News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin May Face Renewed Selling Pressure as Crypto ETPs Post $1.43B Outflows, Largest Since March2Whale Returns with $16.8M Chainlink ($LINK) Buy3XRP’s Next Big Move: ETF Hype, Whale Accumulation, and a $30 Target

Spot Ethereum ETFs Soar: $404.54M Inflows Mark Astounding Eleventh Day of Growth

BitcoinWorld·2025/07/20 17:05

USDT Transfer: Unveiling the Massive $200M Move to Aave and Its Market Impact

BitcoinWorld·2025/07/20 17:05

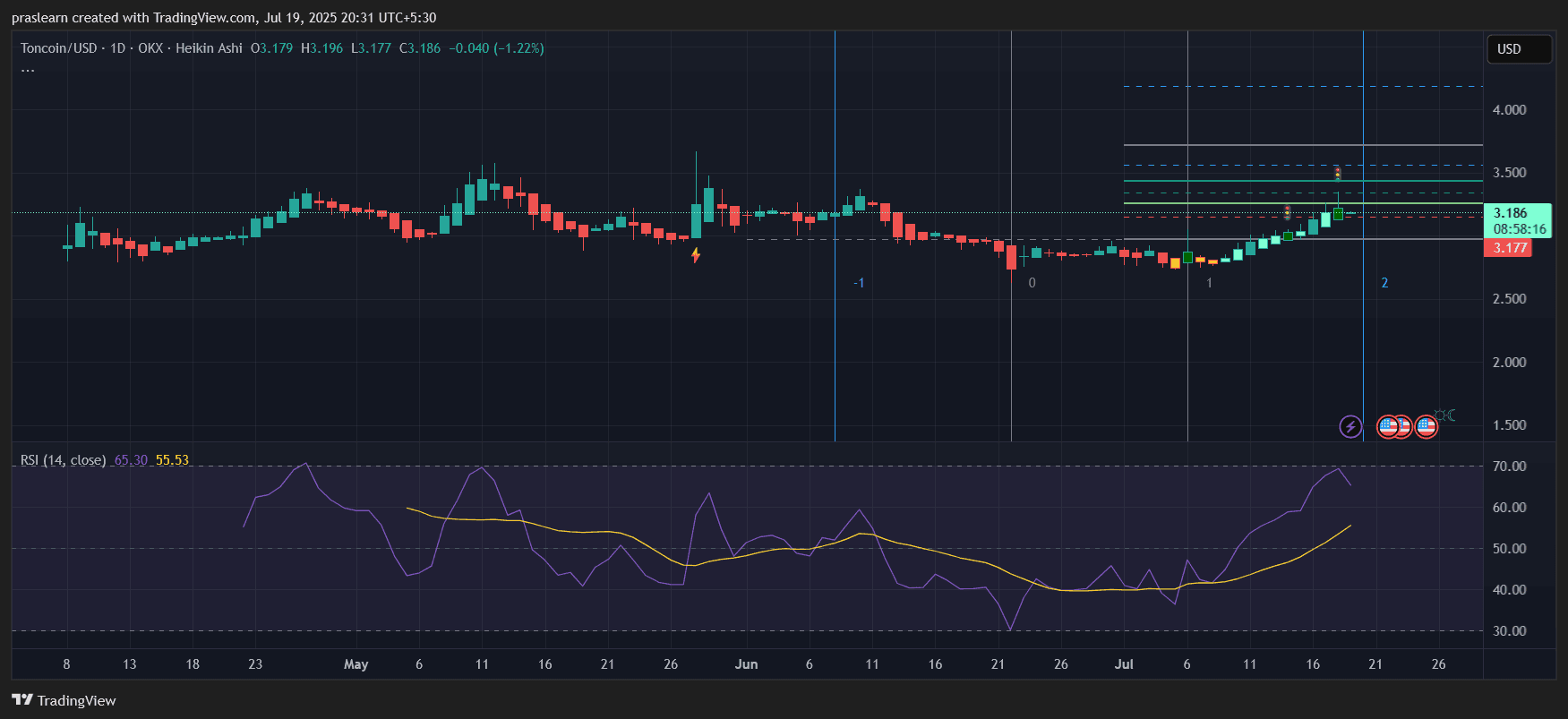

TON Price Prediction: Is a 30% Surge to $4 Next?

