News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

This article provides an in-depth analysis of the rise of Perp DEX, using SunPerp as an example to explore how it drives Perp DEX towards mainstream adoption through innovation across multiple dimensions, including technology, ecosystem, and user experience.

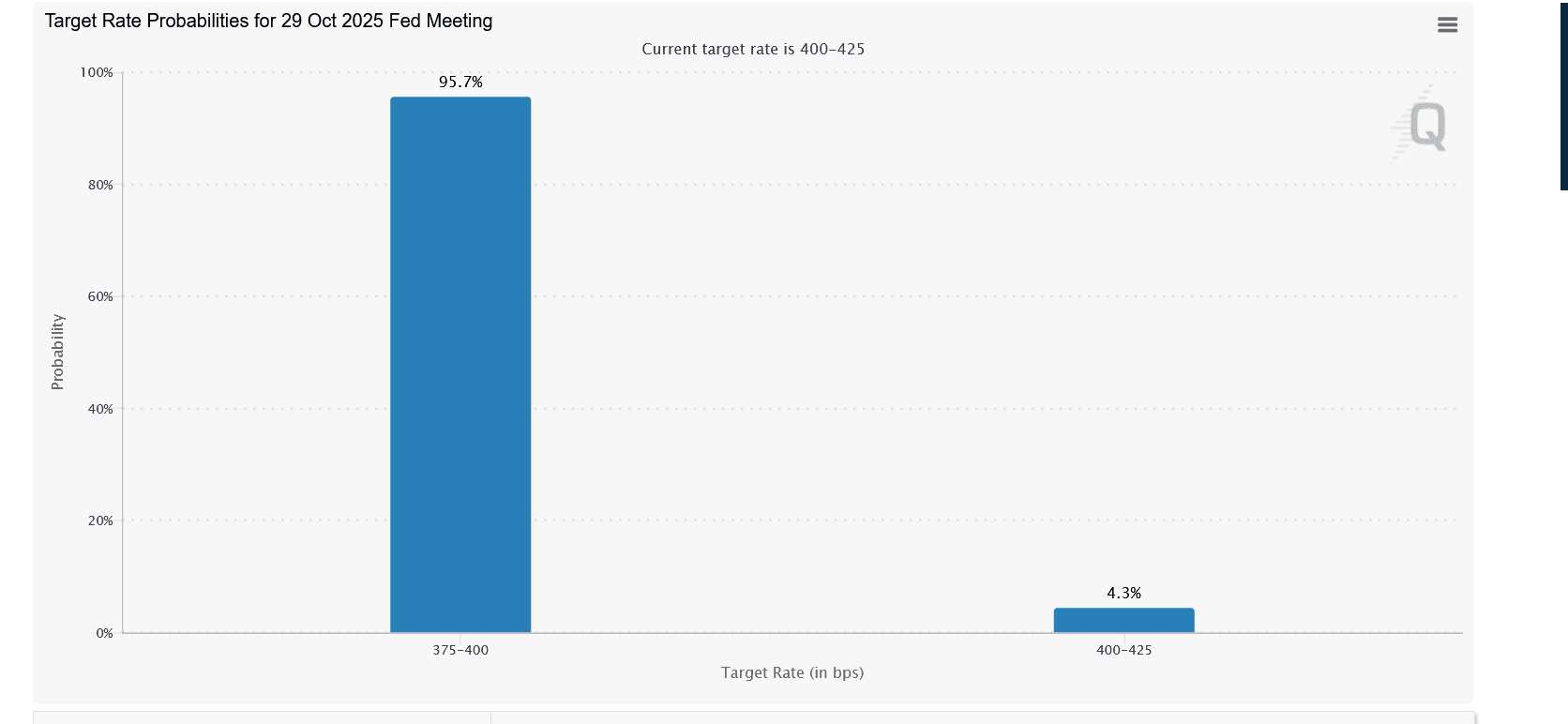

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.

Quick Take Summary is AI generated, newsroom reviewed. Tom Lee and Arthur Hayes predict Ethereum could reach $10,000 by end of 2025. Institutional adoption and clearer regulations support growth. Ethereum upgrades improve speed, efficiency, and scalability. Investors should research and diversify before investing.References BULLISH: Tom Lee and Arthur Hayes call for a $10k $ETH price.

- 13:42SOLOTEX receives FINRA approval to offer tokenized stock trading services to U.S. retail investorsChainCatcher news, according to Coindesk, SOLOTEX will offer tokenized stock trading services to U.S. retail investors under the approval of the Financial Industry Regulatory Authority (FINRA).

- 13:37Benson: List of Federal Reserve Chair candidates to be submitted to Trump after ThanksgivingChainCatcher news, according to Golden Ten Data, US Treasury Secretary Bessent stated on Wednesday that he plans to submit a list of three to four candidates for Federal Reserve Chair to Trump after Thanksgiving, for Trump to interview and decide on the next Fed Chair. Bessent pointed out that Trump will make his decision after listening to the opinions of dozens or even hundreds of people. Regarding the criteria for replacing current Chair Powell, Bessent said that one of the standards is to maintain an open mind. Powell's term as Chair will end in May next year.

- 13:37OpenEden's TBILL Fund Receives "AA+" Rating from S&P GlobalChainCatcher news, according to The Block, the TBILL fund managed by New York Bank under OpenEden has been awarded an “AA+f” fund credit quality rating and an “S1+” fund volatility rating by S&P Global Ratings, which are the highest ratings under S&P’s credit quality and stability system. This latest recognition builds upon the TBILL fund’s previous “A” rating from Moody’s, making it the first tokenized US Treasury fund to receive dual ratings from the world’s two major credit rating agencies. This milestone not only enhances confidence in OpenEden’s product design, but also highlights the growing legitimacy of tokenized real-world assets (RWA) in the institutional finance sector.