News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Cook resigns, it would potentially allow Trump to gain four seats, giving him a majority on the seven-member board.

In history, September has usually been one of the worst-performing months for Bitcoin and Ethereum, known as the "September Curse," having occurred multiple times during bull market cycles.

Pantera’s $1.25 billion Solana treasury push has failed to spark gains as SOL slides nearly 10%. Weak futures demand and bearish signals point to further downside risks.

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn. Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs. Bitcoin Should Defend $110,800 Glassnode explains that the average … <a href="https://beincrypto.com/110800-bitcoins-new-key-defense-line-glassnode/">Continued</a>

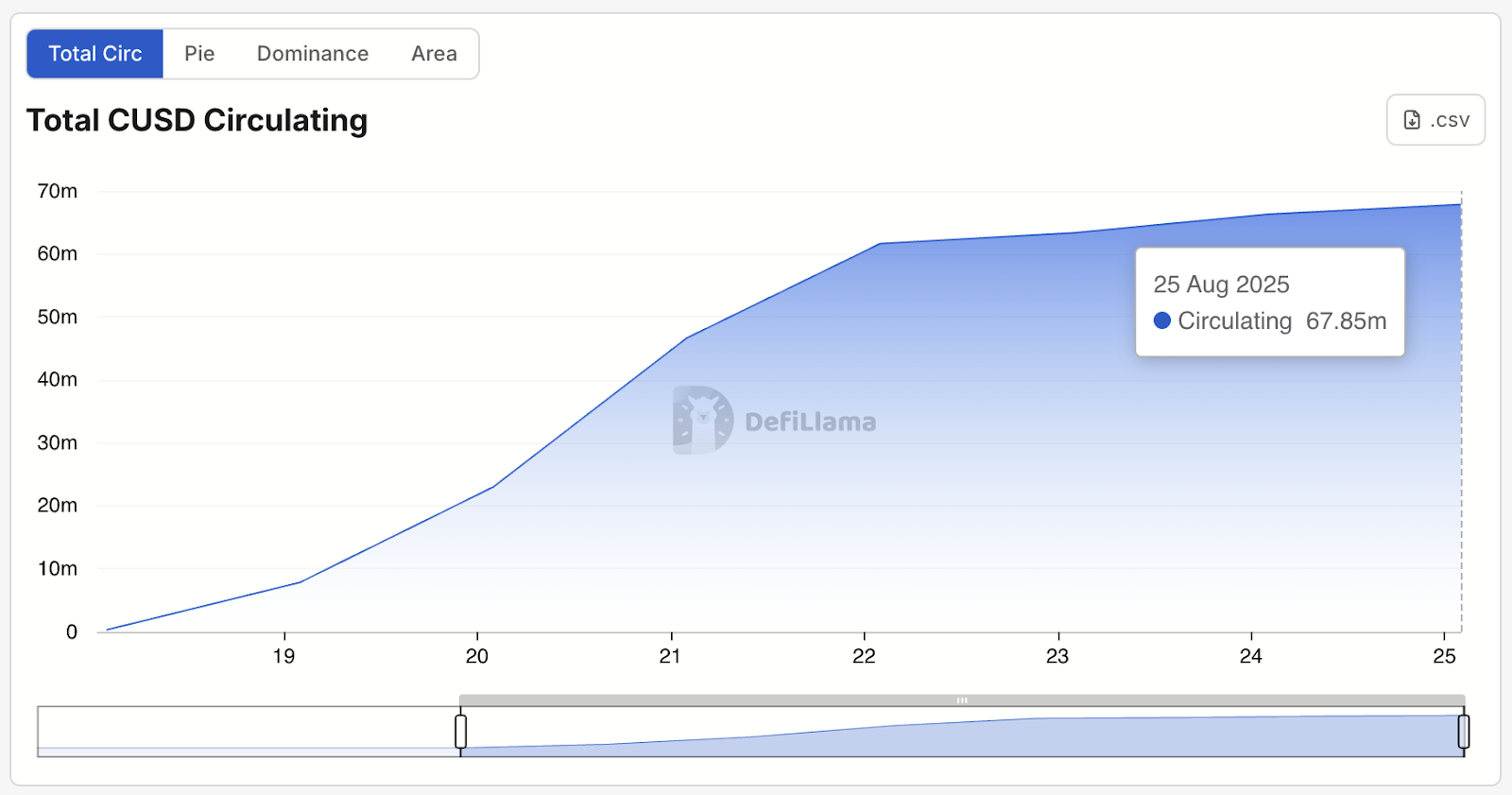

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Bitcoin’s $110,000 support is under pressure as futures and spot traders lean bearish. Without renewed demand, BTC risks sliding to $107,557.

- 23:05The 10-year US Treasury yield rises by about 5 basis points during the "Fed rate cut week"Jinse Finance reported that on Friday (December 12), at the close of trading in New York, the yield on the US 10-year benchmark Treasury note rose by 2.75 basis points to 4.1841%. Over the week, it increased by a total of 4.90 basis points, trading overall within the range of 4.1002%-4.2074%. From Monday to Wednesday (prior to the Federal Reserve's announcement of an interest rate cut and Treasury purchase plan), yields continued to rise, then showed a V-shaped trend. The yield on the two-year US Treasury note fell by 1.82 basis points to 3.5222%, with a cumulative decline of 3.81 basis points for the week, trading overall within the range of 3.6253%-3.4989%.

- 22:44San Francisco Fed President: Supports This Week's Rate Cut Decision, Overly Tight Monetary Policy May Be Detrimental to HouseholdsJinse Finance reported that Mary Daly, President of the Federal Reserve Bank of San Francisco, stated that the Federal Reserve's decision to cut interest rates this week was not easy, but she ultimately supported the move. In a post on LinkedIn, she said, "Real wage growth comes from long-term, stable economic expansion. And the current economic expansion is still at a relatively early stage." Daly noted that the Federal Reserve must continue to bring inflation down to the 2% target level, but must also be cautious in protecting the labor market. "Overly tight policy could cause unnecessary harm to American households and expose them to two problems: inflation above the target level and a weakening labor market."

- 22:29The yield on the US 30-year Treasury bond rises to its highest level since September.Jinse Finance reported that U.S. long-term Treasury prices have fallen, with the 30-year Treasury yield rising to its highest level since early September. This week, the impact of the Federal Reserve's rate cuts and policy stance has gradually permeated the market. The 30-year Treasury yield once rose by 6 basis points to 4.86%, reaching a new high since September 5, and has increased by about 5 basis points this week. The 2-year Treasury yield was basically flat on Friday, with a slight decline for the week. Expectations that the Federal Reserve may further cut rates next year have supported lower yields on short-term Treasuries, while long-term yields reflect persistently high inflation. On Friday, Chicago Fed President Goolsbee and Kansas City Fed President Schmid said that inflation concerns are the main reason they oppose rate cuts and support maintaining the status quo. Strategist Edward Harrison stated: "Goolsbee said he opposes rate cuts due to concerns about inflation. Given that traders still expect two 25-basis-point rate cuts by the end of 2026, his comments indicate that U.S. Treasuries face downside risks."