Cryptoticker·2025/07/20 17:00

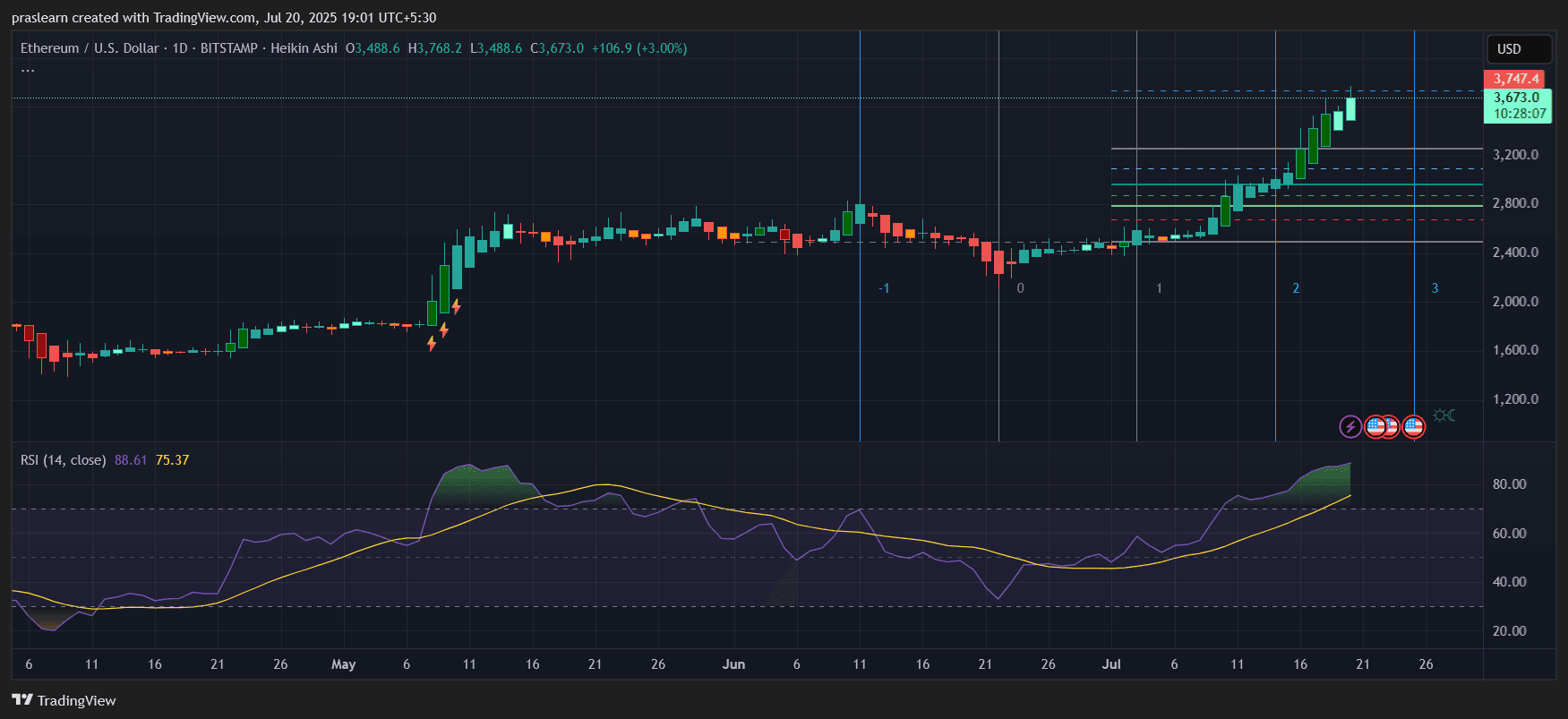

Ethereum Price Skyrockets: What’s Coming Next?

