News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

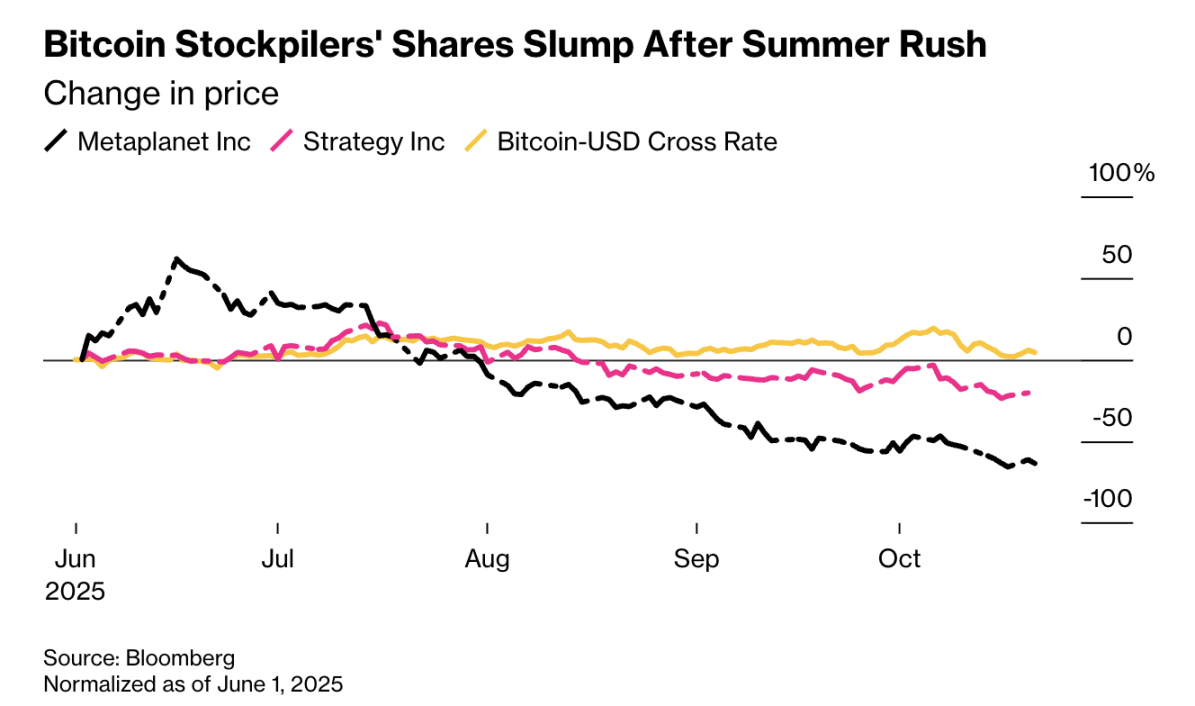

Three major exchanges in the Asia-Pacific region resist "crypto treasury companies"

Several Asia-Pacific countries, including Hong Kong, India, Mumbai, and Australia, are resisting corporate hoarding of cryptocurrencies.

深潮·2025/10/23 03:32

The 11th Global Blockchain Summit 2025 Grandly Opens: Web3, Boundless

At this new historical starting point, the entire industry is working together to move toward a more open, interconnected, and efficient future.

深潮·2025/10/23 03:31

Low threshold, all-weather: Bitget brings the "iPhone moment" to US stock investment

Investing globally no longer requires a cross-border identity, just a Bitget account.

ForesightNews·2025/10/23 03:15

He asks each employee to generate $100 million in profit: Tether CEO discusses the ultimate meaning of "stability"

律动BlockBeats·2025/10/23 03:10

The public sale of Megaeth: a renaissance without airdrops

律动BlockBeats·2025/10/23 03:09

Bitwise CIO: Why Has Gold Outperformed Bitcoin?

律动BlockBeats·2025/10/23 03:09

120,000 Bitcoins intercepted? In-depth analysis of the regulatory challenges behind the "Prince Group" case

律动BlockBeats·2025/10/23 03:09

Dogecoin Targets $0.886 Resistance Again With Analysts Predicting Q4 2025 Retest

Cryptonewsland·2025/10/23 02:57

LINK Price Gains 7.6% Amid Renewed Market Activity and Strong Support at $17.02

Cryptonewsland·2025/10/23 02:57

XRP Targets $2.48 Resistance as Chart Mirrors Its 2013 and 2018 Breakout Cycles

Cryptonewsland·2025/10/23 02:57

Flash

- 03:53a16z: Privacy Protection Returns to the Spotlight and Will Gain Greater Momentum in the FutureJinse Finance reported that a16z has released its latest crypto report, pointing out that privacy protection is returning to the spotlight and may become a prerequisite for mass adoption. Signs of rising attention include: a surge in Google searches related to crypto privacy in 2025; Zcash's shielded pool supply growing to nearly 4 million ZEC; and Railgun's monthly transaction volume surpassing $200 million. At the same time, the Ethereum Foundation has established a new privacy team; Paxos has partnered with Aleo to launch a private and compliant stablecoin (USAD); and the Office of Foreign Assets Control has lifted sanctions on the decentralized privacy protocol Tornado Cash. We expect that as crypto technology continues to go mainstream, this trend will gain even greater momentum in the coming years.

- 03:53Strategy's Bitcoin accumulation rate drops to its lowest level in five yearsJinse Finance reported that the world's largest bitcoin corporate treasury company, Strategy, has slowed its bitcoin accumulation to the lowest level in five years. As of this quarter, Strategy only increased its holdings by 388 bitcoins, bringing its total holdings to 640,031 by the end of the third quarter—a growth of just 0.1%. In previous quarters, Strategy's treasury growth was typically in the high single-digit or even double-digit percentages. In fact, in the fourth quarter of 2024, its BTC holdings saw a multi-year high increase of 77%. Unfortunately, as BTC purchases decreased, a certain exchange also dropped by 10% this quarter. Back in 2020, Michael Saylor's 1990s enterprise software company pivoted to leveraged bitcoin purchases, starting from a smaller base and accumulating 70,470 bitcoins by the end of that year. Its BTC treasury continued to grow strongly in 2021, with double-digit and high single-digit percentage increases, slowed down in 2022, and then picked up again in 2023 and 2024.

- 03:11RootData: ARENA will unlock tokens worth approximately $2.26 million in one weekAccording to ChainCatcher, based on token unlock data from the Web3 asset data platform RootData, The Arena (ARENA) will unlock approximately 66.025 million tokens at 00:00 on October 30 (UTC+8), with a total value of about $2.26 million.