News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.25)|Trump’s Son Says ETH Is Deeply Undervalued; Over $15.4B in BTC & ETH Options Expiring; deBridge Launches Reserve Fund Program2Bitcoin Cycle Theory May Be Changing as Analyst Revises Previous Bear Market Prediction3Ethereum’s Open Interest Hits Record High, Spurs Market Caution

Hedera (HBAR) Slides 2.5% Amid Bearish Momentum

Hedera's price action remains bearish, with weak trend strength and key resistance ahead as traders brace for potential market shifts.

BeInCrypto·2025/04/02 11:00

Research Report | In-depth Analysis of PumpBTC & PUMP Market Valuation

远山洞见·2025/04/02 10:03

Pump Fun Introduces PumpFi for Memecoins and NFTs Funding

Bitcoininfonews·2025/04/02 10:00

Bitcoin Price Weakness: Exploring Factors Beyond the US Tariff War and Market Sentiment

Coinotag·2025/04/02 09:22

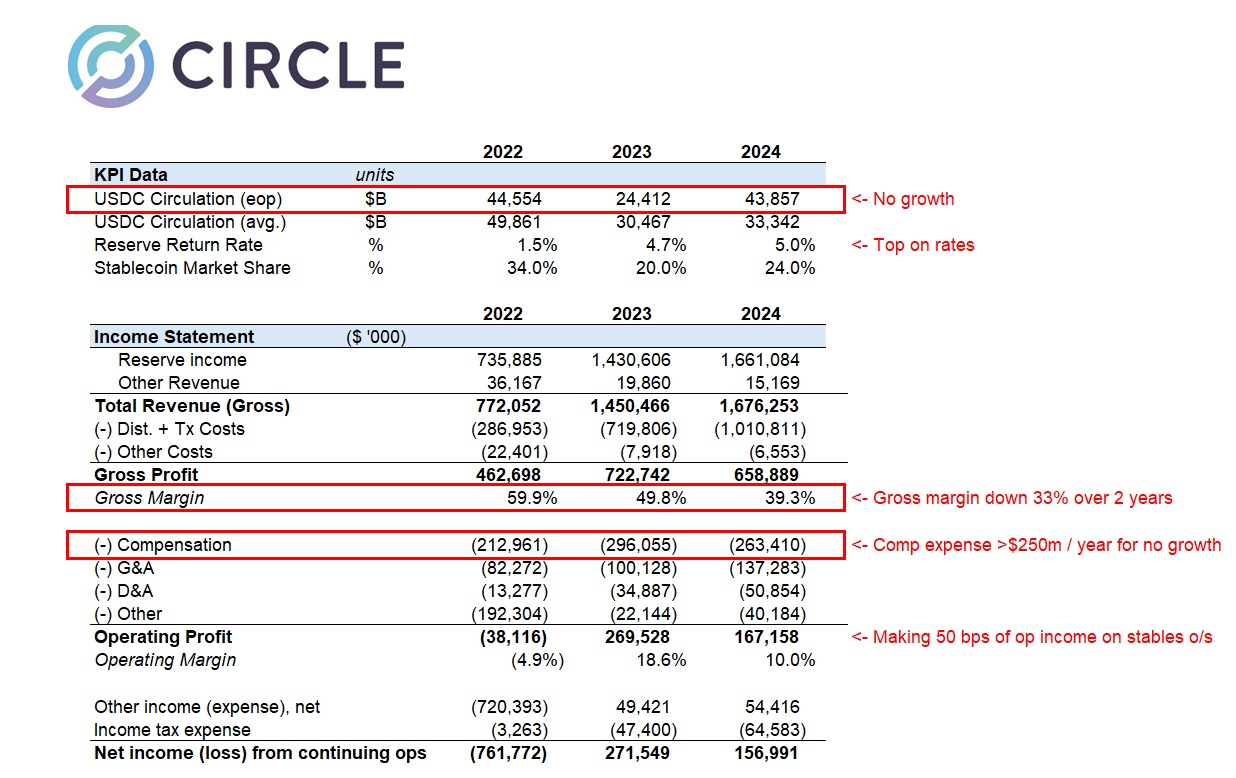

Concerns Arise Over Circle’s IPO Amid Revenue Growth and Profitability Challenges

