News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Global tech elites gather to spark new ideas, driving a new chapter in the digital future.

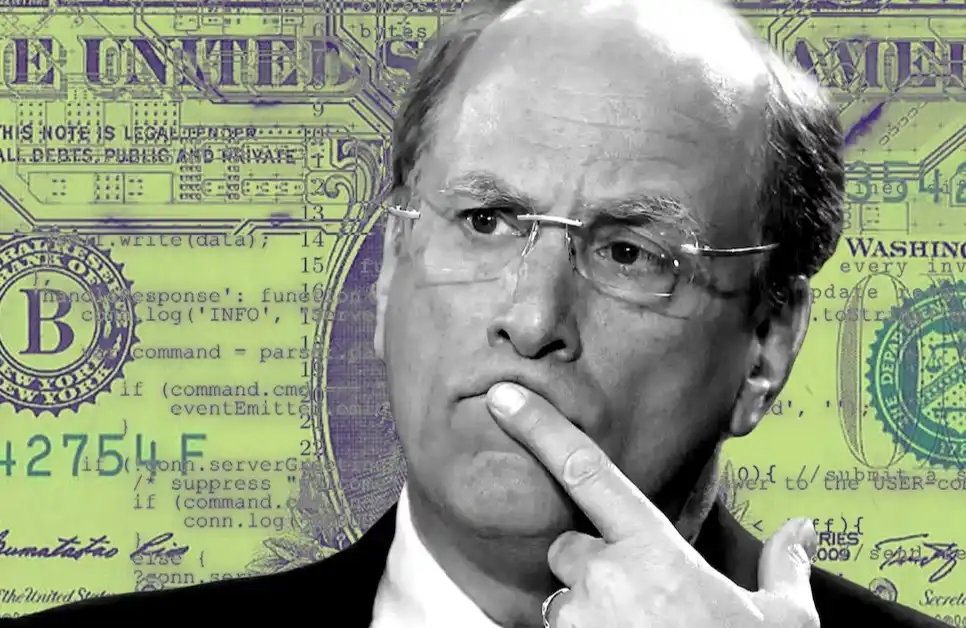

BlackRock has revealed its goal to bring traditional investment products such as stocks and bonds into digital wallets, targeting an ecosystem worth over $4 trillions.

Setting a high-performance standard: Chainlink oracle network brings ultra-low latency market data to the first real-time blockchain, ushering in a new narrative for on-chain finance.

The development of this stablecoin will depend on the extent to which it is adopted by payment providers and investors, who are seeking a reliable euro-denominated alternative asset in the digital economy.

Traders' desire for high-yield investment opportunities has not diminished; they are shifting from perpetual contracts to Memecoin.

- 18:46U.S. stocks extend losses, Dow Jones falls 1%ChainCatcher news, according to Golden Ten Data, the US stock market continues its decline, with the Dow Jones Industrial Average down 1%.

- 18:16Data: If ETH breaks through $4,098, the cumulative short liquidation intensity on major CEXs will reach $1.389 billions.According to ChainCatcher, citing data from Coinglass, if ETH breaks through $4,098, the total short liquidation intensity on major CEXs will reach $1.389 billions. Conversely, if ETH falls below $3,711, the total long liquidation intensity on major CEXs will reach $746 millions.

- 18:07Bitwise: The market is in a state of panic, making it the perfect time to accumulate Bitcoin.Jinse Finance reported that Bitcoin's recent weak performance appears to have dampened market enthusiasm, with Google search interest dropping to a multi-month low. The latest market sentiment index reflects typical bear market characteristics, with cautious sentiment dominating the entire crypto market. The Crypto Fear & Greed Index has dropped to 24, reaching the "fear" level, which is the lowest point in the past year and a sharp decline from last week's 71. This drop is similar to the sentiment seen in April this year when Bitcoin briefly fell below $74,000, and also echoes the market downturn cycles of 2018 and 2022. Despite the sharp decline in sentiment, Bitwise analysts believe the current situation is more suitable for "buying the dip" rather than retreating. The company's Head of Research André Dragosch, Senior Researcher Max Shannon, and Research Analyst Ayush Tripathi stated that the recent adjustment is mainly driven by external factors, and historically, such extreme sentiment often signals a good entry point before a strengthening market.