News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Satoshi Nakamoto is now the 11th richest person in the world with a net worth of $129 billion in Bitcoin. Nakamoto could be the richest person in the world if Bitcoin hits a price target of around $366,241 per coin. An analyst predicts that BTC will reach $400,00 during this year using a Bitcoin power model based on gold prices.

Share link:In this post: Trump proposed a 30% tariff rate on the EU and Mexico. Investors have been counting on the president to reduce or back down from the tariffs. Cryptocurrencies fell slightly following Trump’s new tariff announcement.

Share link:In this post: Hong Kong’s Financial Secretary visited Seoul for three days to promote the special administrative region’s financial, trade, and innovation opportunities. Korean financial institutions have shown a strong interest in investing in Hong Kong, with securities trading volume exceeding HK$1.5 trillion in the first five months of the year. The Chinese SAR is working on a digital asset strategy that uses stablecoins and tokenized assets to address global economic challenges.

The US House of Representatives launched “Crypto Week” today, advancing three pivotal cryptocurrency bills through the Rules Committee that could reshape America’s digital asset regulatory landscape

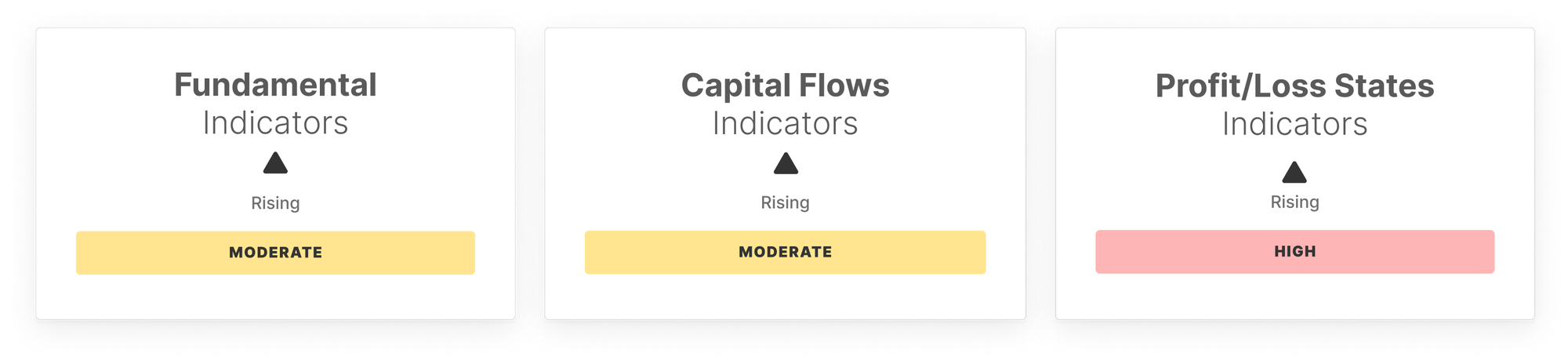

Bitcoin breaks above $120K as investor conviction surges. This week’s Market Pulse analyzes rising spot and ETF flows, aggressive futures positioning, and elevated on-chain profitability - highlighting both bullish momentum and rising correction risks.

- 07:42Opinion: BlackRock May Sell Off $506 Billion Worth of Bitcoin and EthereumAccording to a report by Digital Asset cited by Jinse Finance, BlackRock has transferred BTC and ETH worth $366 million to an exchange, suggesting a potential large-scale sell-off. Data from LookOnChain shows that on August 21, BlackRock moved 1,885 Bitcoins and 59,606 Ether to an exchange, with a total value of $366 million. The market is divided in its interpretation of BlackRock's asset transfer. Some analysts believe this may simply be a portfolio rebalancing, while others think it could reflect weakening sentiment among institutional investors. BlackRock's large-scale transfer of digital assets has heightened market anxiety, especially as Federal Reserve Chair Jerome Powell is about to deliver a speech. According to CoinMarketCap data, on August 22, Bitcoin was trading at $112,975.31, down 0.61% from the previous day; Ethereum was trading at $4,280.45, down 0.22%.

- 07:11Flipflop launches its first 30 projects, creating a value launchpad for micro-BitcoinForesight News reports that the first batch of 30 projects has launched on Flipflop, showing steady growth. Deployed on the Solana chain, Flipflop distinguishes itself from many other launch platforms as the first truly fair launch platform to adopt Bitcoin’s halving and difficulty adjustment mechanisms. Flipflop resists extreme price volatility, advocates for gradual upward movement, and rewards consensus communities, long-term builders, and long-term holders. The platform protects IP reputation and fan communities through the URC invitation code and a Refund mechanism that allows for refundable participation, with all minting fees used to provide liquidity. Its social mechanisms establish community self-governance and ecosystem expansion functions, and in the future, tokens can even be launched automatically via AI.

- 07:03The Fed’s Baseline Scenario: A 25-Basis-Point Rate Cut in SeptemberAccording to ChainCatcher, citing Jintou News, Huatai Securities Fixed Income Research stated that the current situation in the United States suggests that employment growth faces downside risks, which may require policy adjustments. Following Powell's speech, the market is trading on expectations of Federal Reserve easing, and the probability of a soft landing for the U.S. economy has increased. It is expected that a 25 basis point rate cut in September is the baseline scenario, and the probability of two 25 basis point cuts in the fourth quarter may be higher than that of just one cut.