News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

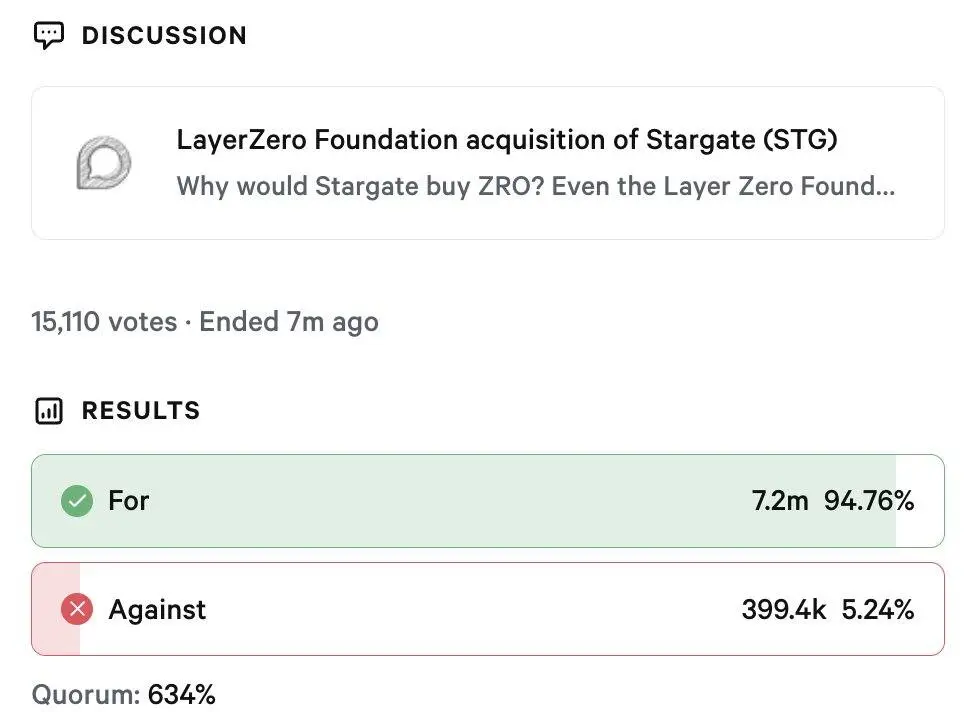

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

- 12:16Bitwise advisor: Bitcoin OG whales are still selling, which may be unfavorable for price increasesChainCatcher news, Bitwise advisor Jeff Park stated in an article, "The current market structure is fundamentally not conducive to a substantial price increase for bitcoin. The reason is that, on one hand, bitcoin OG holders are still continuously selling, while on the other hand, demand from ETF and DAT is simultaneously slowing down. For bitcoin to break out of its current trend, it must return to a significantly higher level of implied volatility in a sustained manner, especially upward volatility. Back in November, I said 'volatility or death,' and shared the first abnormal breakout signal at that time, and finally saw volatility start to pick up again, reigniting some hope. Unfortunately, over the past two weeks, implied volatility has once again been comprehensively suppressed. From a peak of 63% in late November, it has now fallen back to 44%."

- 11:59Machi reduces 25x ETH long position, current liquidation price is $3,042.74According to ChainCatcher, monitored by HyperInsight, Huang Licheng has reduced his holdings by 786 ETH and currently holds 3,144 ETH (9.69 million US dollars), with the current liquidation price at 3,042.74 US dollars.

- 11:46Data: A certain whale sold 1,654 ETH and opened a high-leverage long position on ETH, with a total loss exceeding $3.3 million.According to ChainCatcher, monitored by Lookonchain, whale 0x76AB sold 1,654 ETH (worth $5.49 million) on the spot market and switched to holding a high-leverage ETH long position. He made three trades, two of which resulted in losses, accumulating a total loss of over $3.3 million in just four days.