Coinotag·2025/04/02 09:22

Bitcoin’s Easing Selloffs and RSI Breakout May Signal Potential Price Surge to $91,000

Coinotag·2025/04/02 09:22

Bitcoin sales at $109K all-time high 'significantly below' cycle tops — Research

Bitcoin midterm holders — even those with a cost basis at around $3,600 — are still refusing to sell despite major profits and BTC price volatility.

Cointelegraph·2025/04/02 09:15

Exciting Bitcoin IPO: Hut 8 and Trump Alliance Unveils Groundbreaking Venture

BitcoinWorld·2025/04/02 08:22

Decoding Altcoin Season Index: Is Bitcoin Dominance Crushing Altcoins?

BitcoinWorld·2025/04/02 08:22

Flash

- 06:22Analyst: This Week’s Selling Pressure Reached Extreme Levels for the Cycle, but BTC’s Stable Price Can Be Seen as a Positive SignalAccording to a report by Jinse Finance, CryptoQuant analyst Axel stated on social media that during the current bull market cycle, there have only been 12 weeks with short-selling pressure equal to or greater than this week, accounting for about 7.3% of the entire cycle. This means that the level of selling pressure this week ranks among the top 7% of extreme historical levels, yet the price has rebounded to $117,000—a fact that can itself be seen as a positive signal.

- 04:26Decentralized Data Platform Sapien Announces Tokenomics with a Total Supply of 1 Billion TokensAccording to official sources reported by Jinse Finance, the decentralized data platform Sapien has announced its tokenomics. The token is named $SAPIEN, with a total supply of 1 billion tokens. The main allocation is as follows: 47% is allocated to protocol development participants (contributors, builders, early supporters), and 53% is allocated to contributor incentives (task rewards, liquidity incentives, community treasury). The distribution plan is as follows: Seasonal airdrop accounts for 13%, with 130,000,000 tokens, 100% unlocked at TGE; Liquidity incentives account for 7%, with 70,000,000 tokens, 100% unlocked at TGE; Staking incentives account for 5%, with 50,000,000 tokens, 100% unlocked at TGE; Supporters/investors account for 26.82%, with 268,161,963 tokens, locked for 12 months and released linearly over 24 months; Team and advisors account for 20.18%, with 201,838,037 tokens, locked for 12 months and released linearly over 24 months; Contributor rewards account for 15%, with 150,000,000 tokens, released linearly over 36 months; Community treasury accounts for 13%, with 130,000,000 tokens, released linearly over 36 months.

- 04:07Data: Bitcoin Spot ETFs Recorded a Total Net Inflow of $131 Million Yesterday, with BlackRock’s IBIT Leading at $92.83 MillionAccording to ChainCatcher, citing SoSoValue data, the total net inflow into Bitcoin spot ETFs yesterday (July 25, Eastern Time) was $131 million. The Bitcoin spot ETF with the highest single-day net inflow yesterday was BlackRock's ETF IBIT, with a net inflow of $92.83 million for the day. To date, IBIT's historical total net inflow has reached $5.724 billion. Next was the ETF ARKB from Ark Invest and 21Shares, with a single-day net inflow of $30.27 million. ARKB's historical total net inflow now stands at $2.83 billion. The Bitcoin spot ETF with the largest single-day net outflow yesterday was Grayscale's ETF GBTC, with a net outflow of $50.5 million for the day. GBTC's historical total net outflow has reached $23.59 billion. As of press time, the total net asset value of Bitcoin spot ETFs is $151.45 billion, with the ETF net asset ratio (market value as a percentage of Bitcoin's total market cap) at 6.50%. The historical cumulative net inflow has reached $54.82 billion.