News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Dogecoin May Face Breakout or Pullback After Volume Spike, Market Cap Rises to $31.7B2World Liberty Financial (WLFI) Undertakes Token Burn as Possible Measure to Curb Post-Launch Price Decline3Yunfeng Financial, Linked to Jack Ma, Acquires 10,000 ETH and May Bolster Institutional Support for Ethereum in Hong Kong

Andrew Webley Reacts to UK Bitcoin Treasury and Narf Cyber Report

coinfomania·2025/09/04 02:30

Treasury Bitcoin Firm Raises $147M and Buys 1,000 BTC

coinfomania·2025/09/04 02:30

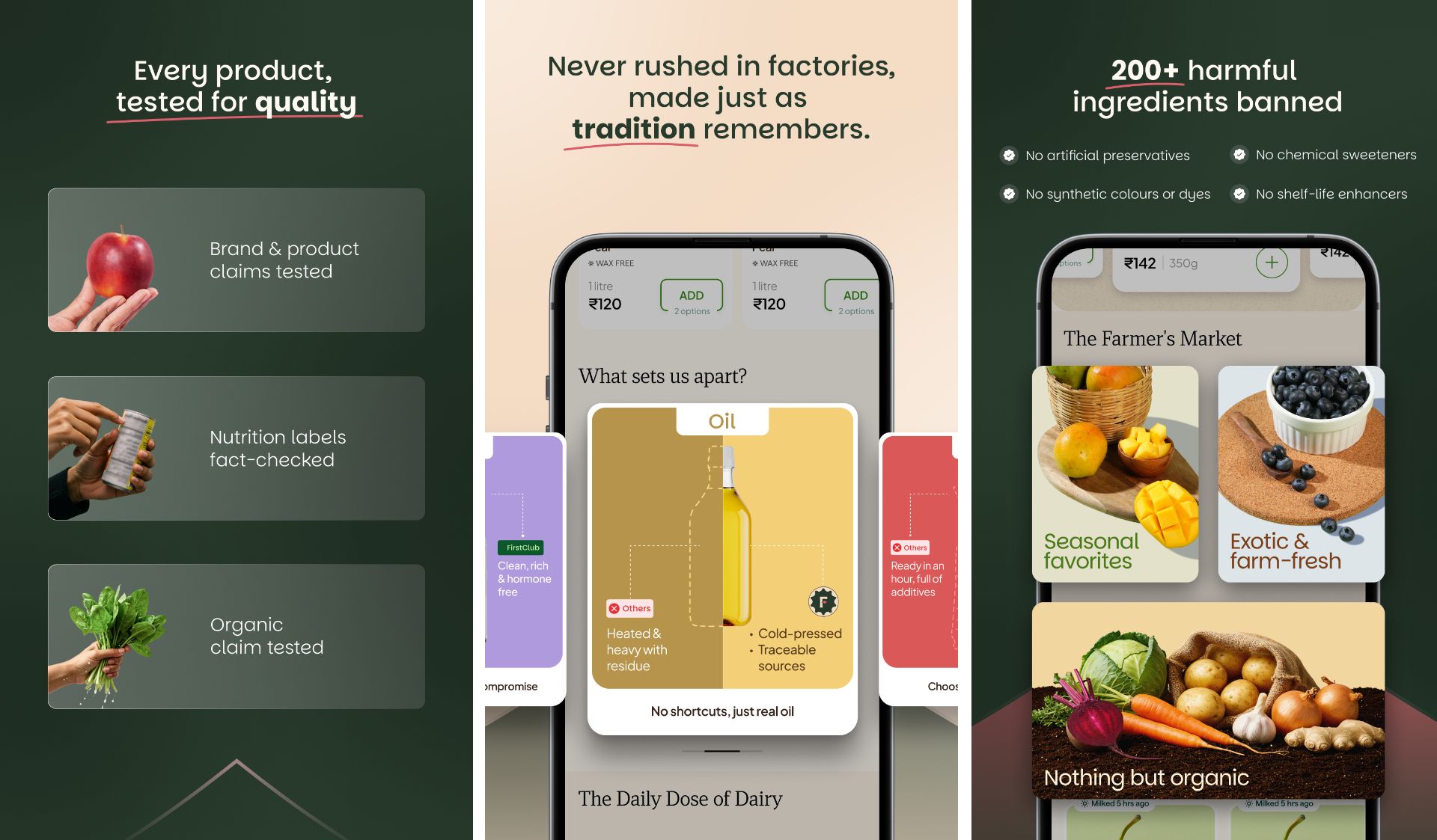

FirstClub bucks India’s speed obsession, quickly triples valuation to $120M with premium approach

techcrunch·2025/09/04 02:17

Mistral, the French AI giant, is reportedly on the cusp of securing a $14B valuation

techcrunch·2025/09/04 02:17

Metaplanet Secures Capital Approval for Bitcoin Acquisition

Coinlive·2025/09/04 02:10

Ethereum NFT Activity Drops to Record Lows in 2025

Coinlive·2025/09/04 02:10

Flash

- 03:22Spot gold falls below $3,520 per ounce, down 1.11% on the dayJinse Finance reported that spot gold fell below $3,520 per ounce, down 1.11% on the day, with a short-term drop of $15.

- 03:17Lido partners with Veda and Mellow to launch a simplified Earn strategy libraryChainCatcher reported that the decentralized staking protocol Lido has launched the Earn label, which is used to showcase a curated selection of various strategy vaults. The first project to go live is GG Vault (GGV), launched by Veda Labs, which provides one-click access to "blue chip" DeFi strategies using ETH, WETH, stETH, or wstETH. The second project to go live is the Decentralized Validator Vault (DVV) developed by Mellow, which is expected to launch in mid-September.

- 03:17South Korea's Vice Finance Minister: South Korea aims to join the MSCI Developed Markets Index and is considering extending foreign exchange trading hoursChainCatcher news, according to Golden Ten Data, the South Korean Vice Finance Minister stated that South Korea aims to join the MSCI Developed Markets Index and is considering further extending foreign exchange trading hours. The 35 billion USD investment plan in the United States may be led by policy financial institutions. The risk of a global bond sell-off currently appears to be controllable. The foreign exchange market will be closely monitored, and actions will be taken to stabilize the forex market if necessary.