Bitget Daily Digest (7.25)|Trump’s Son Says ETH Is Deeply Undervalued; Over $15.4B in BTC & ETH Options Expiring; deBridge Launches Reserve Fund Program

远山洞见2025/07/25 02:28

By:远山洞见

Today’s Preview

Today’s Preview

1、Venom (VENOM) will unlock 59.26 million tokens at 16:00 (2.84% of supply).

2、US prosecutors expected to conclude evidence phase for Tornado Cash co-founder Roman Storm by July 25.

Macro & Hot Topics

1、Trump’s Son Endorses “ETH Is Deeply Undervalued” View

Eric Trump, son of US President Donald Trump, retweeted and agreed with an opinion saying Ethereum (ETH) is seriously undervalued. The original post claims, “ETH is catching up with global liquidity. If mapped to M2 money supply growth, ETH should already be above $8,000. This highlights just how undervalued ETH is—it’s likely one of the biggest opportunities right now.”

2、Deribit: Over $15.4B in BTC & ETH Options Set to Expire

Deribit reported more than $15.4B in BTC and ETH options will expire this Friday. Specifically, $12.66B in BTC options (Put/Call ratio: 0.88, max pain at $112K); $2.75B in ETH options (Put/Call: 0.87, max pain at $2,800).

3、REX-Osprey’s Solana Staking ETF to Distribute 100% JitoSOL Rewards to Shareholders

REX-Osprey’s Solana staking ETF, in partnership with JitoSOL, will distribute 100% of staking rewards to shareholders. It is the first US crypto ETF to offer such rewards. Since launch (July 2), it has seen at least $222M in total trading volume and over $100M in assets under management.

4、Resolv Activates Protocol Fee Mechanism—Profits to RESOLV Stakers

Resolv is activating protocol fees: starting this month, a portion of daily profit will be distributed to RESOLV stakers for ecosystem growth and product development. The fee will start at 2.5% of daily profit in week 1, then increase to 5%, 7.5%, and 10% from week 4 onwards—charged only on profitable days. Users will be able to track all incomes and allocations via a transparent dashboard.

Market Updates

1、BTC and ETH pulled back, as did alts; liquidations: $551M in 24H, mostly longs.

2、Fed “Renovation-gate” intensifies; Trump ramps up public rate-cut pressure; Powell firing concerns subside for now, Besant warns other risks remain.

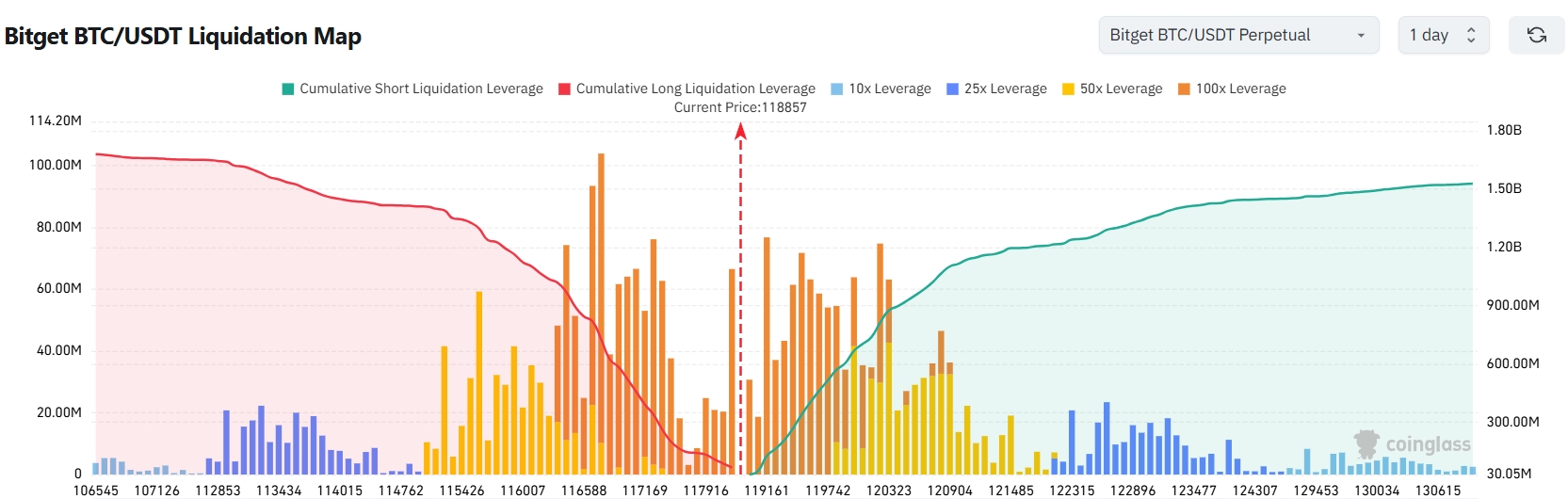

3、Bitget BTC/USDT liquidation map: At 117,680 USDT, a 2,000-point drop to 115,680 would trigger $1.3B in long liquidations; a 2,000-point rise to 119,680 would trigger $356M in short liquidations. Long liquidation risk much higher—use leverage cautiously.

