News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

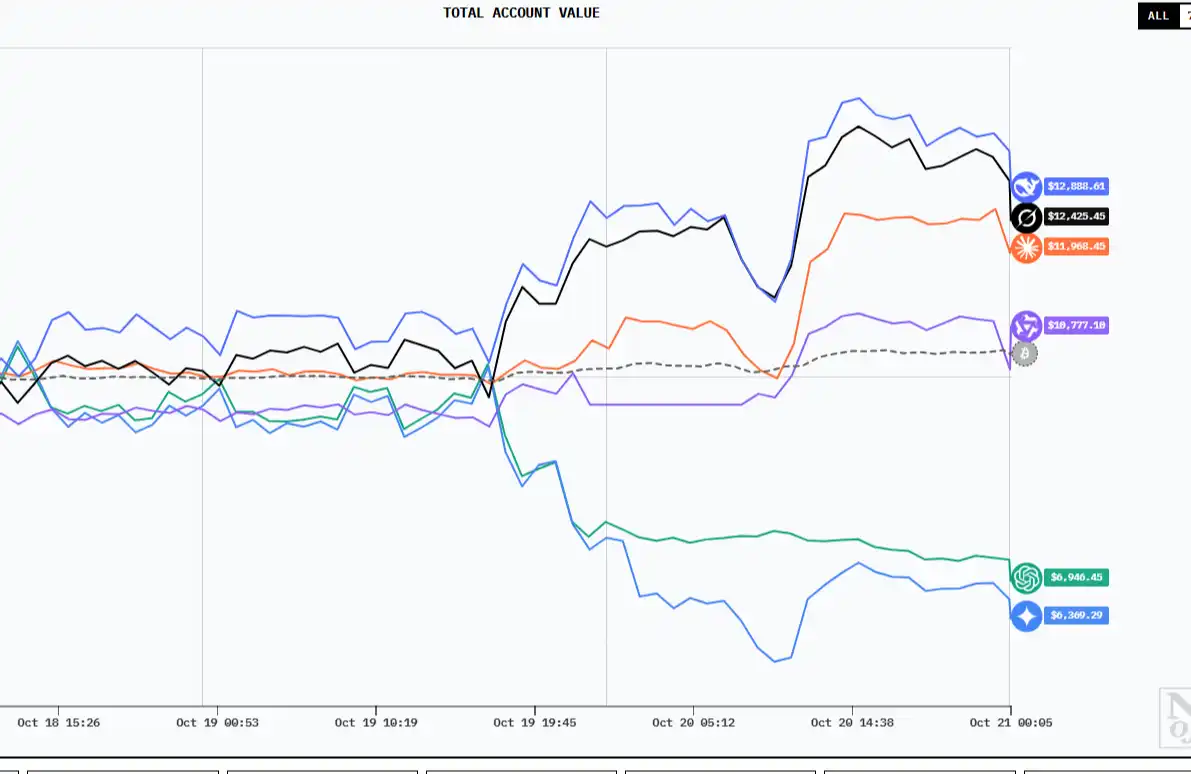

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.

Binance has teamed up with BNB Chain to support its top "flagship project."

Although the Solana ETF has been launched, network revenue trends are declining. Jito is at the intersection of new capital inflows and microstructure improvements.

Stablecoins Reshape Global Financial Architecture by Embracing a “Narrow Banking” Model to Absorb Liquidity

Solana provides Base with a $500 million annual "implicit subsidy," yet few people are aware of it.

This time, there are more Super PACs, some of which have taken a more explicit stance aligning with Republican candidates.

- 09:55Market News: France Raises Digital Tax Rate for Companies such as Amazon and Google’s Parent Company from 3% to 6%Jinse Finance reported that the French National Assembly has passed an amendment to the 2026 budget bill, proposing to increase the digital revenue tax rate for companies such as Amazon, Alphabet (Google's parent company), and Meta from the current 3% to 6%. Although this increase is lower than another proposal to raise the tax rate to 15%, it still means a significant rise in this tax. France's move may trigger a strong reaction from Trump, who has repeatedly threatened to impose retaliatory tariffs on France over this measure. US Republican lawmakers have warned that raising the tax rate to 15% would constitute an unwarranted attack on US tech companies and would leave the US Congress and the Trump administration with almost no choice but to take tough retaliatory action. This amendment is only one part of the budget bill, which may be voted on next month or in December, and it is still uncertain whether it will eventually become law. Although the 6% tax rate amendment was proposed by lawmakers from President Macron's party, the French government remains cautious, stating that it will continue to communicate with the parliament. The French Finance Minister said: "We have noted the parliament's desire to strengthen taxation on digital giants. This matter needs to be handled with caution, especially regarding the threshold for raising the tax rate. We must advance this work through European and international dialogue." (Golden Ten Data)

- 09:32Ant Digital Technologies L2 Jovay Network: No tokens have been issued on any chain, beware of scamsOn October 29, Ant Digital Technology L2 Jovay Network officially issued an urgent security warning, pointing out that unauthorized projects have appeared in the market, fraudulently issuing fake tokens under the name of Jovay on multiple blockchains such as Solana, BSC, and Ethereum. The official statement clarified: Jovay has not issued any tokens on any blockchain at this time. Users should remain vigilant, refrain from purchasing or interacting with any tokens claiming to be from Jovay, and are advised to obtain accurate information through Jovay's official channels.

- 09:19Data: Bitcoin options with a notional value of $14.42 billions will expire and be settled this FridayChainCatcher news, according to market sources, this Friday (16:00 UTC+8), 127,000 BTC options will expire and be settled, with a notional value of $14.42 billions. The max pain point is $114,000, with a put/call ratio of 0.76. The notional value of expiring Ethereum options is $2.56 billions, with a max pain point at $4,100 and a put/call ratio of 0.7.