News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Share link:In this post: The S&P 500 rose 1.6% and the Nasdaq jumped 2.2% as tech stocks like Nvidia and Amazon rallied. China confirmed there are no trade talks happening with the U.S. and called for removal of tariffs. Trump said he’s open to less confrontation on trade, but no details or negotiations have been set.

Share link:In this post: Trump is now selling a “Trump 2028” hat, openly signaling interest in a third presidential term. The original product description hinted at rewriting the Constitution but was later changed. Trump told NBC News he’s considering legal ways to bypass the two-term limit, including running as vice president.

Share link:In this post: Citigroup predicts $1.6T in stablecoin supply by 2030 in a base scenario and up to $3.7T in a bullish development. Stablecoins may replace cash reserves and some fintech apps. Blockchain may make a comeback for public spending, disbursements and transparent tracking.

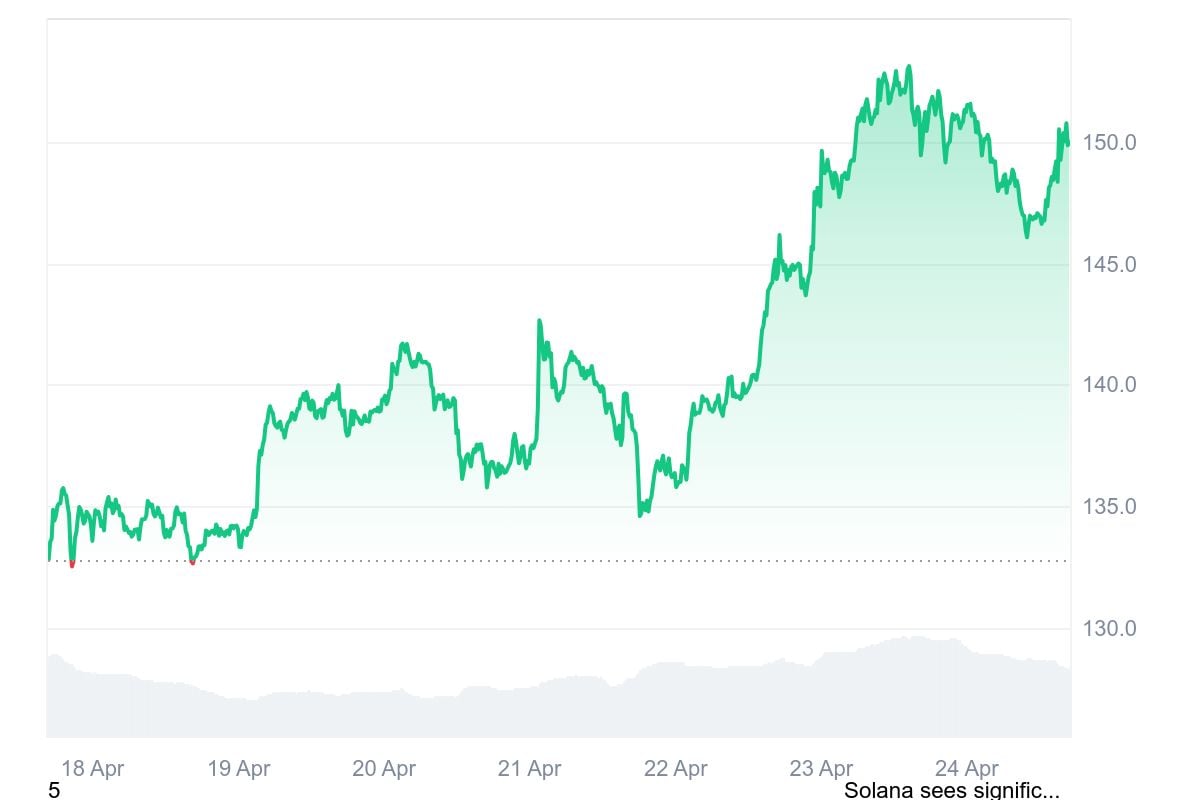

Quick Take Gitcoin is shutting down its primary software development unit, Gitcoin Labs, largely due to a lack of profitability, the project announced on Friday. As part of the shift, the project will sunset its Grants Stack, a tool for managing grants programs, and the Allo Protocol blockchain funding mechanism.

- 00:02CMB Macro: As long as the inflation gap exceeds the employment gap, it will be difficult for the Federal Reserve to cut interest ratesAccording to ChainCatcher, citing a macroeconomic research report from CMB International via Jintou Data, Powell remains concerned about the risk of stagflation, which means that as long as the inflation gap exceeds the employment gap, it will be difficult for the Federal Reserve to cut interest rates. In June, the Federal Reserve provided a forward-looking assessment of stagflation risks, and this tone continued in July. Powell’s concern about “inflation” is clearly greater than his concern about “stagnation.” The most important statement is that “current inflation is above the target level, while employment is at the target level, so policy should remain appropriately restrictive.” What Powell needs to confirm is that the inflationary impact of tariffs has been fully reflected.

- 2025/07/30 23:09Hong Kong Monetary Authority Keeps Base Rate Unchanged at 4.75%According to Jinse Finance, the Hong Kong Monetary Authority has kept the base rate unchanged at 4.75%, while the US Federal Reserve also held rates steady overnight.

- 2025/07/30 22:40The probability of a Fed rate cut in September is 45.7%According to ChainCatcher, data from CME "FedWatch" shows there is a 54.3% probability that the Federal Reserve will keep interest rates unchanged in September, and a 45.7% probability of a 25 basis point rate cut.