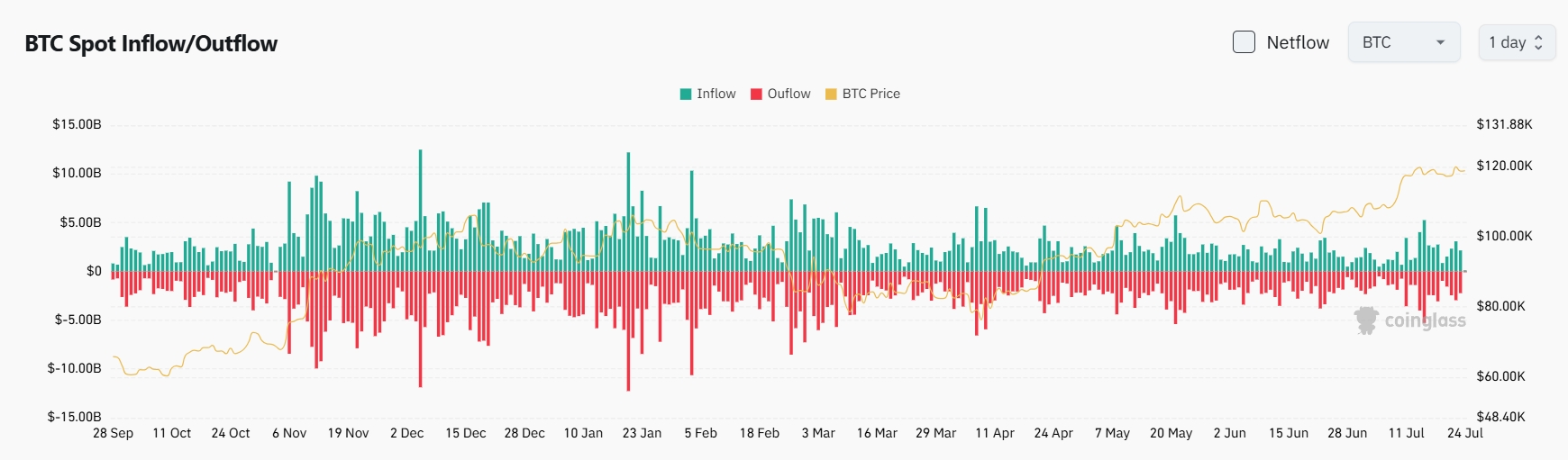

4、Past 24H BTC spot flows: $2.3B in, $2.4B out—net outflow $100M.

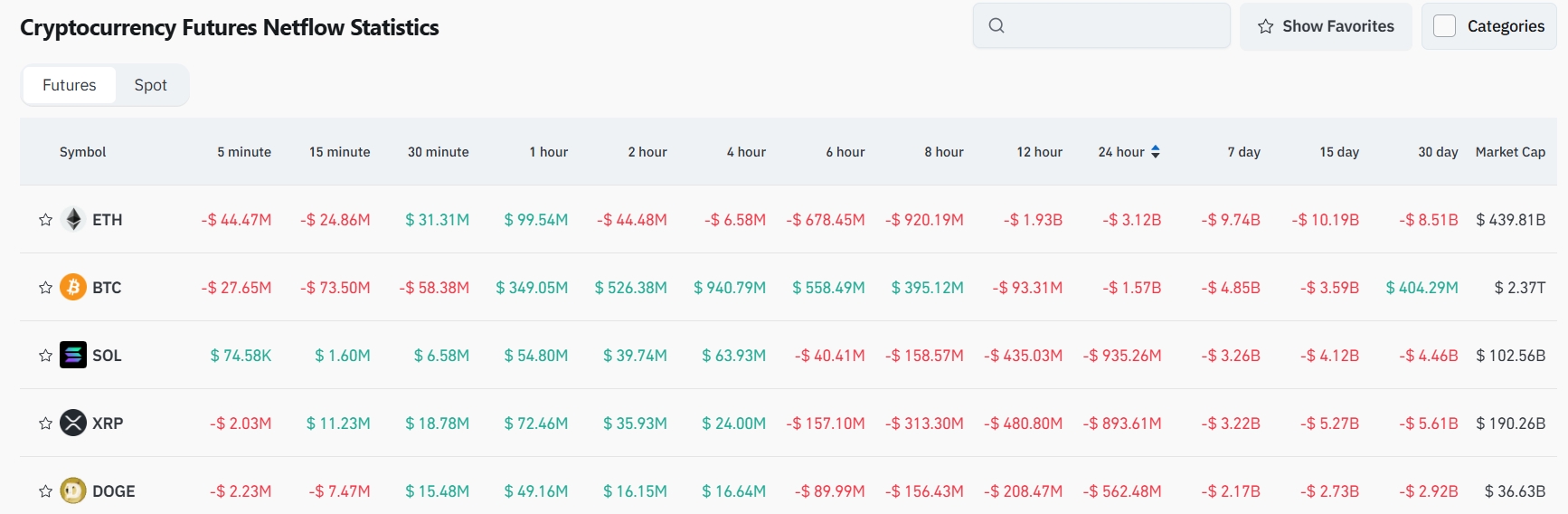

5、Past 24H, contracts with largest net outflows: $BTC, $ETH, $SOL, $XRP, $DOGE—potential trading setups.

