News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin Community Split Over Purpose May Coincide With Outperformance Versus Major Assets, Mow and JAN3 Say2Ethereum Near $4,475: Clearing $4,500 or Holding $4,362–$4,200 Could Determine Next Direction3Must-Read Before WLFI Launch: 20 Q&As Fully Explain the Governance Model

Going Global: Architecture Selection and Tax Optimization Strategies

How important is having an appropriate corporate structure?

深潮·2025/09/02 07:03

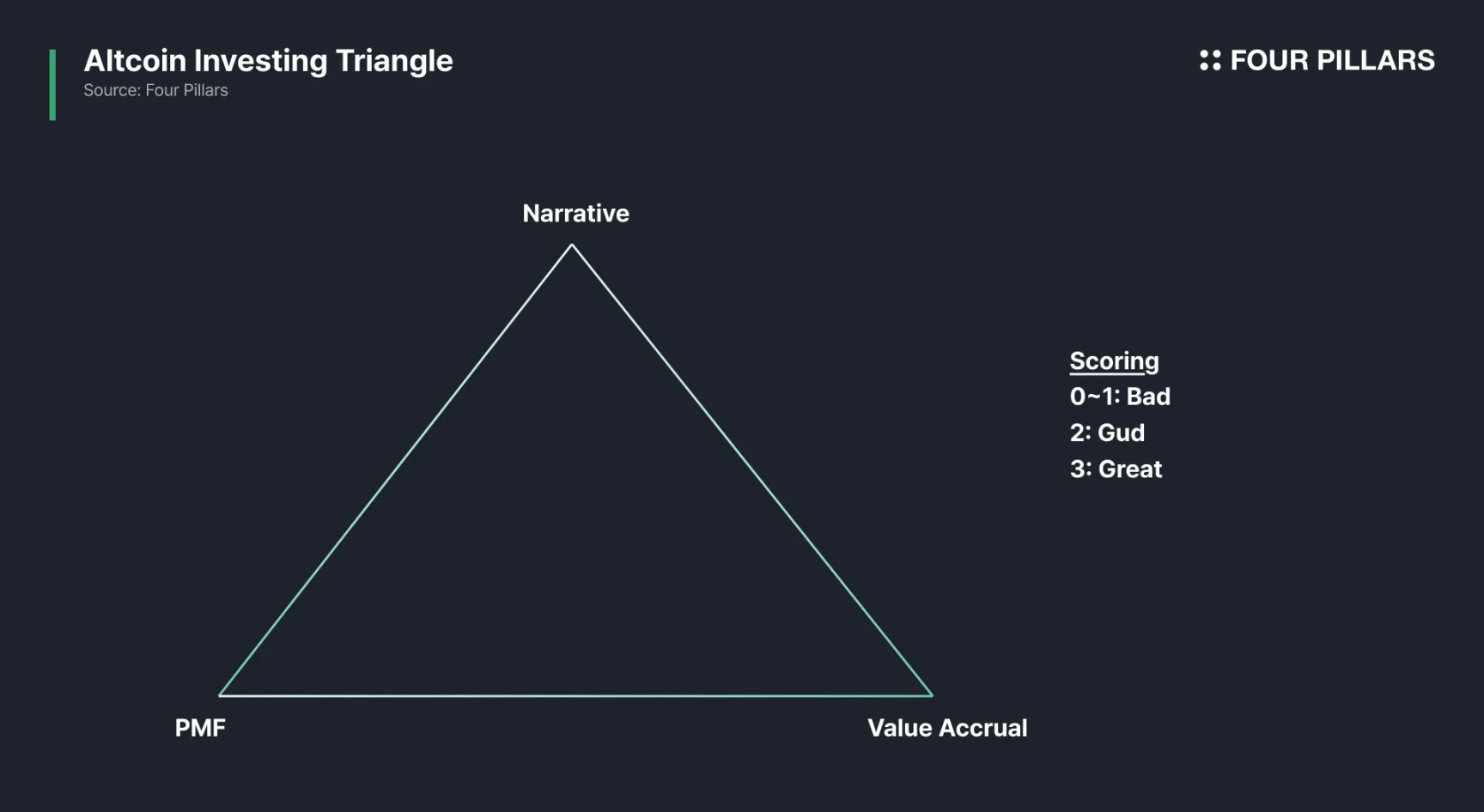

The Evolution of Altcoin Investment from the Perspective of $HYPE

In an era where indicators can be manipulated, how can we see through the narrative fog surrounding token economics?

深潮·2025/09/02 07:03

Paraguay Launches Tokenized Innovation Hub on Polkadot

Coinspaidmedia·2025/09/02 05:40

The underestimated Malaysian Chinese: the invisible infrastructure builders of the crypto world

The foundational infrastructures and emerging narratives in the crypto industry, such as CoinGecko, Etherscan, and Virtuals Protocol, all originate from Malaysian Chinese teams.

BlockBeats·2025/09/02 05:13

Interpretation of AAVE Horizon: Trillions Market Awaiting Unlock, the Key Piece for RWA On-Chain?

What does it mean when U.S. Treasury bonds and stock funds can both be used as collateral in DeFi?

BlockBeats·2025/09/02 05:12

Flash

- 07:47Analyst: Bitcoin's current 12.8% pullback from its all-time high is closer to a moderate correction rather than a full-scale sell-off.According to a report by Jinse Finance, CryptoQuant analyst @AxelAdlerJr has released a chart showing that Bitcoin (BTC) has currently retraced 12.8% from its all-time high (ATH). In this bull market cycle, most local peak pullbacks have ranged between -10% and -18%, while deeper corrections typically extend to -20% to -30%. The current 12.8% retracement is closer to the moderate range, which is consistent with a repair/consolidation phase rather than a full-scale sell-off.

- 07:28On-chain credit platform Creditlink announces strategic investment from Four.memeChainCatcher News, according to official sources, the on-chain credit rating platform Creditlink has announced that it has received strategic investment from Four.meme, with the investment amount undisclosed. At the same time, Four.meme will explore introducing Creditlink's token health reports and user credit ratings into its future platform ecosystem. Creditlink is committed to providing transparent and reliable on-chain credit rating services for the Web3 industry, covering dimensions such as project token health assessment, user on-chain credit scoring, and batch address Sybil detection. This strategic investment marks an important step for Creditlink in promoting the construction of the on-chain credit ecosystem. It also signifies that on-chain credit is gradually moving towards the Web3 infrastructure layer, gaining broader application and recognition.

- 07:18The top Ethena address received approximately $1.85 million worth of WLFI tokens yesterday and has not sold them yet.Jinse Finance reported that, according to on-chain analyst Ai Yi (@ai_9684xtpa), the address ranked first on the Ethena leaderboard, AndreIsBack (0x9cb...c06ce), has received an unlocked 7.74 million WLFI tokens, currently valued at approximately $1.85 million. Previously, this address invested 170 ETH (about $580,000) in the first phase of the WLFI public sale and received 38.71 million tokens. On-chain data shows that this address currently holds a 3x leveraged short position on the Hyperliquid platform, with an unrealized profit of $585,000. The address holds assets exceeding $41.69 million, has participated in 21 decentralized finance projects, ranks first in the Ethena Season 3 leaderboard with 1.28 trillion points, accounting for 3.57% of the total prize pool.