Cryptoticker·2025/07/20 17:00

Stellar’s XLM Shows Ultra-Bullish Pattern—Just Like XRP

CryptoNewsFlash·2025/07/20 16:55

Bitcoin Golden Cross Is Here—Will BTC Repeat a 2,000% Run?

CryptoNewsFlash·2025/07/20 16:55

Q2 earnings watch: What are investors watching for this week?

Share link:In this post: Major U.S. companies, Tesla, Alphabet, Intel, Coca-Cola, Verizon, and GM will report earnings this week. Key housing data, jobless claims, and durable goods reports are due in the U.S. The ECB is expected to hold rates steady, though U.S. tariff threats could trigger future cuts.

Cryptopolitan·2025/07/20 16:55

Ether surpassed $3,800 for the first time since December

Share link:In this post: Ether broke above $3,800 for the first time since December 2024. Its market cap hit $450 billion, with a 45.48% monthly price increase. Analyst Gert Van Lagen expects Ether to reach $10,000 based on Elliott wave theory.

Cryptopolitan·2025/07/20 16:55

XRP hits new all-time high after seven years as market cap tops $200B

Cryptobriefing·2025/07/20 16:50

Litecoin (LTC) To Rally Higher? Key Fractal Pattern Signals Potential Bullish Move

CoinsProbe·2025/07/20 16:05

Flash

- 01:46A total of 655 million WLFI tokens have been transferred to the Lockbox contract, accounting for 6.55% of the total token supplyAccording to Jinse Finance, on-chain analyst Ai Yi (@ai_9684xtpa) has monitored that 6.55 billion WLFI tokens have been transferred to the Lockbox contract, accounting for 6.55% of the total token supply. The team announced that the Lockbox opened at 03:57 (UTC+8) today, and within just five and a half hours, a large number of tokens had already been received. Based on the current contract price, the estimated value is $1.5 billion. Among the top 10 individual holders, two (TOP1 & TOP8) have completed their transfers. Earlier this morning, it was reported that WLFI tokens will officially begin unlocking at 8:00 AM Eastern Time on September 1, and the related feature page (Lockbox) is now live.

- 01:41Galaxy Digital Founder: Galaxy to Tokenize Its Stock, Possibly Launching on SuperstateAccording to a live report from Jinse Finance, on August 26 at the WebX2025 event in Japan, Galaxy founder Mike Novogratz stated that Galaxy stock is about to be tokenized and launched on Superstate. He expects the pace of this process to exceed all expectations. Novogratz emphasized that asset tokenization will be an inevitable trend in the future. With technological advancements, artificial intelligence will leverage stablecoins to facilitate transactions on the blockchain. He believes the boundaries between traditional finance (TradFi) and decentralized finance (DeFi) are becoming increasingly blurred. From the perspective of market participants, he sees significant value in asset tokenization. On one hand, it can drive financial democratization; for example, young people in Cambodia or Zimbabwe will be able to easily hold shares of companies like SoftBank, Apple, and Galaxy via their mobile phones in the future. On the other hand, for non-traditional assets such as private equity funds, tokenization will greatly enhance the ease of transfer. Currently, the process of selling private equity fund shares is complex, but after tokenization, trading can be done effortlessly. Novogratz believes that the substantial increase in liquidity brought by asset tokenization will further drive up asset prices.

- 01:31Huma Finance Announces Launch of Season 1 AirdropAccording to Jinse Finance, Huma Finance has announced the launch of its Season 1 airdrop to reward liquidity providers, HUMA stakers, ecosystem partners, and community users. The official statement noted that since the Season 0 airdrop, the platform has completed approximately $6 billion in PayFi transactions.