News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- XRP's 2025 strategy focuses on price reclamation above $2.94 amid regulatory clarity and technical upgrades. - SEC's Q3 2025 commodity reclassification unlocked $7.1B institutional flows and ETF approvals with 78-95% approval probability. - Ripple's XRPL upgrades attracted JPMorgan, Santander, and BNY Mellon for cross-border payments and RWA tokenization. - Whale accumulation and macro tailwinds suggest potential $5-$7 surge by mid-2026 if $2.94 support holds.

- Ethereum's 2025 staking surge sees 29% of supply staked, generating $89.25B annualized yield, outpacing Bitcoin's zero-yield model. - 4.6B ETH queued for unstaking faces 17-day delays, but institutional ETFs absorbed 1.83M ETH/month, stabilizing price through strategic retention. - Dencun/Pectra upgrades enable 10,000 TPS at $0.08/tx, combined with CLARITY Act utility token status, reinforcing Ethereum's institutional infrastructure role over Bitcoin.

- Decentralized governance is reshaping industrial sectors, with firms like Maersk reporting 15-35% efficiency gains through real-time decision-making and AI-driven collaboration. - Mynd Solutions (MSTY) remains silent on adopting this model despite heavy AI/blockchain investments, raising concerns about regulatory delays or strategic short-termism. - Investors face a dilemma: MSTY’s lack of governance reform risks being outpaced by competitors leveraging decentralized leadership for agility, while Deloitt

- SoftBank's $2B Intel investment signals confidence in AI-driven semiconductor demand, aligning with Intel's U.S. manufacturing and tech pivot. - U.S. government support via CHIPS Act and Trump-era equity stakes creates a $10.9B public-private partnership to bolster semiconductor independence. - Intel's stock rebound and strategic AI infrastructure bets highlight the sector's consolidation phase, urging investors to prioritize semiconductor leaders and AI infrastructure. - Risks include stiff competition

- Zhou Xiaochuan warns stablecoins pose systemic risks to China's tightly controlled digital currency ecosystem, emphasizing existing payment systems' efficiency. - Hong Kong's 2025 Stablecoins Bill tests state-sanctioned fiat-backed tokens, aligning with Beijing's yuan internationalization strategy while maintaining surveillance. - PBOC restricts speculative stablecoin projects, directing focus to state-backed digital yuan and permissioned blockchain initiatives like AntChain. - Investors are advised to a

- Ethereum dominates 2025 institutional treasuries via yield generation, regulatory clarity, and deflationary dynamics, outpacing Bitcoin's zero-yield model. - SEC's in-kind ETF approval boosted Ethereum liquidity, enabling 3-5% staking yields while Bitcoin ETFs face structural limitations in low-interest environments. - Institutional adoption accelerates as 19 public companies allocate 2.7M ETH for active yield, contrasting Bitcoin ETFs' $171M vs Ethereum ETFs' $1.83B inflows in August 2025. - Ethereum's

- Google Gemini and xAI Grok-4 compete with ChatGPT using divergent strategies: ecosystem integration vs. premium performance. - Gemini leverages Google's product ecosystem and tiered pricing to dominate enterprise and Android markets, while Grok-4 targets high-value users with real-time data and advanced reasoning capabilities. - Financially, Google benefits from Alphabet's $85B infrastructure investments, while xAI faces $1B/month burn rates despite $80B valuation driven by Musk's brand and X platform ac

