News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

A "long-awaited" data release and an unchanged decision? Although inflation is expected to return to the "3 handle," traders are almost fully betting that the Federal Reserve will cut interest rates again later this month.

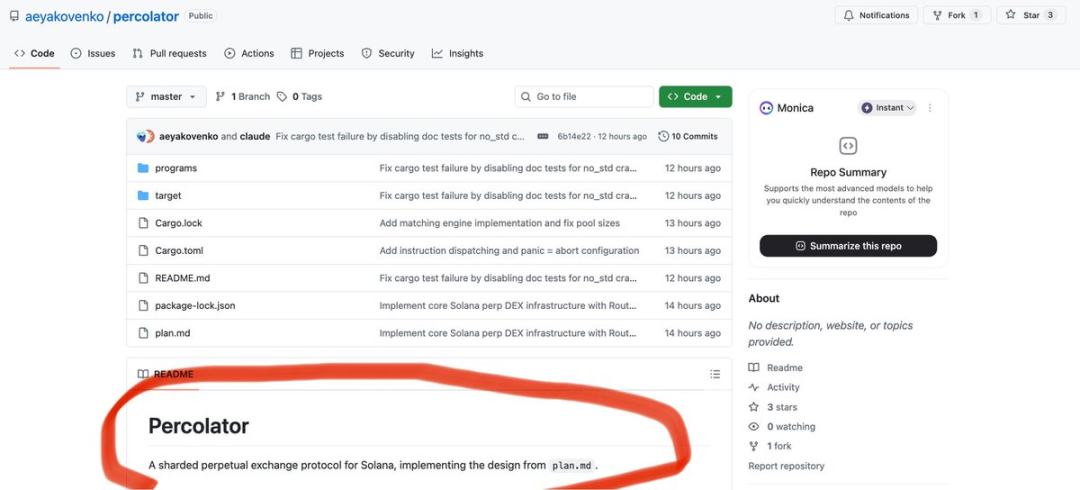

Solana has the potential to provide Perp DEX infrastructure with a real application scenario that can meet the trading demands of traditional financial assets, rather than remaining limited to native crypto asset trading.

When Trump's decision to cancel the summit and the heavy blow targeting the lifeblood of the Russian economy struck simultaneously, the Kremlin remained unexpectedly silent...

DeriW may be becoming the starting point of a new round of dividends. In March 2025, Hyperliquid due to ...

Dolphin wallets added 681K BTC in 2025, staying above 1-year MA, hinting the bull run may continue.A Bullish Indicator for the MarketWhat This Means for Crypto Investors

BlackRock buys 1,000 Bitcoin worth $107.8M for its spot ETF on Oct. 23, signaling strong institutional interest.Why This Buy MattersInstitutional Confidence Is Growing

Bitcoin ETFs saw $20.3M inflows while Ethereum ETFs faced $127.4M outflows on October 23, signaling diverging investor sentiment.Ethereum ETFs Hit by Massive OutflowsWhat This Could Mean for the Market

- 11:39Meta plans to lay off about 600 employees in its artificial intelligence divisionAccording to Jinse Finance, Meta, the parent company of tech giant Facebook, plans to lay off about 600 employees in its artificial intelligence division. Reports indicate that the newly established TBD Lab, which previously recruited many top AI researchers from competitors such as OpenAI and Apple with high salaries, is not affected by this round of layoffs. The layoffs are reportedly aimed at addressing the "organizational bloat" caused by large-scale hiring to rapidly advance AI projects in the past. It is understood that in recent months, Meta has been actively adjusting its AI strategy to keep pace with competitors, investing billions of dollars in infrastructure projects and talent recruitment. (CCTV Finance)

- 11:39The previously damaged Satoshi Nakamoto statue in Switzerland has been restored.According to ChainCatcher, citing Lugano Plan B, the Satoshi Nakamoto statue in Lugano, Switzerland has been restored. Previously, on August 2 this year, the statue was forcibly removed from its base by unknown individuals.

- 11:10Infinex founder: The team's share, accounting for 20% of the total supply, will be re-locked for 12 months after TGE, followed by a 12-month linear vesting period after unlocking.On October 24, it was announced that kain.mega, founder of the cross-chain aggregation DeFi platform Infinex, stated that the Infinex token will soon be launched. After careful evaluation, the team unanimously believes that obtaining token liquidity before achieving product-market fit would be unfair to the community. Therefore, the team has voluntarily decided to re-lock all of its token shares (accounting for 20% of the total supply) for 12 months, and after unlocking, implement a 12-month linear vesting period. This decision has received unanimous support from all members, and we are well prepared for long-term development.