News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

John Bollinger says to ‘pay attention soon’ as big move could be imminent

Cointelegraph·2025/10/19 16:15

Can Ethereum price reclaim $4,500 in October?

Cointelegraph·2025/10/19 16:15

Bitcoin weekly close must hit this $108K+ level to rescue key ‘demand area’

Cointelegraph·2025/10/19 16:15

Shiba Inu Eyes a Massive Rebound as Bulls Eye a 3X Rally

Cryptonewsland·2025/10/19 12:09

Bitcoin Plummets Again, But Here’s Why It Might Be a Bullish Signal

Cryptonewsland·2025/10/19 12:09

HYPE Struggles at $43 — Is a Breakout or Breakdown Coming Next?

Cryptonewsland·2025/10/19 12:09

Bullish XRP Trader Shares Deep Insights Explaining How $8, $20, and $27 Bull Targets Can Be Hit

Cryptonewsland·2025/10/19 12:09

3 Cryptos Ready To Skyrocket — Don’t Miss These Buying Opportunities

Cryptonewsland·2025/10/19 12:09

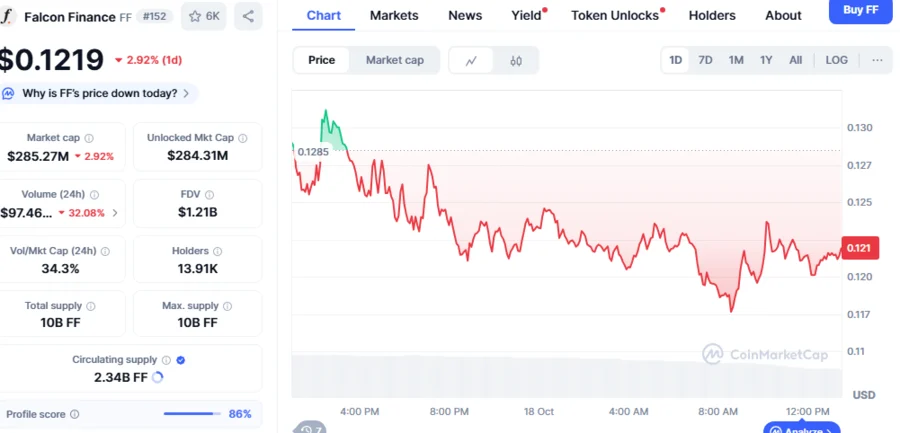

Whales Turn to FF Token Accumulation Amid Falcon Finance’s 37.9% Price Slump

CryptoNewsNet·2025/10/19 11:45

Flash

- 16:12A suspected single whale holds over 14.66 million HYPE, with a peak value reaching $870 million.BlockBeats News, October 19, according to MLM monitoring and analysis, multiple wallet clusters related to HYPE are suspected to be controlled by the same entity, involving a total of 12.26 million HYPE, and their activities closely match those of the well-known on-chain whale Technorevenant. Analysis shows that these wallets have exhibited consistent trading times, execution patterns, and protocol usage habits over the past period. Among them, some wallet clusters established large Aster hedging positions on Hyperliquid, with timing overlapping with HYPE sell-off activities. If Technorevenant's wallets that have been identified are included, the total HYPE holdings once reached 14.66 million (with a peak value of about 870 million USD), after which gradual reductions began. Currently, the related wallets still hold about 9.59 million HYPE (approximately 347 million USD), of which 2.56 million have been unlocked, while the remaining portion is staked. Meanwhile, Technorevenant also holds about 1.42 million HYPE (about 51.4 million USD) in DeFi protocols on HyperEVM, using them as collateral to borrow 17.7 million USDT0. Multiple wallets involved in HYPE sell-offs share the same API key characteristics as other addresses of Technorevenant, with nearly identical trading execution patterns. This has led to external speculation that these wallets are highly likely to be controlled by the same individual or team.

- 16:12BitMine has accumulated nearly 380,000 ETH since the "10.11 crash"BlockBeats News, October 19, according to BMNRBullz, Bitmine went all-in on buying ETH during the downturn, accumulating a total of 379,271 ETH (approximately $1.48 billions): · During the decline two days ago: +72,898 ETH (approximately $281 millions);· Four days ago: +104,336 ETH (approximately $417 millions);· After the weekend crash: +202,037 ETH.

- 16:12Andrew Kang-related address executes "long-short double kill": Profited from ETH at highs and then reversed to short, currently holding nearly $100 million in short positionsBlockBeats News, on October 19, according to on-chain AI analysis tool CoinBob (@CoinbobAI_bot) tracking and analysis, Mechanism Capital co-founder Andrew Kang's related address (0x0b5) closed ETH long positions at a high and then switched to shorting. The day before, he had made a position adjustment, closing all short positions and establishing long positions in ETH, BTC, and SOL, while also increasing his ENA long position. However, today he adjusted his positions again, turning from bullish to bearish. He currently holds nearly $31 million in BTC short positions, $59.78 million in ETH short positions, and $22 million in ENA long positions. The monthly trading volume of this address reaches $176 million, and the current total position value is about $26.64 million. All positions are currently in floating profit, with some positions having a maximum floating yield of over 70%.