News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Official Trump (TRUMP) To Rise Higher? Key Harmonic Pattern Signals Potential Upside Move2AAVE To Rally Higher? Key Pattern Signals Potential Upside Move3Stellar XLM Flashes Mini Golden Cross. Bulls Eye $0.50 for Takeoff

Forecasting $130K Bitcoin: Identifying Trends from 2023 & 2024 Predictions

Analyzing Data Trends: Unpacking BTC's Third Corrective Phase on its Quest to a $130K Value

Coineagle·2025/03/05 07:44

Dogecoin (DOGE) Attempts Rebound—Will Recovery Gain Momentum?

Newsbtc·2025/03/05 07:33

Despite Market Declines, Crypto Economy Shows Signs of Strength

Bitcoin.com·2025/03/05 07:22

Bitcoin Price Watch: Bulls Fight Back as Bitcoin Eyes $90K Breakout

Bitcoin.com·2025/03/05 07:22

BlackRock CEO sees rocky 2025, but bets on long-term tech boom amid escalating trade tensions

Cryptobriefing·2025/03/05 07:11

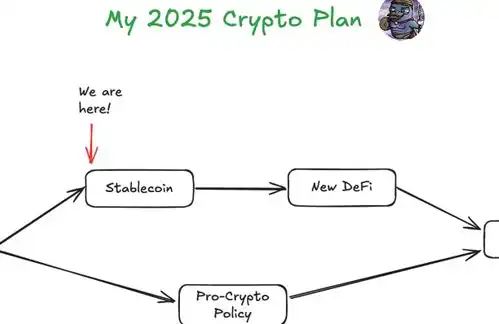

2025 Crypto Market Survival Guide: Is Stablecoin the Next Big Bet?

Stablecoin is the new oil

BlockBeats·2025/03/05 07:11

Arthur Hayes says no one can save America from a recession now thanks to Trump

CryptoNewsNet·2025/03/05 00:44

AAVE Jumps 3.96% After It Proposes Major Tokenomics Overhaul

Cryptotale·2025/03/05 00:17

Aave Proposes New Tokenomics, Shifting Revenue and Liquidity Management

Aave governance is advancing its tokenomics overhaul, introducing changes that impact staking rewards, liquidity management, and revenue distribution. The proposed adjustments seek to enhance capital efficiency while reducing reliance on native token incentives, signaling a shift in how decentralized finance protocols approach long-term sustainability.

CryptoNews·2025/03/04 23:44

Flash

- 17:02U.S. stocks edge lower, Dow currently down 0.55%According to Jinse Finance, U.S. stocks have edged lower, with the Dow Jones currently down 0.55%, the Nasdaq down 0.08%, and the S&P 500 down 0.12%.

- 16:55US July Inflation Expectations Continue to Decline, Consumer Confidence Remains Largely UnchangedBlockBeats News, July 18 — Joanne Hsu, Director of the University of Michigan Consumer Survey, stated that U.S. consumer confidence changed little compared to June, rising slightly by about 1 point to 61.8. Although the index reached a five-month high, it remains about 16% lower than in December 2024 and is still well below the historical average. Unless consumers are convinced that inflation is unlikely to worsen—for example, if trade policy stabilizes in the foreseeable future—they are unlikely to regain confidence in the economy. Current interview results show little evidence that other policy changes, including the recently passed tax and spending bills, have had a significant impact on consumer confidence. Inflation expectations for the coming year fell for the second consecutive month, dropping from 5.0% last month to 4.4% this month. Long-term inflation expectations declined for the third consecutive month, falling from 4.0% in June to 3.6% in July. Both indices are at their lowest levels since February 2025, but remain higher than in December 2024, indicating that consumers still see a significant risk of rising inflation in the future. (Jin10)

- 16:54Improved Inflation Expectations Boost U.S. Consumer ConfidenceBlockBeats News, July 18 — As expectations for the economy and inflation continue to improve, the U.S. consumer confidence index rose to a five-month high in early July. Data released by the University of Michigan on Friday showed that the preliminary consumer confidence index for July increased to 61.8 from 60.7 a month earlier. However, this figure still remains below last year's average level. Consumers expect the annualized increase in prices over the next year to be 4.4%, down from 5% last month, marking the lowest level since February this year. They anticipate an annual inflation rate of 3.6% over the next five to ten years, also the lowest in five months. Meanwhile, concerns over tariffs continue to limit optimism about the economic outlook. Joanne Hsu, the survey director, stated in a release: "Consumers' expectations for business conditions, the labor market, and even their own incomes are weaker than a year ago. That said, the rise in confidence over the past two months suggests that consumers believe the risks of the worst-case scenarios they anticipated in April and May have eased. However, announcements of tariff increases or rising inflation could dampen market sentiment." (Jin10)