News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Whales have been accumulating Chainlink, Cardano, and PEPE in anticipation of the US CPI release, with LINK rising by 30%, ADA reaching a 14-day high, and PEPE seeing a 17% increase.

Global M2 money supply is climbing again, raising hopes for a potential Bitcoin price surge.Why M2 Matters for CryptoThe Road Ahead for BTC

Etherex sees a massive 503% TVL surge in 7 days, hitting $119.6M on Ethereum Layer 2 network Linea.What’s Driving the Surge?Implications for DeFi and Layer 2 Adoption

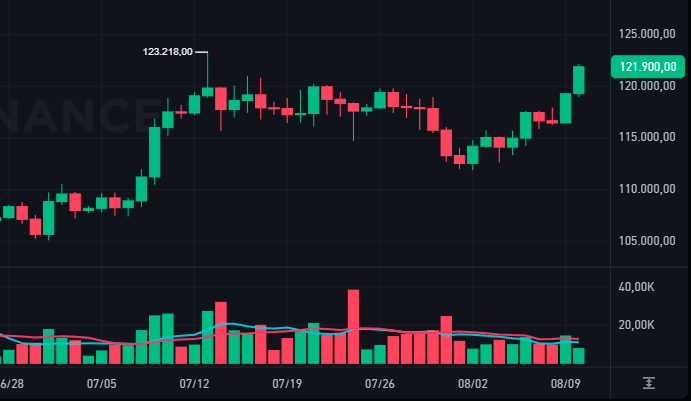

Large investors are scooping up millions in Chainlink, signaling rising confidence in LINK’s future.Millions Spent in Hours on LINKWhat This Means for the Market

Rumble will buy AI firm Northern Data in a $1.17B all-stock deal with support from Tether.Tether’s Strategic InvolvementWhat This Means for Rumble and the Industry

Crypto market sentiment turns more bullish as the Fear & Greed Index rises from 64 to 70 in just one week.What a Reading of 70 Means for InvestorsBalancing Optimism and Caution

$1.57B poured into crypto funds after US allowed 401(k) investments, reversing earlier losses.From Outflows to Weekly GainsInstitutional Interest Likely to Grow

: Ethereum profit realization rises to $553M/day as short-term holders drive gains, matching long-term December 2024 levels.Long-Term Holders Hold SteadyMarket Implications of the Current Trend

- 04:27Hedge Fund Situational Awareness Acquires 5.8% Stake in Bitcoin Mining Firm Core ScientificAccording to a report by Jinse Finance, Situational Awareness, a hedge fund founded by 23-year-old AI influencer and former OpenAI researcher Leopold Aschenbrenner, has made significant purchases of shares in Bitcoin mining company Core Scientific. Regulatory filings submitted on Tuesday reveal that the fund has acquired 17.7 million shares of this Bitcoin mining and data center operator, securing a 5.8% ownership stake. The fund increased its holdings in Core Scientific between July 18 and August 13. In the filing, the fund stated that the acquisition was driven by its belief that the company is undervalued and represents an attractive investment opportunity. The fund also noted that it may increase or decrease its holdings in the future depending on market conditions, Core Scientific’s performance, or broader industry trends.

- 04:12Data: Ethereum Spot ETF Saw Net Outflows of $240 Million Yesterday, the Third Highest on RecordAccording to ChainCatcher, citing SoSoValue data, the total net outflow from Ethereum spot ETFs yesterday (August 20, Eastern Time) was $240 million. The Ethereum spot ETF with the highest single-day net inflow yesterday was the Grayscale Ethereum Mini Trust ETF (ETH), with a net inflow of $9.0017 million for the day. The historical total net inflow for ETH has now reached $1.312 billion. Next was the Fidelity ETF (FETH), with a single-day net inflow of $8.642 million. The historical total net inflow for FETH has reached $2.51 billion. The Ethereum spot ETF with the largest single-day net outflow yesterday was the BlackRock ETF (ETHA), with a net outflow of $258 million for the day. The historical total net inflow for ETHA has reached $11.814 billion. As of press time, the total net asset value of Ethereum spot ETFs stands at $26.857 billion, with the ETF net asset ratio (market value as a percentage of Ethereum’s total market cap) at 5.11%. The historical cumulative net inflow has reached $11.802 billion.

- 04:11A trader initiates a third long position on YZY token after losing $159,600 in the previous two attemptsAccording to a report by Jinse Finance, on-chain analytics platform Lookonchain (@lookonchain) has monitored that wallet address 0x68c0 has once again taken a 3x leveraged long position on the YZY token. In the past hour, this address has executed two long trades on YZY, both of which have been closed, resulting in a total loss of $159,600. This marks the third attempt by this address to go long on the YZY token.