News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

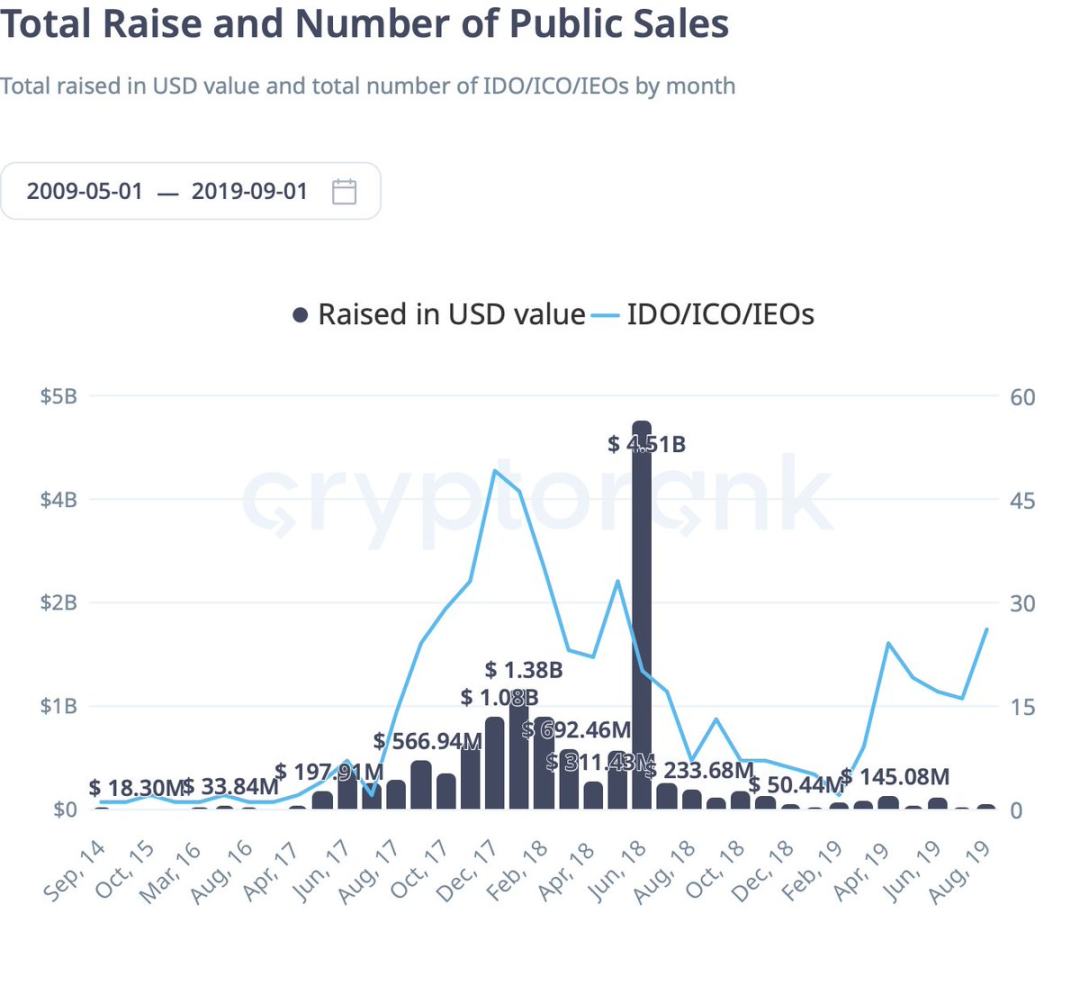

In 2025, ICOs accounted for approximately one-fifth of all token sale trading volume.

The L2 project MegaETH, backed by Vitalik, is about to launch its public sale.

