News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

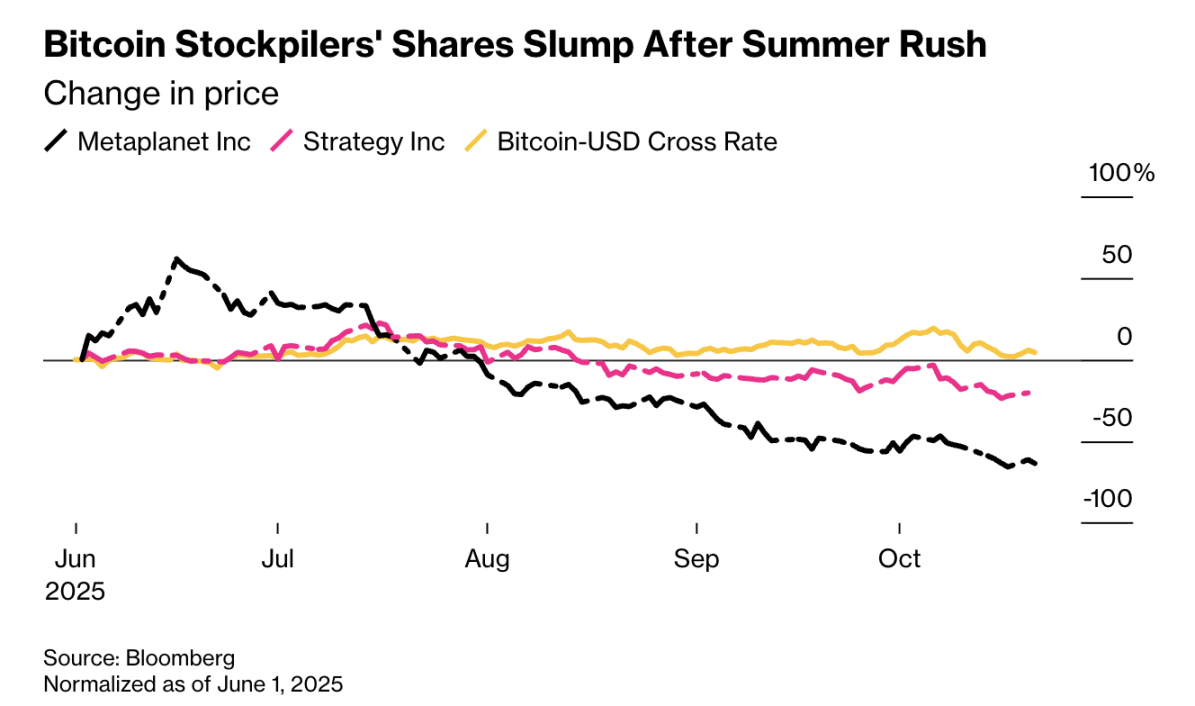

Three major exchanges in the Asia-Pacific region resist "crypto treasury companies"

Several Asia-Pacific countries, including Hong Kong, India, Mumbai, and Australia, are resisting corporate hoarding of cryptocurrencies.

深潮·2025/10/23 03:32

The 11th Global Blockchain Summit 2025 Grandly Opens: Web3, Boundless

At this new historical starting point, the entire industry is working together to move toward a more open, interconnected, and efficient future.

深潮·2025/10/23 03:31

Low threshold, all-weather: Bitget brings the "iPhone moment" to US stock investment

Investing globally no longer requires a cross-border identity, just a Bitget account.

ForesightNews·2025/10/23 03:15

He asks each employee to generate $100 million in profit: Tether CEO discusses the ultimate meaning of "stability"

律动BlockBeats·2025/10/23 03:10

The public sale of Megaeth: a renaissance without airdrops

律动BlockBeats·2025/10/23 03:09

Bitwise CIO: Why Has Gold Outperformed Bitcoin?

律动BlockBeats·2025/10/23 03:09

120,000 Bitcoins intercepted? In-depth analysis of the regulatory challenges behind the "Prince Group" case

律动BlockBeats·2025/10/23 03:09

Dogecoin Targets $0.886 Resistance Again With Analysts Predicting Q4 2025 Retest

Cryptonewsland·2025/10/23 02:57

LINK Price Gains 7.6% Amid Renewed Market Activity and Strong Support at $17.02

Cryptonewsland·2025/10/23 02:57

XRP Targets $2.48 Resistance as Chart Mirrors Its 2013 and 2018 Breakout Cycles

Cryptonewsland·2025/10/23 02:57

Flash

- 04:11Data: Bitcoin spot ETF saw a total net outflow of $101 millions yesterday, while BlackRock IBIT had a net inflow of $73.63 millions.ChainCatcher News: According to SoSoValue data, the total net outflow of Bitcoin spot ETFs yesterday (October 22, Eastern Time) was $101 million. The Bitcoin spot ETF with the highest single-day net inflow yesterday was Blackrock ETF IBIT, with a single-day net inflow of $73.6272 million. Currently, IBIT's historical total net inflow has reached $6.5165 billion. Next is Valkyrie ETF BRRR, with a single-day net inflow of $2.1376 million. Currently, BRRR's historical total net inflow has reached $323 million.The Bitcoin spot ETF with the highest single-day net outflow yesterday was Grayscale ETF GBTC, with a single-day net outflow of $56.6288 million. Currently, GBTC's historical total net outflow has reached $24.555 billion. As of press time, the total net asset value of Bitcoin spot ETFs is $146.27 billion, and the ETF net asset ratio (market value as a proportion of Bitcoin's total market value) has reached 6.81%. The historical cumulative net inflow has reached $61.874 billion.

- 04:10A newly created wallet withdrew 8,491 ETH worth $32.47 million from an exchange within two hours.According to Jinse Finance, crypto analyst Yu Jin has monitored that a newly created wallet withdrew 8,491 ETH from a certain exchange within the past two hours, valued at approximately $32.47 million, with an average withdrawal price of $3,824.

- 04:09Limitless: 0.2% of the token supply will be allocated to designated users todayJinse Finance reported that the prediction market platform Limitless announced on X that today it will distribute 0.2% of its token supply to designated users, including active traders from pre–Season 1 (with trading amounts over $200) and Atlantis World NFT holders. The tokens will be sent directly to the relevant users' wallets, and no action is required from them.