, and a notional value of $880 million.This week, nearly $6 billion worth of options will be settled, accounting for more than 10% of the current total open interest. According to the main options data, in terms of implied volatility, BTC's IV has rebounded slightly, with all major maturities maintaining at 40%. ETH's IV has risen sharply, with major maturities reaching as high as 70%. However, the price movement range for ETH remains wide, and it is not yet the right time for sellers to enter the market.