News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.22)|Over 90% of ETH Addresses in Profit, FTX Seeks Delay in Responding to Objections, $470M in Claims May Be Frozen, Public Companies Establish DOGE Corporate Treasury2Chainlink Breaks $19 After Gann Arc Shift and Targets $28 Resistance3Top Banks Lobby Against Ripple, Circle Trust Approval — Fear of XRP Disruption?

Ethereum market cap at $252B despite 57% drop

Grafa·2025/03/25 06:50

Nostra halts borrowing after $STRK token price error

Grafa·2025/03/25 06:50

Research Report | BUBB Project Analysis & Market Value Assessment

西格玛学长·2025/03/25 06:45

Hedera (HBAR) Gains Strength as Market Inflows Boost Price Outlook

HBAR's recent price action signals a shift toward bullish momentum, with potential for further gains if the token breaks above key technical levels.

BeInCrypto·2025/03/25 05:00

Dogecoin Foundation Unveils Massive 10M DOGE Reserve: A Bold Leap for Crypto Payments?

BitcoinWorld·2025/03/25 04:55

Crypto ETFs Gaining Massive Popularity Among U.S. Advisors as 'Reputational' Risk Gone

Cointime·2025/03/25 04:36

Solana’s 12% Surge Faces Key Technical Headwinds: What You Need to Know

Solana's 12% surge may not be as strong as it seems, as technical indicators show weakening buying support and bearish sentiment among traders. The coin faces a critical moment, with its price potentially dropping to $130.82 if key support fails.

BeInCrypto·2025/03/25 02:00

BlackRock Brings Bitcoin ETP to Europe with 0.15% Fee Waiver

Following the success of its US Bitcoin ETF, BlackRock is launching a Bitcoin ETP in Europe, offering a temporary fee waiver to attract both retail and institutional investors.

