Morgan Stanley raises gold target price to $3,800, silver may see better-than-expected performance

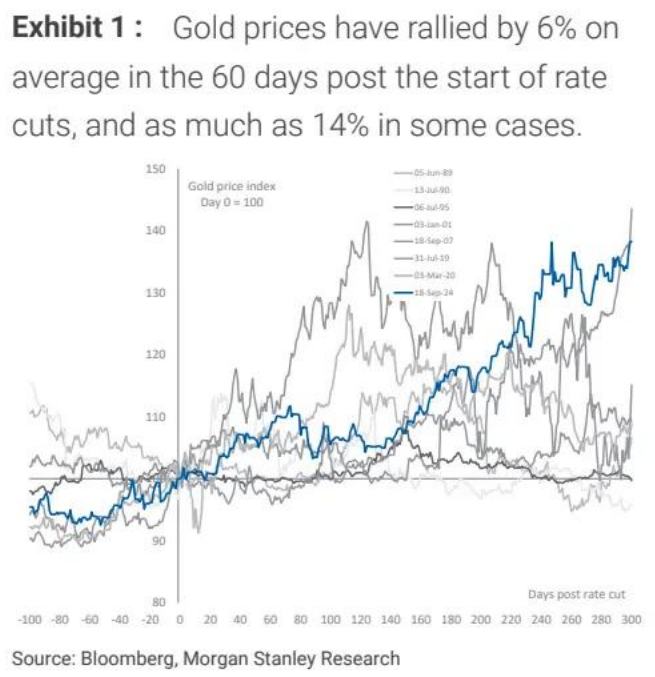

According to Jinse Finance APP, the latest research report from Morgan Stanley points out that the precious metals market is entering an upward cycle driven by multiple favorable factors, with gold and silver prices expected to diverge amid the Federal Reserve's rate-cutting cycle and changes in the macro environment. According to the report, historical data shows that precious metals usually experience significant gains after the Federal Reserve cuts rates—gold rises by an average of 6% (up to 14%) within 60 days after a rate cut, while silver rises by an average of 4% during the same period. This pattern provides important reference for the current market.

Figure 1

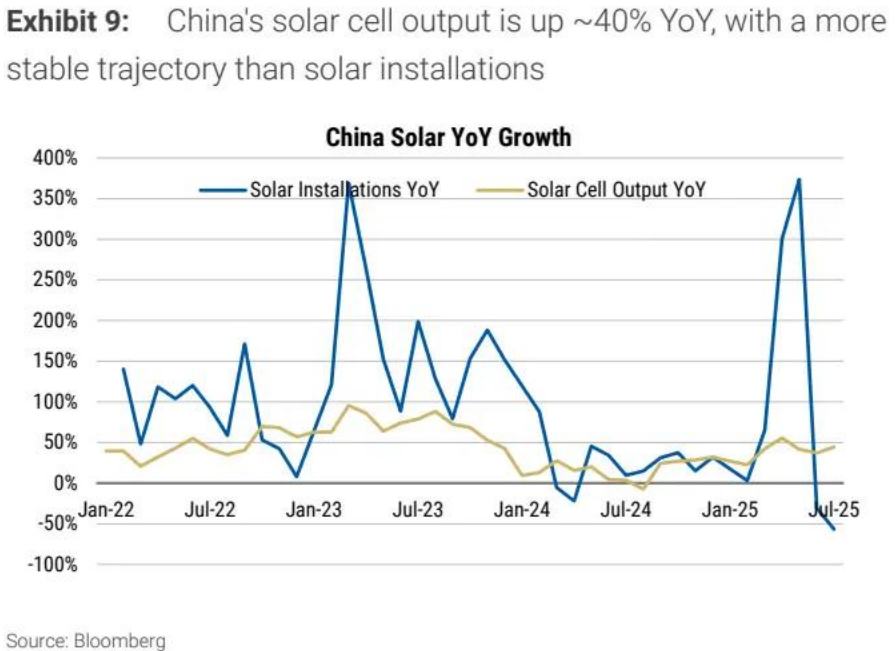

On the demand side, global gold ETFs have increased their holdings by about 440 tons this year, reversing the net outflow trend of the previous four years, indicating a rebound in institutional demand for gold allocation. Silver ETF holdings have increased by 127 million ounces during the same period, but the report warns that speculative trading may lead to excessive price surges.

Figure 2

It is worth noting that India's gold import data for July has shown signs of improvement. Although jewelry demand in the second quarter hit its lowest level since Q3 2020, expectations of increased consumer purchasing power brought by local Goods and Services Tax (GST) reforms may lay the groundwork for a subsequent demand recovery.

