News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Ethereum may undergo the largest upgrade in history: EVM to be phased out, RISC-V to take over2Bitcoin Price Analysis: Key Support and Resistance Levels to Watch for Strategic Entry and Exit Points3Is XRP Poised to Break Above $2.64 and Challenge a New All-Time High?

Lido Faces Three-Year Low in Ethereum Staking Share

Coinlineup·2025/07/25 01:30

Bitcoin Hits $115K in Selloff Linked to Trump-Powell Meeting

Cryptotale·2025/07/25 00:20

Bitcoin May Face Short-Term Dip Amid Bearish Divergence and CME Gap Below $115,000

Coinotag·2025/07/25 00:00

U.S. Jobless Claims Drop to 217K, Beating Forecasts

U.S. initial jobless claims fall to 217K, below the expected 227K. What it means for the economy and crypto markets.Jobless Claims Surprise with Lower-Than-Expected NumbersWhat This Means for Financial and Crypto MarketsCrypto Traders Should Watch Closely

Coinomedia·2025/07/24 23:25

SenseTime Announces HKD 2.5 Billion Fundraising Plan

TokenTopNews·2025/07/24 23:25

XRP price staggers as Ripple moves 200 million tokens

Coinjournal·2025/07/24 23:15

AI and Digital Payments Drive Cryptocurrency Adoption Boom in 2025

Cointribune·2025/07/24 23:15

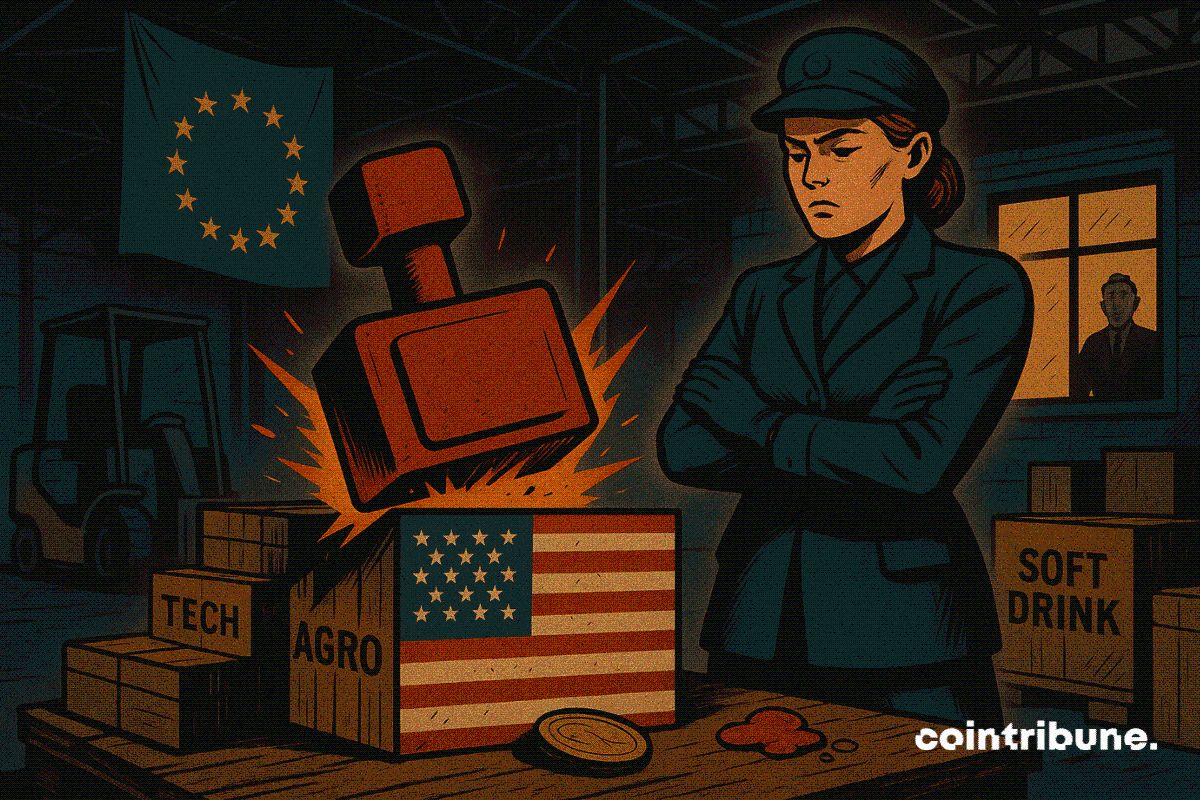

EU Trade Defense Hits €93 Billion Milestone

Cointribune·2025/07/24 23:15

Chris Larsen Under Pressure After A Massive Transfer Of XRP – Is It Disguised Dumping?

Cointribune·2025/07/24 23:15

Flash

- 16:26Overview of Institutional Ethereum Holdings: Leading Bitmine and SharpLink Continue to Increase Holdings and Remain Top TwoChainCatcher News, according to strategicethreserve data, the following treasury companies and institutions have seen significant changes in their Ethereum holdings over the past 30 days: Bitmine Immersion Tech (BMNR) ranks first, currently holding 1.7 million ETH, valued at approximately $7.95 billions, with a 202.4% increase in holdings over the past 30 days; SharpLink Gaming (SBET) ranks second, currently holding 797,700 ETH, valued at approximately $3.7 billions, with a 121.1% increase in holdings over the past 30 days; The Ether Machine (ETHM) ranks third, currently holding 345,400 ETH, valued at approximately $1.6 billions, with an 8.01% increase in holdings over the past 30 days; Ethereum Foundation ranks fourth, holding 231,600 ETH, valued at approximately $1.007 billions, with a 2.1% decrease in holdings over the past 30 days; Bit Digital (BTBT) ranks seventh, holding 120,300 ETH, valued at approximately $557.9 millions, with no change in holdings over the past 30 days; ETHZilla (ETHZ) ranks eighth, holding 102,200 ETH, valued at approximately $474 millions, with a 24.4% increase in holdings over the past 30 days; BTCS Inc (BTCS) ranks eleventh, holding 70,000 ETH, valued at approximately $324 millions, with no change in holdings over the past 30 days.

- 16:26Hackers Use Anthropic AI Tools to Launch Ransomware AttacksJinse Finance reported that artificial intelligence company Anthropic stated that hackers have used Anthropic's technology to carry out a large-scale cybercrime operation, affecting at least 17 institutions. This is an "unprecedented" case of attackers weaponizing commercial AI tools on a large scale. According to Anthropic's report, the hacker used Anthropic's agent-based coding tool Claude Code to launch data theft and extortion attacks against government, healthcare, emergency services, and religious institutions over the past month, resulting in the leakage of medical data, financial information, and other sensitive records. The ransom demands ranged from $75,000 to $500,000, to be paid in cryptocurrency.

- 16:08Circle and Paxos are testing a new cryptocurrency issuance verification technologyJinse Finance reported that stablecoin giants Circle and Paxos are testing a new cryptocurrency issuance verification technology to help physically verify their digital asset holdings. Circle and Paxos are partnering with Bluprynt, a fintech startup founded by Georgetown Law School professor Chris Brummer, to utilize cryptography and blockchain technology to provide issuer verification when stablecoins are issued physically, allowing tokens to be traced back to the verified issuer.