BeInCrypto·2025/03/25 01:48

Bitcoin proxy Strategy acquires 6,911 BTC, now holds 506,000 BTC

Cryptobriefing·2025/03/25 00:11

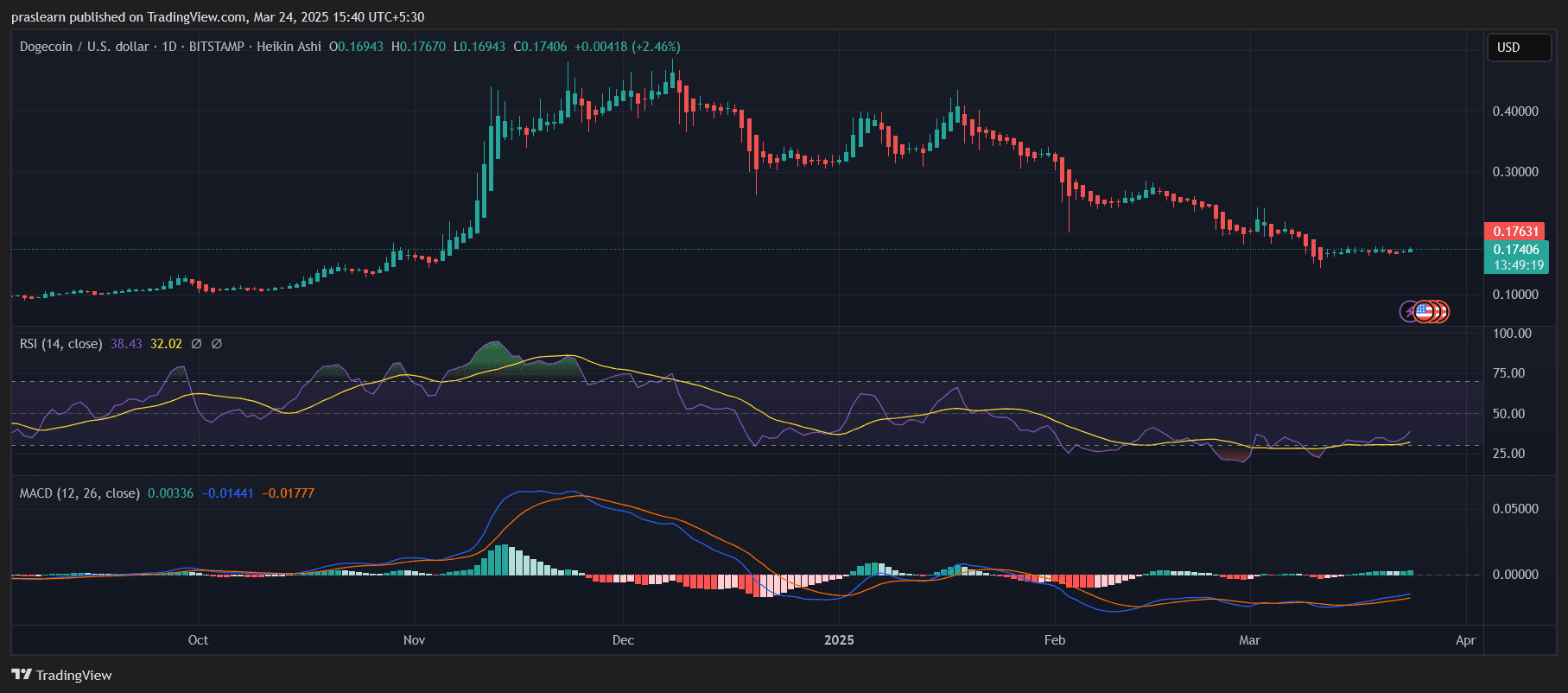

Dogecoin Prediction for April 2025: Will DOGE Price Skyrocket to $5?

Cryptoticker·2025/03/24 22:22

Flash

- 17:03Bloomberg Analyst: Positive Signs Emerge for Spot Creation and Redemption Mechanism Approval in Bitcoin and Ethereum ETFsAccording to ChainCatcher, Bloomberg ETF analyst James Seyffart stated in a recent post that five funds listed on the CBOE have submitted amended documents to the SEC, indicating that regulators are actively communicating with fund providers and making detailed adjustments, possibly paving the way for a physical creation and redemption mechanism. It is worth noting that this mechanism applies only to authorized participants, such as major Wall Street institutions and market makers. Ordinary investors cannot directly exchange ETF shares for spot Bitcoin or Ethereum assets.

- 16:38With the Rise of Decentralized Derivatives Trading, USDC Supply on Hyperliquid Grows to 4.9 BillionAccording to ChainCatcher, citing The Block, the supply of USDC on Hyperliquid has grown significantly since the beginning of the year, doubling to 4.9 billion tokens. This expansion reflects the rising importance of decentralized perpetual contract trading platforms, with USDC serving as the primary settlement currency for derivatives trading on the platform. Hyperliquid has demonstrated strong trading momentum, processing over $150 billion in trading volume in July alone. The platform’s trading volume has reached 11.5% of a certain exchange, indicating its rapid emergence as a leading on-chain perpetual contract platform.

- 16:24Skynet Releases Stablecoin Rankings, with USDT, USDC, PYUSD, and RLUSD Leading the ListForesight News reports that Web3 security firm CertiK has released the "Skynet 2025 H1 Stablecoin Panorama Report." According to the report, stablecoins are rapidly integrating into the mainstream financial system, with total supply surpassing $250 billion in the first half of the year and monthly settlement volume increasing by 43% to reach $1.4 trillion. USDT, USDC, PYUSD, and RLUSD have excelled in security, market dynamics, and regulatory compliance, ranking at the top of the scoreboards. The report notes that the primary risks in the stablecoin industry are shifting from smart contracts to the operational management of centralized platforms, with key leaks and operational errors becoming the main sources of risk. Meanwhile, RWA-backed and yield-bearing stablecoins are developing rapidly and are expected to capture 8%-10% of the market share within the year. Due to their complex custody mechanisms and yield structures, these stablecoins demand higher levels of operational transparency and compliance capabilities.