News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

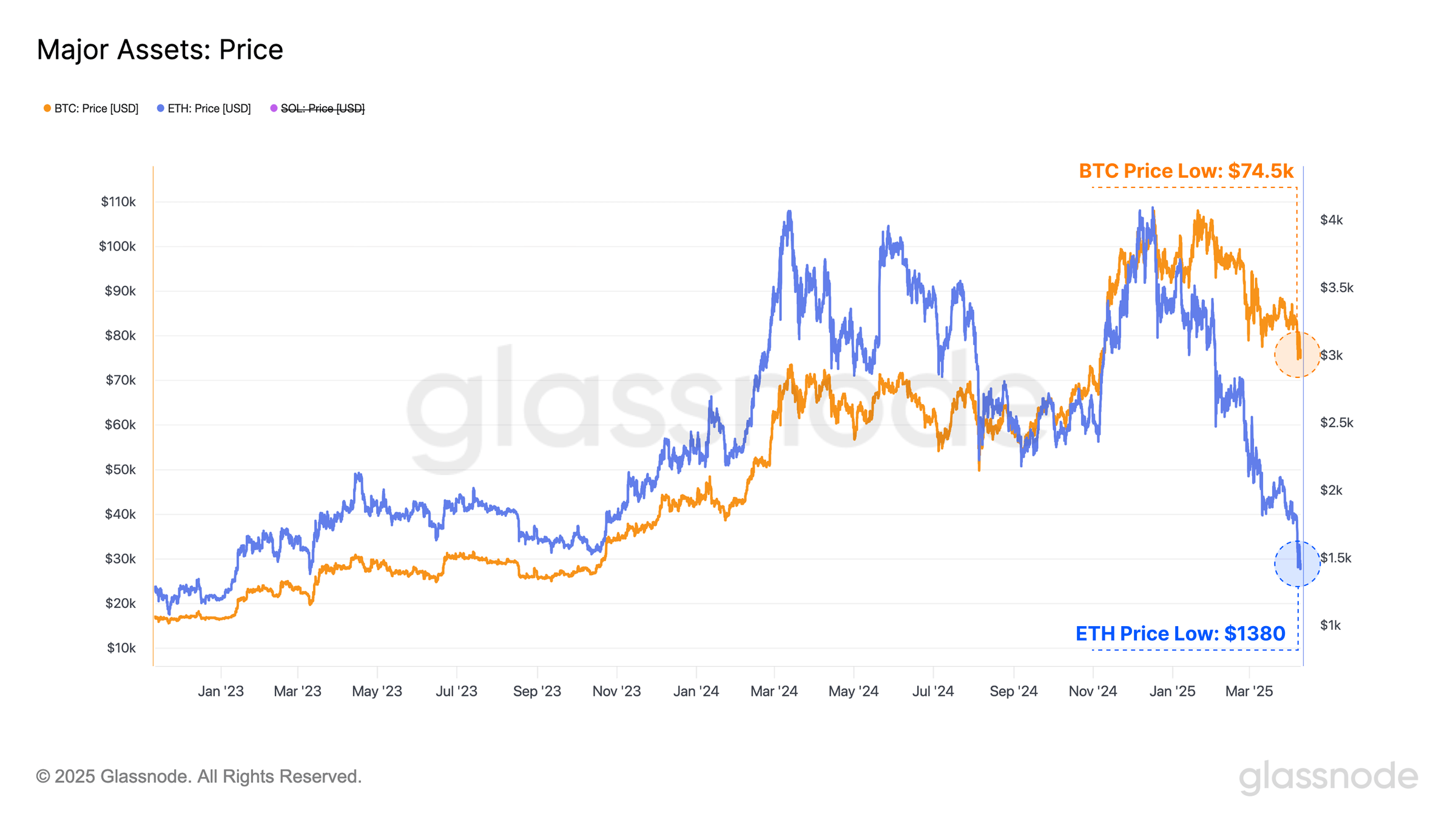

An analyst compares Ethereum to Nokia, suggesting it may lose relevance as Solana outperforms in scalability and user experience. While Ethereum maintains dominance in DEX volume, it must accelerate its development to avoid being overtaken.

While Bitcoin spot ETFs face continued outflows, derivatives markets remain optimistic, with positive funding rates and strong demand for call options signaling bullish sentiment.

Over $2.5 billion in Bitcoin and Ethereum options expire today, with analysts anticipating market volatility due to fading call premiums and global uncertainty. Traders are eyeing these expirations for clues on short-term price direction.

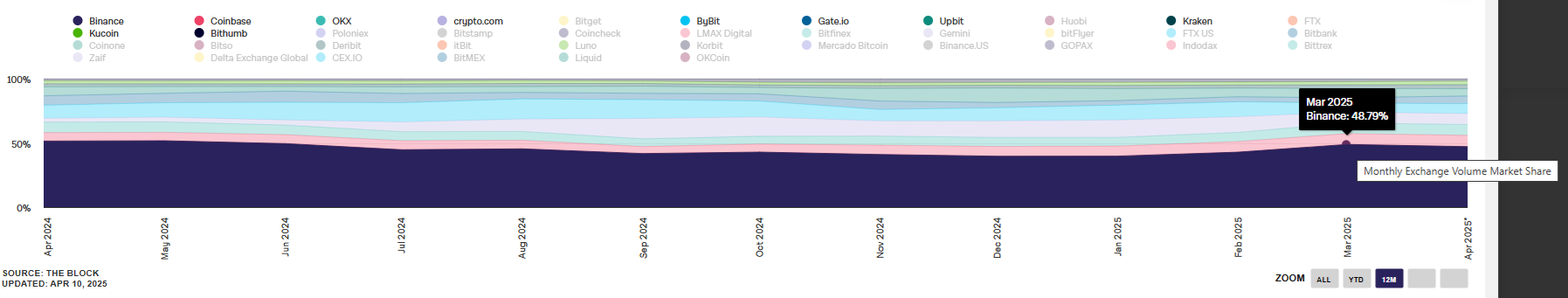

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.

- 17:09If Bitcoin Falls Below $115,000, Total Long Liquidations on Major CEXs Will Reach $1.59 BillionAccording to a report by Jinse Finance, Coinglass data shows that if Bitcoin falls below $115,000, the cumulative long liquidation volume on major CEXs will reach $1.59 billion. Conversely, if Bitcoin surpasses $119,000, the cumulative short liquidation volume on major CEXs will reach $390 million.

- 17:04Trader Eugene: Simply Buying and Holding ETH for Three Months Is Easier Than Chasing Trending Tokens On-ChainBlockBeats News, July 29 — Trader Eugene Ng Ah Sio shared his outlook on the market trends for the coming months: "In my view, there will be very few tokens that can outperform BTC and ETH on a risk-adjusted basis in the near future. Of course, there may be some unexpected meme coins that experience explosive growth, but betting on these in advance is a high-difficulty game. With the market now at relatively high levels, I am more inclined to hold mainstream tokens and reduce high-risk speculative trades. Compared to chasing the next trending token on-chain and getting caught in major volatility, simply buying ETH, holding it for three months without moving, and then selling for a 50% gain is much easier."

- 17:04Number of Voters at the Fed's July Meeting Drops to 11BlockBeats News, July 29 — Federal Reserve Governor Adriana Kugler will be absent from this week’s policy meeting due to personal reasons, reducing the number of voters for this rate decision to 11. Although Governors Waller and Bowman may cast dissenting votes in favor of a rate cut, the committee still holds a sufficient majority to keep rates unchanged. There are no substitutes for governor seats, while president seats can be substituted. (Jin10)