News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 14)|After tariff panic, TACO trading resurfaces; UK plans major tax cuts and advocates for the central bank to hold Bitcoin; multiple tokens set for large unlocks in the ne2Whales sell $4.2 billion worth of bitcoin, mysterious Chinese figure Garrett Jin caught in public controversy3Bitcoin Spot ETF Volume Hits $1B in 10 Minutes

Trump and Xi Jinping to Meet Over Trade Talks

Trump and Xi Jinping plan a key meeting to discuss U.S.-China trade issues, White House confirms.📰 Trade Talks Back on the Table🏛️ Why This Meeting Matters🌍 What Could Be at Stake

Coinomedia·2025/10/14 21:51

Larry Fink: Tokenization of All Assets Just Beginning

BlackRock CEO Larry Fink says the tokenization of all assets is only getting started, signaling a major shift in global finance.🔍 BlackRock Sees Big Future in Tokenization🏦 What Is Tokenization of Assets?🚀 Why It Matters for Investors

Coinomedia·2025/10/14 21:51

TAO Synergies Closes $11 Million Private Round for TAO Strategy

Portalcripto·2025/10/14 21:39

Enso Network launches mainnet and makes ENSO available on Ethereum and BNB

Portalcripto·2025/10/14 21:39

Circle Adopts Safe as Institutional Solution for USDC

Portalcripto·2025/10/14 21:39

Bitpanda Inserts Societe Generale MiCA Stablecoins into DeFi

Portalcripto·2025/10/14 21:39

AI predicts Bitcoin price for end of 2025

CryptoNewsNet·2025/10/14 21:39

What Does Fed Chair Powell’s Statement Today That “Quantitative Tightening Is Ending” Mean for Bitcoin?

CryptoNewsNet·2025/10/14 21:39

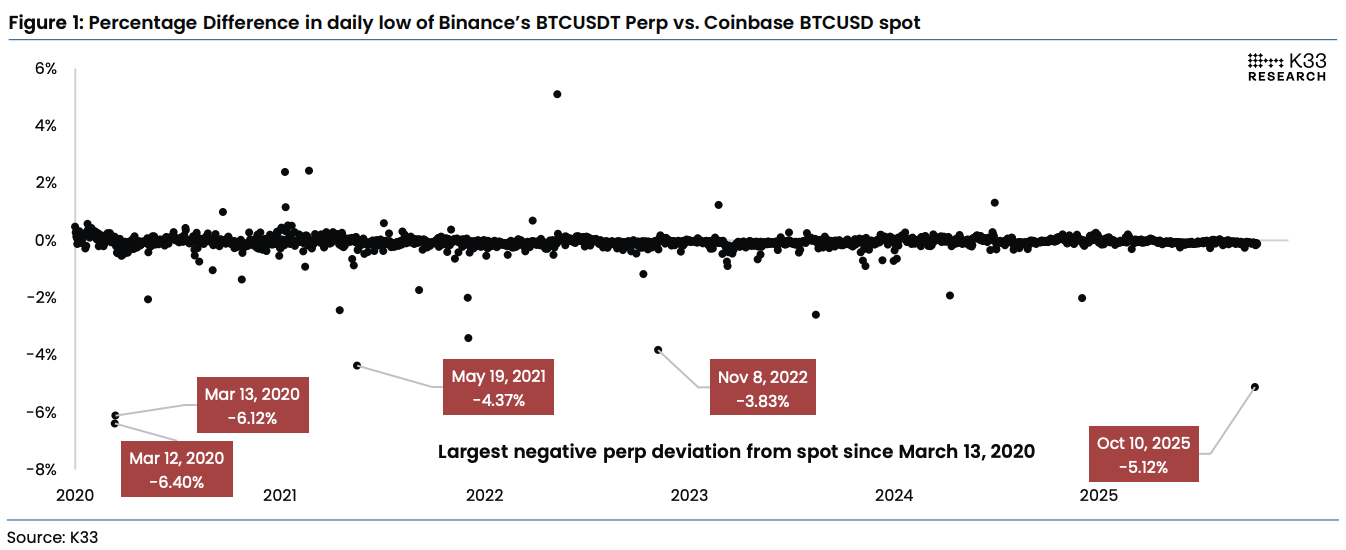

Bitcoin's Leverage Flush Favors Accumulation, K33 Says

CryptoNewsNet·2025/10/14 21:39

IOTA Is About to Move the World’s Rocks — and Unlock $7 Trillion in Global Trade

CryptoNewsNet·2025/10/14 21:39

Flash

- 21:51Bridge, the stablecoin company under Stripe, applies for a U.S. national bank trust charterJinse Finance reported that Bridge, the stablecoin infrastructure company under fintech giant Stripe, is applying to the US Office of the Comptroller of the Currency (OCC) for a national bank trust license. If approved, Bridge will provide regulated stablecoin issuance, management, and custody services under the framework of the "GENIUS Act" to be signed this summer. Bridge co-founder Zach Abrams stated that this regulatory framework will enable the company to drive the tokenization of "trillions of dollars in assets" within a compliant system. Since Stripe acquired Bridge for $1.1 billions last year, stablecoins have rapidly become a core business, including supporting USDC payments in cooperation with an exchange and Shopify, as well as launching the Open Issuance platform for custom stablecoin issuance and the payment-optimized blockchain Tempo.

- 21:44JPMorgan: Powell did not dodge questions about a rate cut in OctoberJinse Finance reported that Michael Feroli, Chief U.S. Economist at JPMorgan, stated that Federal Reserve Chairman Jerome Powell's latest speech "solidified expectations for further rate cuts, which will begin at the next meeting from October 28 to 29." Feroli pointed out that the market was already quite convinced that the Federal Reserve was inclined to ease policy, but Powell's wording left almost no room for ambiguity. He said, "While hardly anyone doubts that the Fed will cut rates at the next meeting, today's speech is a strong confirmation of that expectation." Powell's remarks further strengthened investors' belief that, following a series of weaker inflation and labor market data, the Fed is preparing to lower interest rates again, thereby reinforcing market bets on a rate cut at the end of October.

- 21:43New York City Mayor Eric Adams launches the nation’s first city-level Office of Digital Assets and BlockchainJinse Finance reported that New York City Mayor Eric Adams has signed an executive order to establish the nation’s first “Office of Digital Assets and Blockchain,” aimed at coordinating cooperation between the crypto industry and the government and promoting compliant blockchain and crypto projects in New York. The office will be led by Moises Rendon, who has long been involved in the city government’s digital asset affairs. Its goals include promoting the responsible application of blockchain, attracting fintech talent, expanding financial inclusion, and driving New York to become a center for crypto innovation. Adams stated: “The era of digital assets has arrived, bringing us opportunities for economic growth, talent attraction, and service innovation.” Adams previously received his first three paychecks after taking office in bitcoin and led New York’s first crypto summit. His mayoral term will end at the end of the year, and he has withdrawn from the re-election race due to campaign funding issues.