News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take The Nasdaq-listed media and entertainment company has increased its digital asset treasury management authorization from $100 million to $250 million. As part of this program, the board approved a new NFT yield strategy and formed strategic partnerships with Dialectic’s Ryan Zurrer and Goff Capital’s Rhydon.

Cardano’s ADA token jumped to a four-month high of $0.92 following founder Charles Hoskinson’s announcement of an independent treasury audit to address fraud allegations involving 318 million ADA tokens.

Strategy added 6,220 Bitcoin for $740 million as price traded at new highs, and coincides with insider share sales from executives.

Nasdaq-listed GameSquare Holdings acquired $30 million worth of Ethereum and expanded its crypto investment authorization to $250 million. The company plans to leverage DeFi protocols for yield generation while building NFT portfolios.

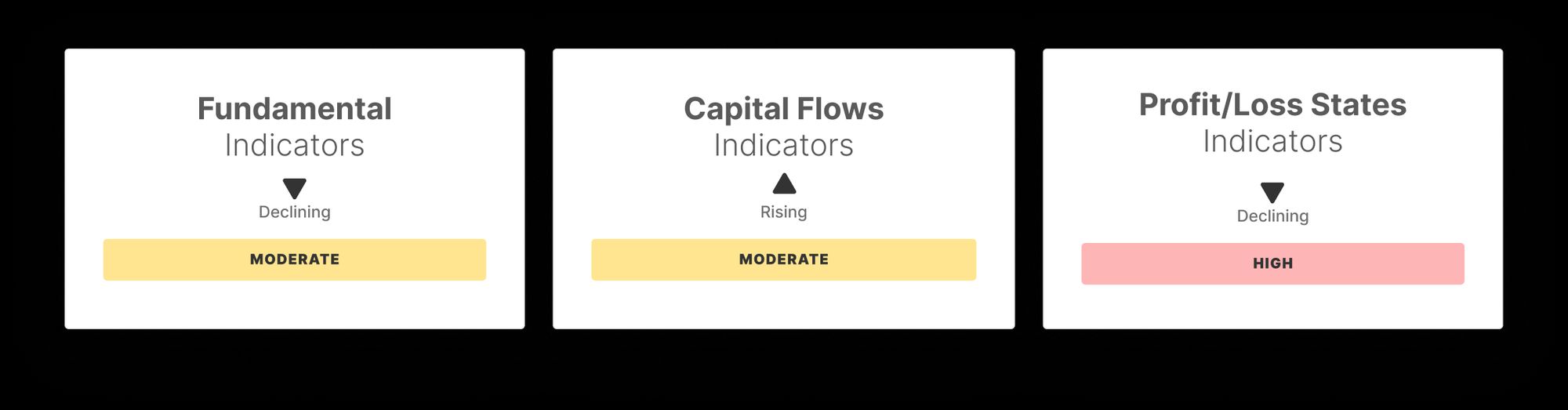

With price pulling back slightly after touching a new all-time high, Bitcoin has hovered around $117k throughout the week. Capital flows remain robust. Profitability metrics have started to cool. Overall, market conditions reflect a healthy yet fragile balance.

- 01:46A total of 655 million WLFI tokens have been transferred to the Lockbox contract, accounting for 6.55% of the total token supplyAccording to Jinse Finance, on-chain analyst Ai Yi (@ai_9684xtpa) has monitored that 6.55 billion WLFI tokens have been transferred to the Lockbox contract, accounting for 6.55% of the total token supply. The team announced that the Lockbox opened at 03:57 (UTC+8) today, and within just five and a half hours, a large number of tokens had already been received. Based on the current contract price, the estimated value is $1.5 billion. Among the top 10 individual holders, two (TOP1 & TOP8) have completed their transfers. Earlier this morning, it was reported that WLFI tokens will officially begin unlocking at 8:00 AM Eastern Time on September 1, and the related feature page (Lockbox) is now live.

- 01:41Galaxy Digital Founder: Galaxy to Tokenize Its Stock, Possibly Launching on SuperstateAccording to a live report from Jinse Finance, on August 26 at the WebX2025 event in Japan, Galaxy founder Mike Novogratz stated that Galaxy stock is about to be tokenized and launched on Superstate. He expects the pace of this process to exceed all expectations. Novogratz emphasized that asset tokenization will be an inevitable trend in the future. With technological advancements, artificial intelligence will leverage stablecoins to facilitate transactions on the blockchain. He believes the boundaries between traditional finance (TradFi) and decentralized finance (DeFi) are becoming increasingly blurred. From the perspective of market participants, he sees significant value in asset tokenization. On one hand, it can drive financial democratization; for example, young people in Cambodia or Zimbabwe will be able to easily hold shares of companies like SoftBank, Apple, and Galaxy via their mobile phones in the future. On the other hand, for non-traditional assets such as private equity funds, tokenization will greatly enhance the ease of transfer. Currently, the process of selling private equity fund shares is complex, but after tokenization, trading can be done effortlessly. Novogratz believes that the substantial increase in liquidity brought by asset tokenization will further drive up asset prices.

- 01:31Huma Finance Announces Launch of Season 1 AirdropAccording to Jinse Finance, Huma Finance has announced the launch of its Season 1 airdrop to reward liquidity providers, HUMA stakers, ecosystem partners, and community users. The official statement noted that since the Season 0 airdrop, the platform has completed approximately $6 billion in PayFi transactions.