News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Rising debt and economic uncertainty are fueling discussions on wealth protection in relation to alternative stores of value beyond traditional assets. As concerns grow over the stability of fiat currencies, Ray Dalio points to Bitcoin’s fixed supply and decentralized nature as potential safeguards against financial instability and shifting monetary policies.

ETH’s price plunge pushes its BTC ratio to 4-year lows. With selling pressure mounting, will ETH break below $2,000 or stage a recovery?

Economist Peter Schiff alleges Trump’s US Crypto Reserve announcement was a market manipulation scheme, urging Congress to investigate insider profits.

Pi Coin struggles near $1.60 but signals a possible reversal. A break above $2.00 could spark a recovery, while failure may lead to further losses.

Bitcoin’s role as a hedge asset weakens as market trends shift, driving a $1 trillion crypto downturn and increasing stock-like behavior.

Trump’s high-stakes Crypto Summit could redefine digital asset policies in the US. Will tax breaks and a national reserve fuel a crypto boom?

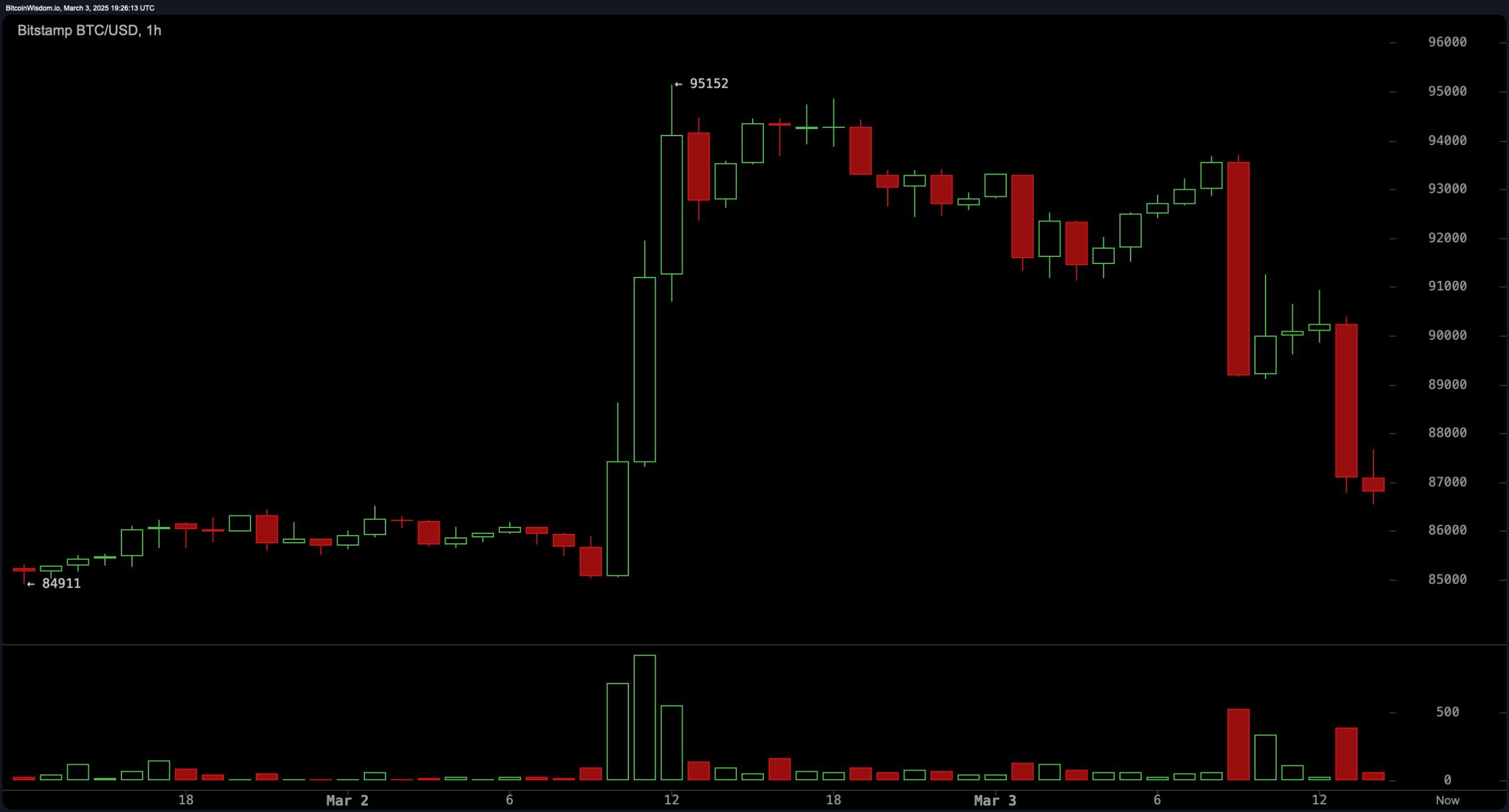

A sharp drop in Bitcoin’s open interest and rising market fear could indicate a buying opportunity. With RSI nearing oversold levels, BTC may be primed for a rebound toward $90,000.

Exploring Market Indicators: Low Retail and Institutional Participation Raising Caution Flags for Bitcoin's Ascend to $90K

- 06:43Wells Fargo: U.S. Importers Forced to Bear Trump Tariff Costs, Early Signs of Passing on to Consumers EmergeAccording to a report by Jinse Finance, Wells Fargo economists Sarah House and Nicole Cervi pointed out that the rise in U.S. import prices indicates that foreign exporters are not bearing the higher tariff costs. Data released on Thursday showed that non-fuel import prices rose 1.2% year-on-year in June. They emphasized that import price data does not include tariffs, so if exporters were absorbing the higher tariff costs imposed by Trump on goods, import prices should have fallen accordingly. They warned, "Since import prices have not declined, domestic companies are being forced to bear the higher tariff costs and have begun to pass them on to consumers."

- 06:43BTC and ETH Options with a Notional Value of $5.81 Billion Set to Expire and Settle TodayAccording to a report by Jinse Finance, data from Greeks.live shows that 41,000 BTC options are set to expire and settle today, with a Put Call Ratio of 0.78, a max pain point at $114,000, and a notional value of $4.93 billion. Meanwhile, 240,000 ETH options will also expire and settle today, with a Put Call Ratio of 1.0, a max pain point at $2,950, and a notional value of $880 million.

- 06:38Greeks.live: Nearly $6 Billion in Options Expire This Week, Including 41,000 BTC OptionsOdaily Planet Daily News: Greeks.live macro researcher Adam released data showing that on July 18, 41,000 BTC options will expire, with a Put Call Ratio of 0.78, a max pain point at $114,000, and a notional value of $4.93 billion. Meanwhile, 240,000 ETH options will expire, with a Put Call Ratio of 1.0, a max pain point at $2,950, and a notional value of $880 million.This week, nearly $6 billion worth of options will be settled, accounting for more than 10% of the current total open interest. According to the main options data, in terms of implied volatility, BTC's IV has rebounded slightly, with all major maturities maintaining at 40%. ETH's IV has risen sharply, with major maturities reaching as high as 70%. However, the price movement range for ETH remains wide, and it is not yet the right time for sellers to enter the market.