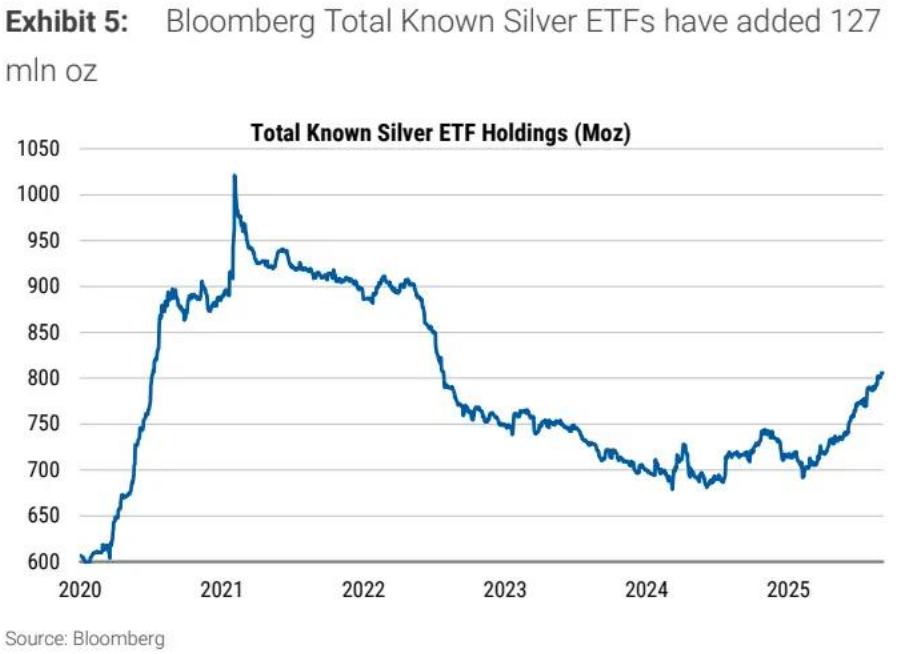

In terms of price forecasts, Morgan Stanley has set its year-end target price for gold at $3,800 per ounce, with three core driving factors: the continued progress of the Federal Reserve's rate-cutting cycle, the potential further weakening of the US Dollar Index (DXY), and the potential recovery of jewelry consumption in emerging markets.

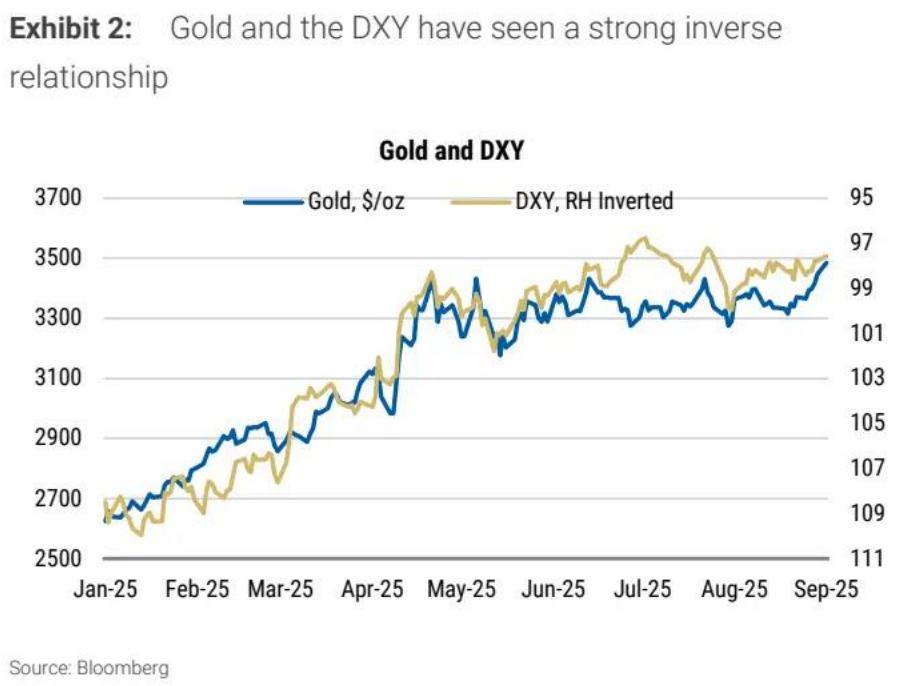

For silver, although analysts remain cautious (target price $40.9 per ounce), the contradiction between stable solar panel production and a 7% year-on-year contraction in Mexican mine supply suggests that silver prices may have upside potential beyond expectations.

Figure 3

The report particularly emphasizes that the strong negative correlation between gold and the US dollar remains a key pricing logic. If the current depreciation trend of the US Dollar Index continues, it will directly benefit precious metals priced in US dollars.

Figure 4

However, the report also highlights risks: although India's GST reform does not directly benefit gold and silver, tax reductions in other areas may indirectly boost consumer purchasing power. In addition, Morgan Stanley's business dealings with related companies should also be considered by investors when making decisions.

Overall, the report believes that gold's safe-haven and anti-inflation attributes during the rate-cutting cycle will support its price increase, while silver needs to find a balance between industrial demand and speculative sentiment. Investors should closely monitor Federal Reserve policy moves, the US dollar trend, and signals of consumption recovery in the Indian market to seize structural opportunities in the precious metals market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETF Inflows Exceed 30,000 BTC as Analysts Warn of Coming Reversal

History Repeats: Altcoin Cap Mirrors 2016 & 2019 — 5 Breakout Picks Targeting 8x–12x Returns

PEPE’s RSI Hits Bottom Again as Traders Eye 0.0000066 for Next Bounce

Bitcoin Needs Just 15% Pump to Trigger $17B Short Squeeze

Bitcoin only needs a 15% move upward to liquidate $17B in shorts, setting the stage for a potential explosive short squeeze.$17 Billion in Shorts at Risk as BTC Nears Critical LevelWhy the Market Is Watching CloselyIs a Short Squeeze Imminent?