News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Gold & Silver Break Out While Bitcoin Chops: Why Capital Is Flowing Into Precious Metals

Newsbtc·2025/12/23 23:12

Ozak AI presale nears completion, analysts project potential 700× returns by 2027

Crypto.News·2025/12/23 23:09

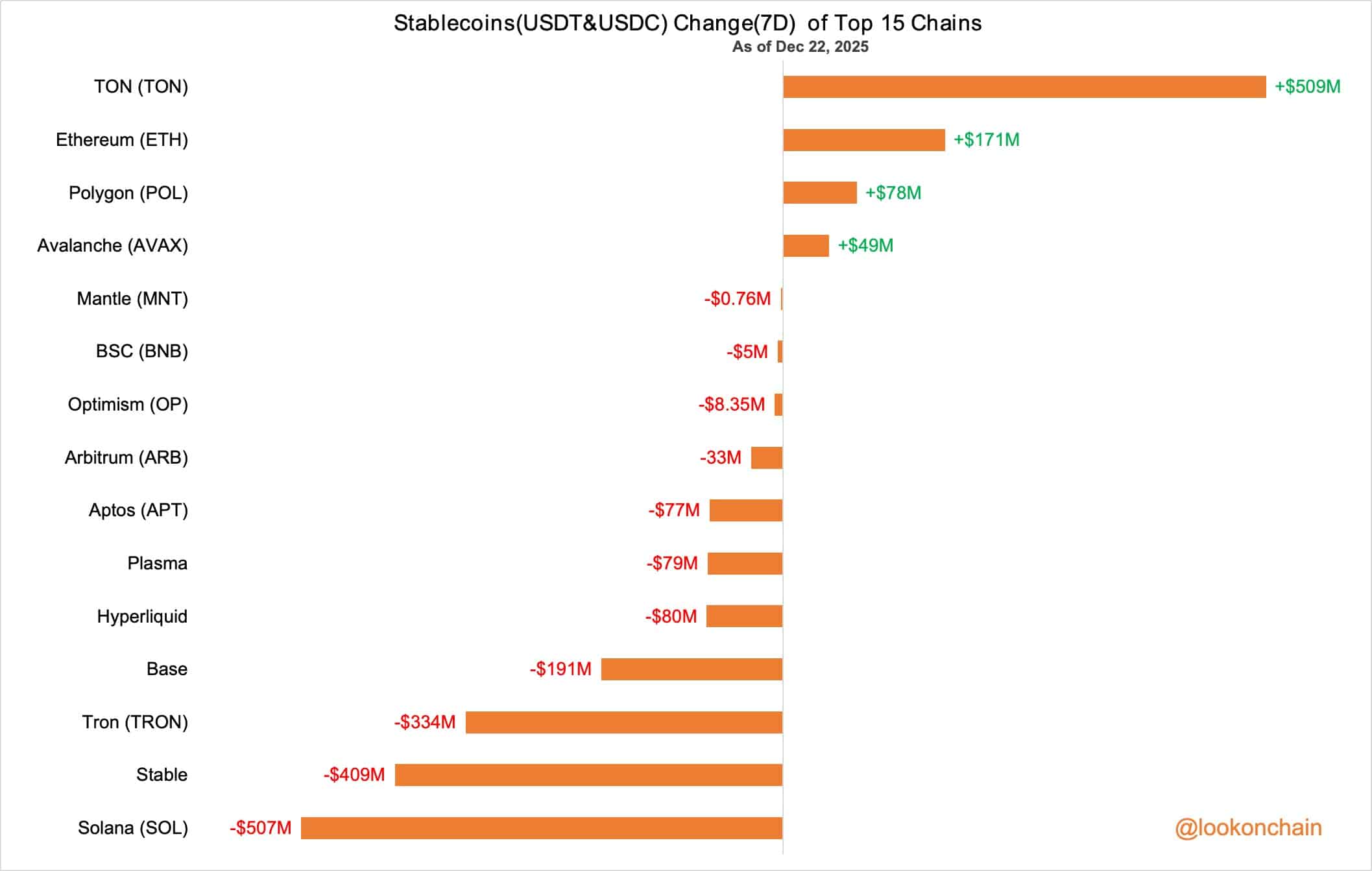

Stablecoins are leaving exchanges – and traders aren’t buying the dip

AMBCrypto·2025/12/23 23:03

Ethereum Nears $3,000 as Bitmine Expands Holdings to 4 Million ETH

BeInCrypto·2025/12/23 22:21

Three Financial Giants Predict Why Crypto Faces Its Hardest Test Yet in 2026

BeInCrypto·2025/12/23 22:21

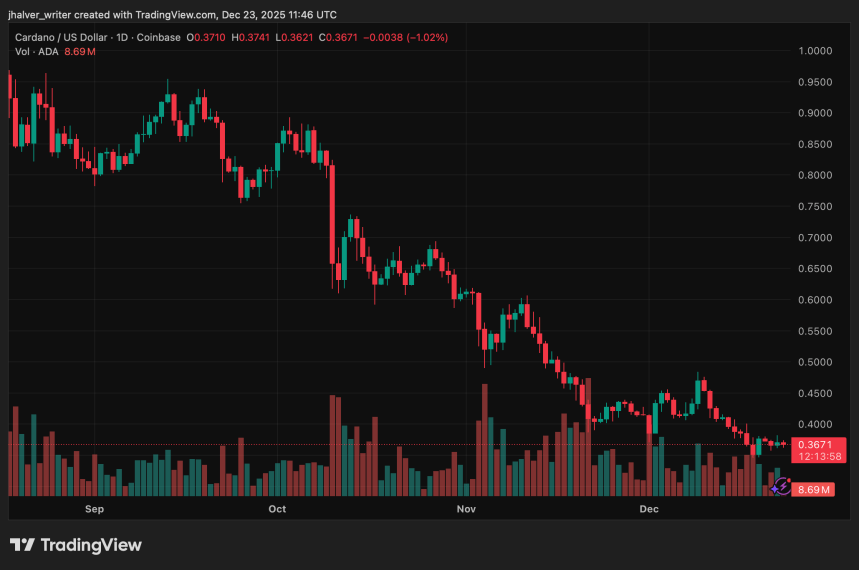

Founder Signals Long-Term Opportunity in Cardano DEXes as Price Consolidation Persists

Newsbtc·2025/12/23 22:06

AI Crypto Coins: ETHZilla Liquidates $74M Worth of ETH, DeepSnitch AI’s $875K Presale Takes Hold of the AI Sector

BlockchainReporter·2025/12/23 21:51

XRP Breaks $1.95 Support After 13 Months, Analyst Sees $0.90 Next

Newsbtc·2025/12/23 21:12

TikTok Users Claim They’ve 'Unredacted' the Epstein Files

Decrypt·2025/12/23 21:01

Russia Plans New Crypto Regulation for 2026

BeInCrypto·2025/12/23 21:00

Flash

03:18

2024 Narrative Review: AI and Meme Were the Most Profitable Sectors, Full Trend Reversal Expected in 2025PANews, December 25 – According to CoinGecko data, the top narratives with the largest gains in 2024 were AI (+2939.8%) and Meme coins (+2185.1%), with RWA and Layer1 also performing impressively. However, the market landscape will change significantly in 2025, with only RWA and Layer1 achieving profits for two consecutive years. Most popular narratives shifted from profit to loss, reflecting the intense rotation of styles in the crypto market.

03:18

Dora Factory launches global crypto opinion polling platform "World MACI"According to Odaily, decentralized governance infrastructure Dora Factory has launched a global crypto opinion polling platform - World MACI. Currently, the World MACI platform is in the public Alpha testing phase.

03:14

A wallet related to Erik Voorhees transferred 1,635 ETH, worth approximately $4.81 million.Foresight News reported, according to Onchain Lens monitoring, a wallet related to Erik Voorhees transferred 1,635 ETH (approximately $4.81 million) to a new wallet and transferred ETH via THORChain. The wallet currently still holds 4,004 ETH, valued at approximately $11.82 million.