News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(8.20)Fed Vice Chair Supports Limited Crypto Holdings for Staff; Wyoming Launches First State-Level Stablecoin FRNT2XRP & Solana ETF delays spark volatility – Stay or exit before October?3Ethereum Could See Continued Volatility After Trader Loses Millions Amid 16% Correction

Bitcoin Mining Facility: Cango’s Bold $19.5M Georgia Acquisition Signals Massive Growth

CryptoNewsNet·2025/08/11 12:20

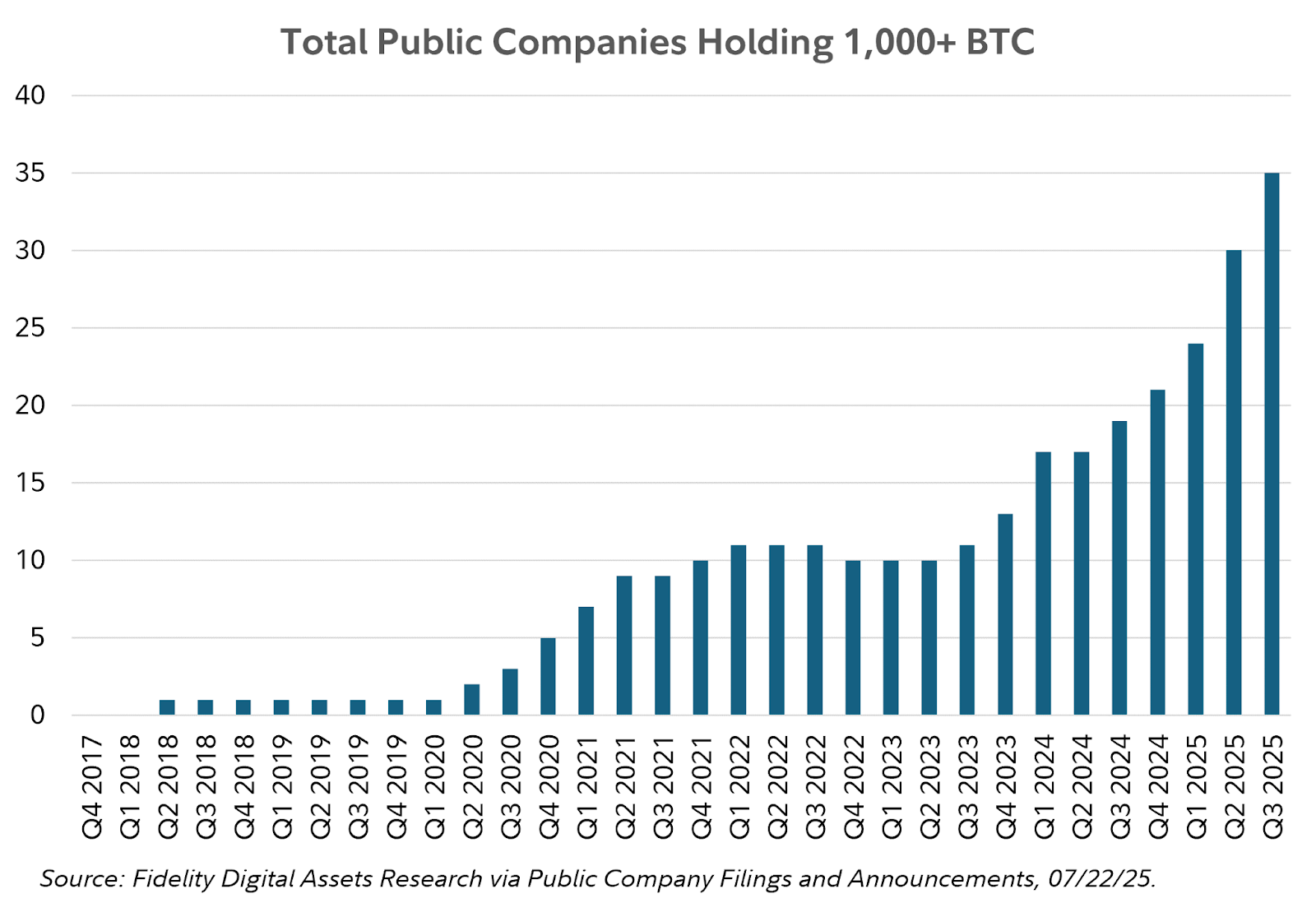

Bitcoin’s corporate boom raises ‘Fort Knox’ nationalization concerns

CryptoNewsNet·2025/08/11 12:20

Dogecoin (DOGE) Price Prediction for August 12

CryptoNewsNet·2025/08/11 12:20

Almost 97% of All Ether Holders Are Now in the Green. What Next?