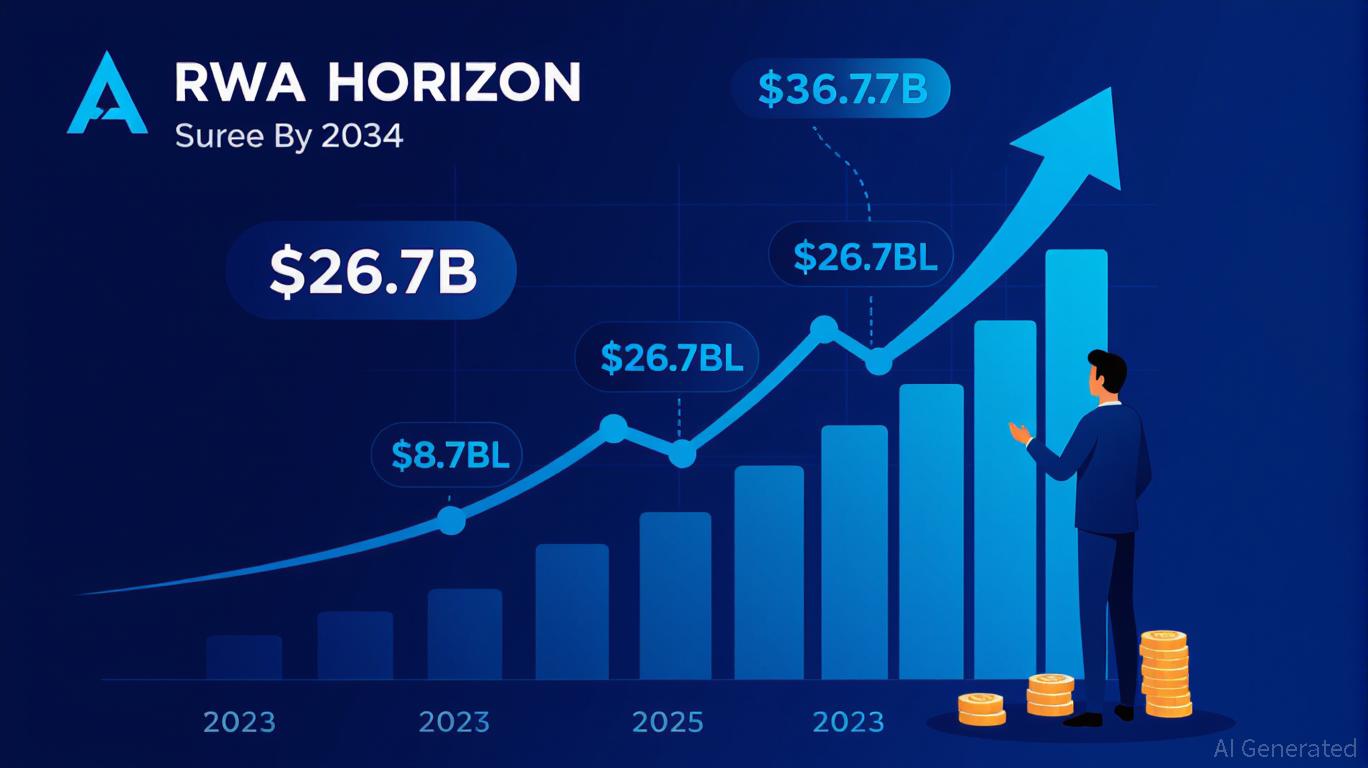

- Aave Horizon unlocks institutional liquidity by tokenizing real-world assets (RWAs) like U.S. Treasuries and real estate, enabling stablecoin borrowing and yield generation via DeFi. - The RWA market surged to $26.71B by August 2025 (260% YTD growth), with Ethereum hosting 51.93% of value and BlackRock’s tokenized fund expanding from $649M to $2.9B. - Partnerships with JPMorgan, Franklin Templeton, and the U.S. Senate’s GENIUS Act validate Aave Horizon’s hybrid model, blending TradFi compliance with DeFi

- Q2 2025 saw institutional capital shift to Ethereum ETFs, capturing $13.3B inflows vs. Bitcoin's $88M. - Ethereum's 4-6% staking yields, regulatory clarity, and DeFi infrastructure drove its institutional adoption. - SEC's utility token reclassification and in-kind mechanisms boosted Ethereum ETF confidence. - Institutional portfolios now favor 60/30/10 allocations (Ethereum/Bitcoin/altcoins) for yield and stability. - Ethereum's 90% lower L2 fees post-Dencun upgrade solidified its infrastructure dominan