News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The victim is an MEV bot.

In the post-crash era, where should cryptocurrency investment go from here?

AINFT aims to build a decentralized AI application aggregation ecosystem, allowing users to freely explore and utilize various AI Agent digital assistants just like using an "App Store."

This article reports on the largest operation to date by US and UK law enforcement targeting the Cambodian Prince Group transnational crime organization and its leader, Chen Zhi. The US Department of Justice (DOJ) seized nearly 130,000 bitcoins (worth approximately $15 billion at the time), marking the largest asset seizure in US history. The operation aims to crack down on "pig-butchering" scam networks and modern slavery scam compounds spread across Southeast Asia.

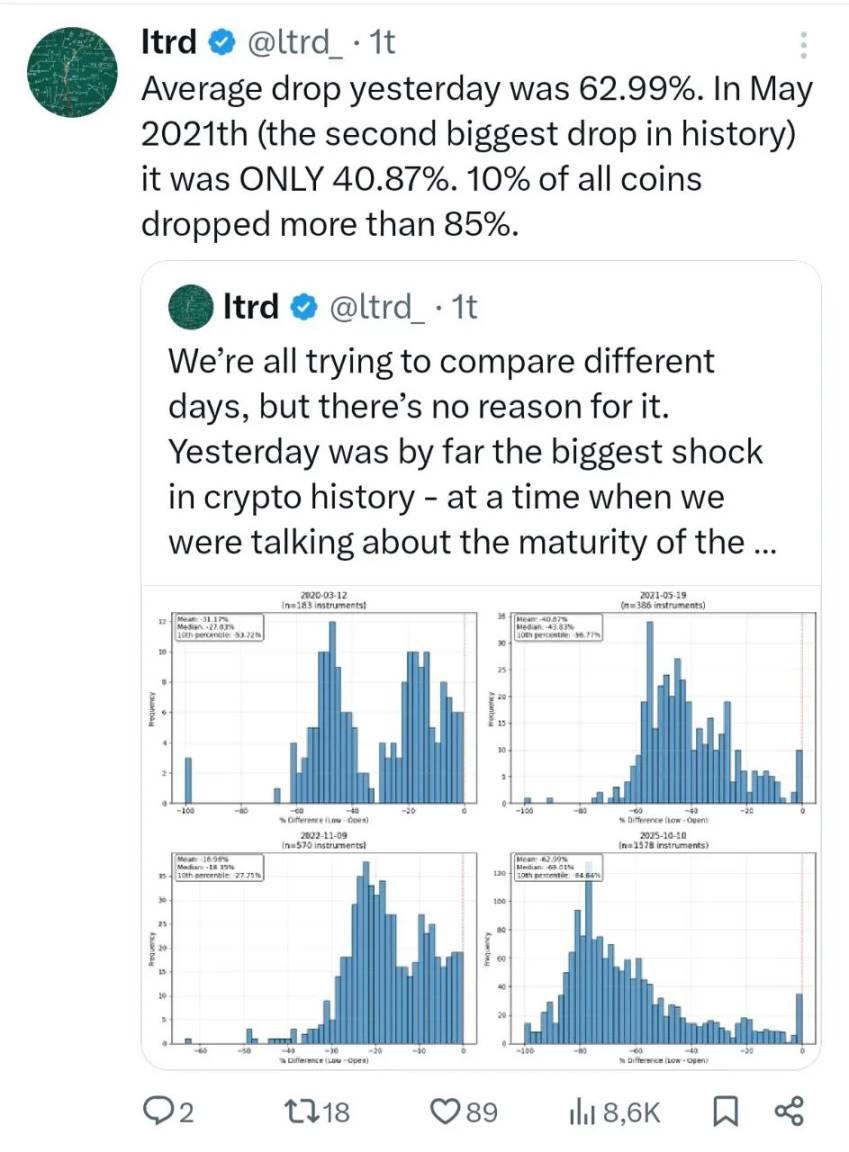

The author reviews four years of dedicated experience in the cryptocurrency field, shares survival strategies during the 10.11 market crash, discusses the risks of leveraged trading and the current state of the industry, and reflects on investment mindset and future direction. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

To take shortcuts, one can only focus on traffic, and in the world of traffic, the most sensitive and resonant content is always about the amount of money.

Hyperliquid has transformed into a composable financial Lego through the HIP-3 upgrade, with its ecosystem covering more than 20 projects, including trading frontends, liquid staking, and DeFi protocols. It features a permissionless framework and innovative perpetual contract applications. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

- 03:47Sei Network to custody Hamilton Lane's tokenized credit fundJinse Finance reported that on October 15, Hamilton Lane, one of the world's largest private market investment management firms, officially launched on-chain. Through KAIO's on-chain infrastructure, the company introduced a tokenized version of its flagship product—the Senior Credit Opportunities Fund (SCOPE)—on Sei Network, providing qualified investors worldwide with access to the private credit market.

- 03:47Arkham: Recent transfer transactions suggest that the U.S. government may have seized an additional $2.4 billion worth of bitcoin from Chen ZhiAccording to ChainCatcher, on-chain analytics platform Arkham posted on X that bitcoin worth $2.4 billion from wallets associated with Chen Zhi has been transferred again. This follows the previously disclosed seizure of $14.1 billion worth of bitcoin, suggesting that the U.S. government may have additionally seized $2.4 billion worth of bitcoin belonging to Chen Zhi. Currently, these bitcoins are stored in wallet addresses that have not been approved or mentioned in any court documents. The related operations may be part of a seizure action that has not yet been officially announced.

- 03:42Head of European Stability Mechanism: Stablecoins Without Proper Collateral and Management Pose a Threat to Financial StabilityAccording to ChainCatcher, citing Bloomberg, a senior EU policymaker stated that stablecoins, if lacking proper collateral and management, will threaten financial stability. Pierre Gramegna, President of the European Stability Mechanism (ESM), said in Washington on Wednesday that if stablecoins become mainstream and cannot be guaranteed like central bank currencies, they will pose a risk to the global financial system. He emphasized that he is not opposed to stablecoins, but they must operate within a framework that ensures the safety of consumers and financial participants. In addition, although Martin Kocher, Governor of the Austrian Central Bank, believes that stablecoins will not be as popular in the eurozone as in other regions, Gramegna pointed out that the EU cannot afford to be marginalized in the cryptocurrency sector. Since 99% of stablecoins are denominated in US dollars, if Europe does not launch euro-denominated stablecoins, it will miss out on opportunities. He also believes that cash, digital currencies, and stablecoins can coexist.