News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

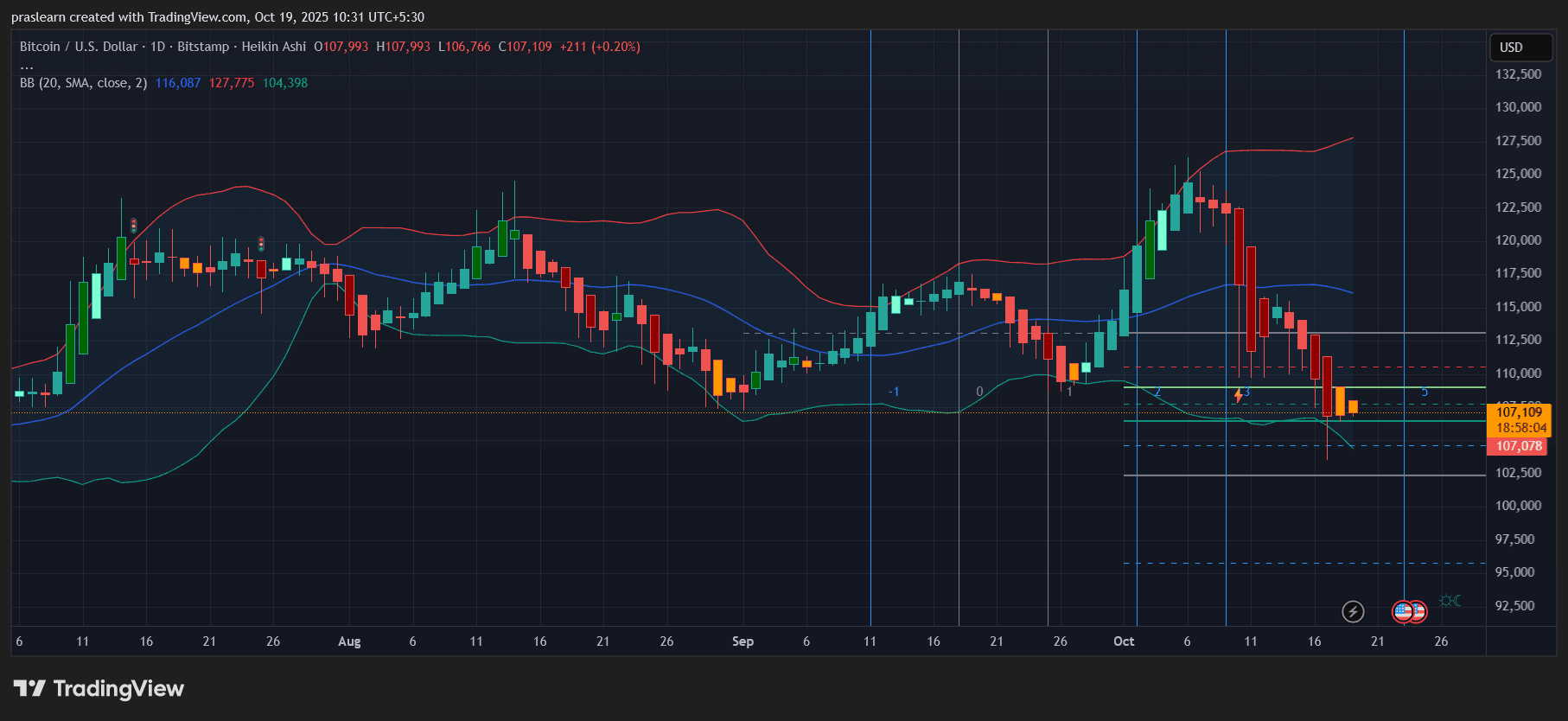

Is Bitcoin’s $100K Floor at Risk as the Fed Struggles to Find Its “Neutral” Rate?

Cryptoticker·2025/10/19 11:21

Bitcoin Consolidates Near $107K: Analysts Have THIS Bitcoin Prediction...

Cryptoticker·2025/10/19 11:21

JST buyback and burn proposal officially launched to drive TRON ecosystem value upgrade with a deflationary model

The proposal plans to use the net income of JustLend DAO and all excess profits exceeding 10 million US dollars in the USDD ecosystem to buy back and burn JST tokens.

深潮·2025/10/19 10:59

Whales Stake $2M Falcon Finance Tokens Amid Market Slump

Coinlineup·2025/10/19 10:42

The New York Times: Trump family’s crypto fundraising is even worse than Watergate

When presidents start issuing tokens, politics is no longer a means of governing the country but becomes a game to boost their own market value.

Chaincatcher·2025/10/19 10:13

Anthony Pompliano Claims Gold Lost Value Against Bitcoin

Theccpress·2025/10/19 08:33

Adam Back Predicts Bitcoin Price Surge Based on Market Trends

Theccpress·2025/10/19 08:33

Bitcoin ETFs Experience $1.2 Billion in Weekly Outflows

Theccpress·2025/10/19 08:33

Flash

- 11:28Andrew Kang increased his short positions to $77.97 million, with unrealized losses of approximately $1 million.According to Jinse Finance, monitored by AI Aunt, the short positions associated with AndrewKang have increased to $77.97 million, including $46.86 million in ETH shorts and $31.14 million in BTC shorts. The current total position has an unrealized loss of $990,000; meanwhile, his ENA long position has an unrealized profit of $2.97 million.

- 11:12Data: A certain whale deposited $2.91 million USDC into Hyperliquid and opened long and short positions worth approximately $70 million.According to ChainCatcher, monitored by Lookonchain, a whale (0x579f...e5ff) deposited 2.91 million USDC into Hyperliquid over the past two days and established positions totaling approximately 70 million USD. These include shorting 232 BTC (worth 25 million USD), shorting 5,810 ETH (worth 22.7 million USD), and going long on 44.79 million ENA (worth 21.3 million USD).

- 10:53X launches account ID trading marketplace Handle MarketplaceChainCatcher news, X has launched the account ID trading marketplace Handle Marketplace, which is used to reallocate unused Handles. Eligible Premium subscribers will be able to search and submit requests, with both free and paid options available. This feature will be launched soon, and you can now join the waiting list.