CryptoNewsNet·2025/08/11 12:20

Crypto developer walks free from Turkish custody after privacy protocol research triggers detention

CryptoSlate·2025/08/11 12:15

Bitcoin: Navigating Crucial Market Tests Near Record Highs

BitcoinWorld·2025/08/11 12:15

Bitcoin Breakout Imminent: Retail Traders Drive Historic Surge

BitcoinWorld·2025/08/11 12:15

Bitcoin DVOL Surges: Unveiling Crucial Market Insights

BitcoinWorld·2025/08/11 12:15

ALT5 Sigma Funding: Historic $1.5 Billion Boost & Trump-Linked DeFi Stake Revealed

BitcoinWorld·2025/08/11 12:15

Apple Siri Set to Revolutionize App Control with Voice Commands

BitcoinWorld·2025/08/11 12:15

Flash

- 04:37Caroline, the person involved in the MyStonks risk control incident: Previously released information about MyStonks was inaccurate and has now been deletedOn August 21, X user Caroline (@thcaroline2233) stated that the previously published information about the MyStonks platform on this account was inaccurate and has now been deleted. Earlier, Caroline had claimed that her $6.2 million on the on-chain securities platform MyStocks had triggered risk controls and could not be withdrawn. MyStonks responded by saying it had received an enforcement request from regulators regarding a specific user. MyStonks emphasized that the safety of user assets and the stable operation of its business are top priorities. The platform will continue to optimize compliance measures to protect the legal rights and fund security of all users. As a compliant platform, MyStonks will actively cooperate with any regulatory actions requested by sovereign nations.

- 04:27Hedge Fund Situational Awareness Acquires 5.8% Stake in Bitcoin Mining Firm Core ScientificAccording to a report by Jinse Finance, Situational Awareness, a hedge fund founded by 23-year-old AI influencer and former OpenAI researcher Leopold Aschenbrenner, has made significant purchases of shares in Bitcoin mining company Core Scientific. Regulatory filings submitted on Tuesday reveal that the fund has acquired 17.7 million shares of this Bitcoin mining and data center operator, securing a 5.8% ownership stake. The fund increased its holdings in Core Scientific between July 18 and August 13. In the filing, the fund stated that the acquisition was driven by its belief that the company is undervalued and represents an attractive investment opportunity. The fund also noted that it may increase or decrease its holdings in the future depending on market conditions, Core Scientific’s performance, or broader industry trends.

- 04:12Data: Ethereum Spot ETF Saw Net Outflows of $240 Million Yesterday, the Third Highest on RecordAccording to ChainCatcher, citing SoSoValue data, the total net outflow from Ethereum spot ETFs yesterday (August 20, Eastern Time) was $240 million. The Ethereum spot ETF with the highest single-day net inflow yesterday was the Grayscale Ethereum Mini Trust ETF (ETH), with a net inflow of $9.0017 million for the day. The historical total net inflow for ETH has now reached $1.312 billion. Next was the Fidelity ETF (FETH), with a single-day net inflow of $8.642 million. The historical total net inflow for FETH has reached $2.51 billion. The Ethereum spot ETF with the largest single-day net outflow yesterday was the BlackRock ETF (ETHA), with a net outflow of $258 million for the day. The historical total net inflow for ETHA has reached $11.814 billion. As of press time, the total net asset value of Ethereum spot ETFs stands at $26.857 billion, with the ETF net asset ratio (market value as a percentage of Ethereum’s total market cap) at 5.11%. The historical cumulative net inflow has reached $11.802 billion.