Quick Take Summary is AI generated, newsroom reviewed. BitMine purchased 104,336 ETH worth $417 million during a 20% price dip. Rising Ethereum whale activity signals renewed institutional accumulation. On-chain data confirms large holders are steadily increasing their positions. The move highlights confidence in Ethereum’s long-term strength despite short-term volatility.References 🔥 TODAY: BitMine bought 104,336 $ETH worth $417M as prices fell 20% from August highs, per onchain data.

With the transfer of 127,271 BTC, the United States has become the world's largest sovereign holder of bitcoin.

- 05:57US crypto stocks mostly fell, with MSTR down 4.35% and SOL treasury stock HSDT down 36.49%.BlockBeats News, October 17, according to market data, U.S. stocks closed lower on Thursday, with all three major indexes declining. The Dow Jones closed down 0.65%, the S&P 500 Index fell 0.63%, and the Nasdaq Composite Index dropped 0.47%. Cryptocurrency stocks generally declined, including: Certain Exchange (COIN) fell 1.8% Circle (CRCL) fell 4.48% Strategy (MSTR) fell 4.35% Bullish (BLSH) fell 1.88% Bitmine (BMNR) fell 5.06% SharpLink Gaming (SBET) fell 3.83% BTCS (BTCS) fell 6.47% BNB Network Company (BNC) fell 10.6% ALT5 Sigma (ALTS) fell 9.13% American Bitcoin (ABTC) fell 10.02% New SOL treasury stock Helius (HSDT) fell 36.49% BTC treasury stock Kindly MD (NAKA) fell 5.36% New stock Figure (FIGR) fell 9.32%

- 05:57Google reveals North Korea-linked hackers use "Ethereum hiding" techniques for cryptocurrency theft and sensitive information collectionJinse Finance reported that Google Threat Intelligence Group (GTIG) released investigation results on the 17th, stating that the North Korea-linked hacker group UNC5324 is using a new technique called "Ether Hiding" to steal cryptocurrencies and collect sensitive information. The group emphasized that this investigation is the first time the "Ether Hiding" technique, which uses public decentralized blockchains to hide malware, has been found to be abused by state-sponsored threat actors, which is of significant importance. GTIG detected that UNC5324 lured developers into installing malware through a social engineering attack campaign called "Contagious Interview" by Palo Alto Networks. This attack affected multiple operating systems including Windows, macOS, and Linux through a multi-stage malware infection process. The attackers stored the malware on immutable blockchains and invoked it in a "read-only" manner, thereby continuously issuing control commands and manipulating victim systems anonymously.

- 05:57Bloomberg: Hyperliquid is currently controlled by a small group of insiders and lacks formal regulatory oversightBlockBeats News, October 17, according to Bloomberg, Hyperliquid is currently controlled by a small group of insiders, raising questions about its degree of decentralization. For its backers, including Paradigm and Pantera Capital, it is both a bet on the future of digital finance and a reminder that the entire industry still operates outside formal regulatory frameworks. Essentially, Hyperliquid is a minimalist trading platform operated by Hyperliquid Labs, a Singapore-based team of about 15 people. As is customary in the industry, the website frontend blocks US users, but anyone can trade on the blockchain that supports it. The lack of identity verification is precisely what makes it attractive, echoing an early pattern: rapidly growing trading platforms with similar models often quickly attract regulatory attention. If HLP is likened to an engine, then validator nodes are the control room. Hyperliquid has about 24 validator nodes, whereas the Ethereum network has over one million. Critics argue that this leads to excessive concentration of power. Hyper Foundation controls nearly two-thirds of the staked HYPE—its native token—thus wielding significant influence over validator node decisions and governance, although in several recent decisions, its nodes have chosen to abstain in order to respect community consensus. Kam Benbrik, Head of Research at blockchain validator node company Chorus One, stated, "If you control more than two-thirds of the staked tokens, you can basically achieve control over the chain." Currently, Washington's relatively relaxed stance provides Hyperliquid with room to grow. The question is, how much longer can it continue to operate outside the regulatory spotlight?