News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1XRP Price Signals: The Key Indicators Traders Can’t Ignore Right Now2PENGU Set for 100% Breakout as Pudgy Penguins Adjust NFT Treasury3Ethereum TVL Nears $95B, Highest Since 2021

Solana Price Outlook for Next Week: What to Expect

Coindoo·2025/08/10 21:15

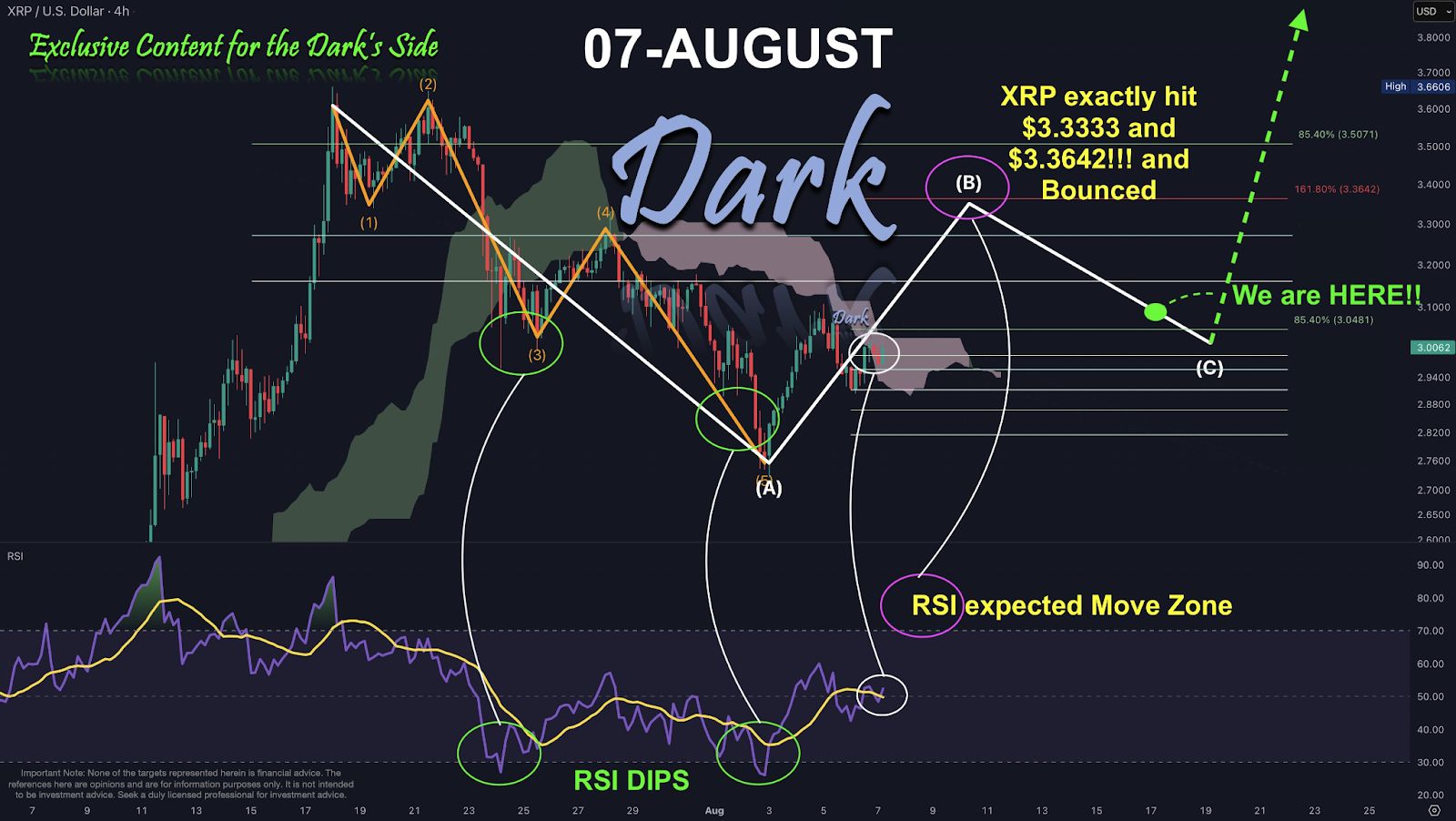

XRP Price Outlook: Key Levels That Could Trigger the Next Rally

Coindoo·2025/08/10 21:15

Vitalik Buterin’s Ethereum Holdings Top $1 Billion as Whales Fight For Limited ETH Supply

Buterin’s billion-dollar ETH stake and a squeeze in OTC liquidity are reshaping market chatter. On-chain data and whale flows hint at rising demand.

BeInCrypto·2025/08/10 20:41

Ether price target now $20K as ETH preps all-time high in '1-2 weeks'

Cointelegraph·2025/08/10 20:40

Bitcoin can liquidate $18B with 10% price gain as traders see $120K next

Cointelegraph·2025/08/10 20:40

How high will Ethereum price go after breaking $4K? ETH analysts weigh in

Cointelegraph·2025/08/10 20:40

Bitcoin’s Technical Shift Suggests Potential for Price Movement Ahead of Key Resistance Levels

Coinotag·2025/08/10 20:05

Ethereum Approaches Critical Channel Resistance: Analyzing Potential Breakout and Divergence Signals

Coinotag·2025/08/10 20:05

Anonymous Whale Stakes 10,999 ETH, Sparking Institutional Interest and Potential Price Stability

Coinotag·2025/08/10 20:05

XRP Shows Promising Support Signals as Analysts Suggest Potential for Major Rally Ahead

Coinotag·2025/08/10 20:05

Flash

- 17:517,625 BTC Transferred from an Exchange to an Unknown New WalletAccording to Jinse Finance, @whale_alert monitoring shows that at 01:42:48 (GMT+8), 7,625 BTC (worth $897,539,735) were transferred from an exchange to an unknown new wallet.

- 17:10Citigroup’s Dirk Willer: European Business Cycle Shifts, Overweight U.S. Stocks, Bearish on the DollarAccording to a report by Jinse Finance, at the "2025 Asset Management Annual Conference," Dirk Willer, Head of Global Macro and Asset Allocation Research at Citi, shared his investment perspectives on major global markets for the second half of this year. Dirk Willer first outlined Citi's asset allocation views: overweight equities (especially the US, and to some extent Europe), underweight UK equities; neutral on government bonds, overweight emerging market bonds, underweight Japanese government bonds; underweight investment-grade credit in Europe and the US; neutral on commodities; short the US dollar, long the euro and select emerging market currencies. Regarding the stock market, Dirk Willer pointed out that the "US exceptionalism" narrative has clearly returned, as evidenced by its performance relative to Europe and other regions globally. The core driver is the resurgence of AI-driven trading—performance in the technology sector is leading the US market and has become a key support. (21 Asset Management)

- 16:22"Big Brother Machi" Sees Long Position Unrealized Losses Widen to $5.1 MillionAccording to ChainCatcher, on-chain data shows that "Machi Big Brother" Huang Licheng's total unrealized loss on long positions has expanded to $5.1 million. Currently, his BTC and HYPE long positions are in profit, while his ETH long position has an unrealized loss of as much as $5.14 million.