News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Mizuho Securities equities researchers say Circle’s stock faces medium-term risks from slower-than-expected USDC growth, rising distribution costs, and a potential Fed rate cut. The analysts give a base case for CRCL of $84 and bear case of $40 through 2027, down from Wednesday’s closing price of $153.16 a day after the firm filed its quarterly earnings.

Quick Take Multiple forces are driving ETH’s rally toward its all-time high, including record spot ETF inflows, new U.S. policy moves, and growing corporate treasury diversification into ETH. Analysts and industry leaders see further upside, with Standard Chartered raising its year-end target to $7,500 and some predicting $6,000 in the near term — though profit-taking near record levels is possible.

Quick Take A wallet that previously dealt with the Ethereum Foundation has sold roughly 2,795 ETH worth $12.7 million amid the second-largest cryptocurrency’s move toward all-time highs. Solana surged 15% in 24 hours to reclaim the $200 level on Wednesday morning as optimism spreads across the altcoin space.

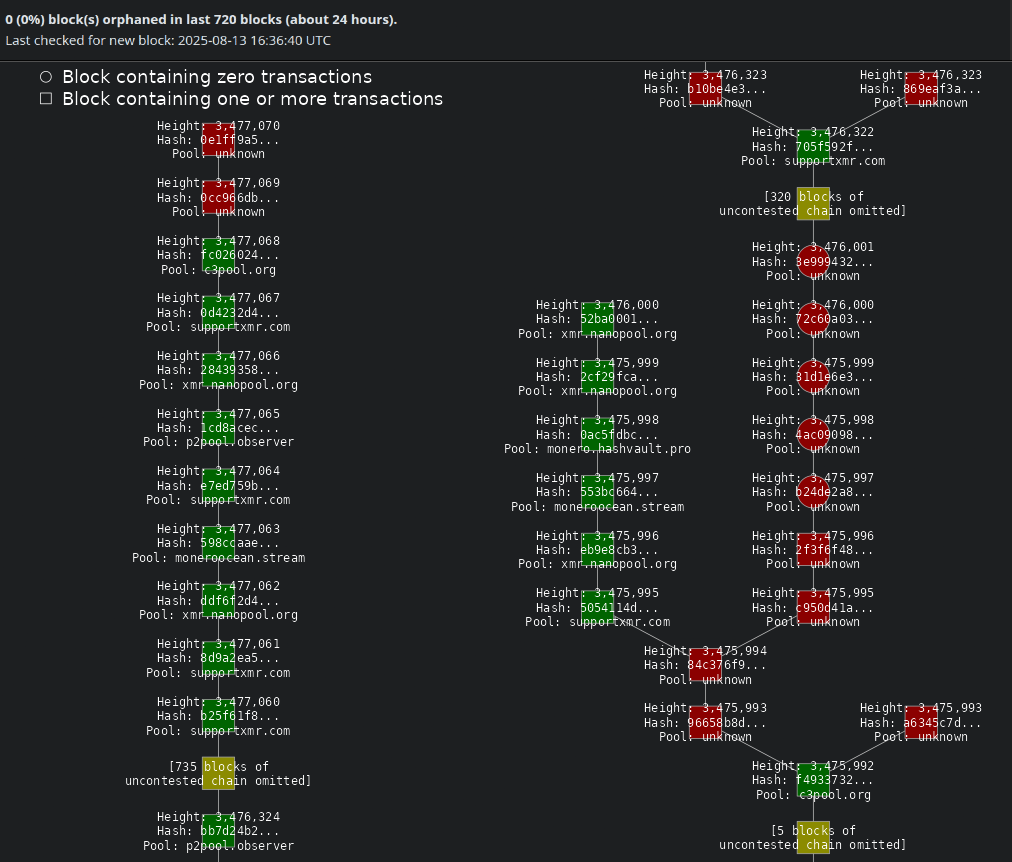

Monero has experienced 36 hours without selfish mining attacks following Qubic pool’s August 12 incident that caused a six-block reorganization. The event was incorrectly labeled a 51% attack, though Qubic controlled approximately 36% of network hashrate.

- 09:03ING: The US dollar's gains may be unsustainable; attention should be paid to inflation dataChainCatcher news, according to Golden Ten Data, ING analyst Francesco Pesole stated that the US dollar's ability to extend this week's gains appears limited. Although the easing of concerns over bad loans at US regional banks has boosted the dollar, he pointed out that unless the market finds a reason to rule out one of the three rate cuts by the Federal Reserve before March next year, it will be more difficult for the dollar to rise further. Pesole believes that the most realistic driver for a repricing of rate expectations this week would be higher-than-expected US inflation data on Friday, but this is unlikely to happen.

- 09:03USDC Treasury burns 55,000,000 USDC on the Ethereum chainAccording to ChainCatcher, Whale Alert monitoring shows that approximately 2 minutes ago, USDC Treasury burned 55,000,000 USDC on the Ethereum blockchain.

- 08:56An institution sold 675,000 HYPE and bought 126,900 SOL in the past 4 hours.According to Jinse Finance, on-chain analyst Yujin has monitored that investors/institutions who received an allocation of 1 million SOL have sold HYPE to purchase SOL for the third consecutive day. In the past 4 hours, this institution sold 675,000 HYPE in exchange for 23.44 million USDC, and then bridged to Solana to purchase 126,900 SOL. Currently, the institution still holds 743,000 HYPE, valued at approximately 26.12 million US dollars.