Institutional Views

-

LD Capital:ETH showing strength, consolidating and nearing the end of its current choppy phase. Read more

-

Greeks.live:Sentiment in English crypto communities has turned noticeably bearish; focus is on the 30% volatility range. Read more

-

CryptoQuant Founder:“Bitcoin cycle theory is dead.” Read more

News Updates

1、Ghana to issue crypto business licenses.

2、EU approves €93B tariff retaliation plan for the US—goes into effect August 7 if talks fail.

3、Eric Trump publicly agrees “ETH is deeply undervalued.”

Project Developments

1、BONK: 500B BONK burned (worth ~$18.62M).

2、BlackRock’s ETHA: Net purchases of 1.035M ETH since July 1; total holdings now 2.8M ETH.

3、Circle: Launches interest-bearing USYC stablecoin natively on BNB Chain.

4、deBridge Foundation: Rolls out new reserve fund program.

5、Solana Devs: Considering hiking block limits by 66% to 100M compute units to boost capacity.

6、Sky Co-founder: Bought back 24.53M SKY and moved them back into staking.

7、Brazil’s VERT: Issues $130M in agri-bonds on XRP Ledger.

8、Espresso Foundation: Snapshot completed.

9、Walrus: Launches Quilt, a new bulk storage solution for small file data.

10、Bitget Wallet: Adds new crypto payment channels—now supports top platforms like Hema, Honor of Kings, Sinopec, JD.com, and more.

X Highlights

1. Crypto Monkey: Whale Tracking Isn’t a Fast Track to Riches—Whale Logic Must Match Narrative & Macro

Tracking smart money flags potential plays, but don’t blindly treat every “top wallet” as a sure sign of imminent pump. Whales often buy in waves, shake out weak hands, and only exit gradually. Successful rebounds need both narrative/macro support and evidence of strong hands accumulating. Don’t overrate “chip concentration” alone—otherwise, you might be someone else’s exit liquidity.

Link

2. Crypto_Painter: No Major BTC Bull Liquidations—Trend Remains Strong, Go With The Flow

Expectations for mass BTC bull liquidations didn’t pan out. Supply remains tight, demand is rising, and spot premiums are recovering. False breakouts suggest strong buyers are still active. It’s a long-biased market; prefer to long dips around $115k or chase a breakout above $120k—not betting hard on a flush out. Flexibility and trend-following is the bull market mindset.

Link

3. Phyrex: Macro Picture Stable, BTC & ETH Buildup Evident, ETF Effect Taking Hold

Macro backdrop remains steady: tariffs and monetary policy are the focus, with the White House expected to release its first BTC policy report this month. On-chain, BTC sell pressure is low, chips are concentrating in the $117k–$118k range—mainstream funds are buying. ETH is seeing ETF-driven inflows, with BlackRock and others building positions rapidly. Staking and RWA may also be in play. In sum, both BTC and ETH are being accumulated by institutions and the bull base remains solid.

Link

4. Rui: Blue Chip Hype Topping Out—Rotation Toward Small Cap Memes and “Tokenization” Plays

BNB’s new highs and the hype around giants like Galaxy and Pantera indicate the major trend is peaking short-term; actual returns aren’t as sexy as they look. Time to watch tokenized stocks and microcap memes, where innovation is more transparent and investment signals are clearer. Focus is shifting from old blue chip themes to new concepts and builder-driven projects.

Link

5

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Claim of StarkWare’s Co-founder on Bitcoin’s Future Debunked

Theccpress•2025/07/26 05:30

Ethereum Spot ETFs See $231 Million Inflows

Coinlive•2025/07/26 02:50

BlackRock’s Ethereum ETF Achieves $10B AUM in Record Time

Coinlive•2025/07/26 02:50

Cardano Holds Strong Support Amid Market Developments

Coinlineup•2025/07/26 02:45

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$117,389.77

+1.76%

Ethereum

ETH

$3,738.57

+3.07%

XRP

XRP

$3.17

+3.24%

Tether USDt

USDT

$1

+0.00%

BNB

BNB

$782.11

+3.00%

Solana

SOL

$186.49

+4.51%

USDC

USDC

$1

-0.01%

Dogecoin

DOGE

$0.2375

+4.90%

TRON

TRX

$0.3181

+1.09%

Cardano

ADA

$0.8236

+3.54%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now