News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Bitcoin, Ethereum, and XRP Plunge: Is the Four-Year Cycle Over?

Cointribune·2025/10/18 21:09

Is Pump.fun (PUMP) Gearing Up For a Rebound? Key Emerging Harmonic Pattern Saying Yes!

CoinsProbe·2025/10/18 21:09

Cardano (ADA) To Bounce Back? This Emerging Pattern Saying Yes!

CoinsProbe·2025/10/18 21:09

Bittensor (TAO) To Surge Ahead? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/10/18 21:09

Ethena (ENA) To Surge Further? Key Harmonic Pattern Hints at Potential Upside Move

CoinsProbe·2025/10/18 21:09

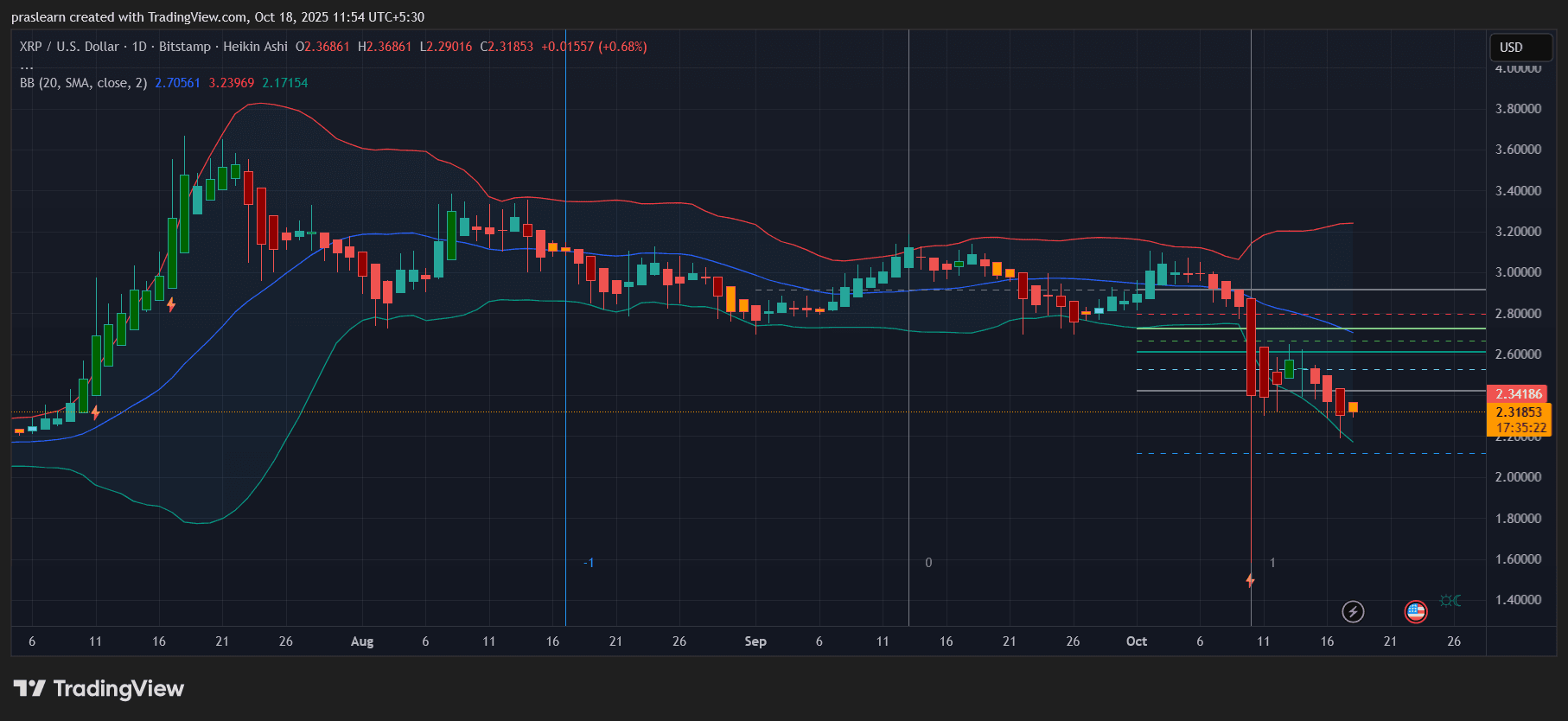

What Will the Upcoming Inflation Report Mean for XRP Price?

Cryptoticker·2025/10/18 20:48

Bitcoin and Ethereum ETFs See Heavy Outflows as Market Holds Firm

Cryptoticker·2025/10/18 20:48

How did Trump's company make 1.1 billions dollars from the crypto market?

Policy and business are integrated, with presidential power leveraging the crypto market.

深潮·2025/10/18 20:27

Astra Nova Secures $48.3 Million for Tokenized Expansion

Coinlineup·2025/10/18 20:12

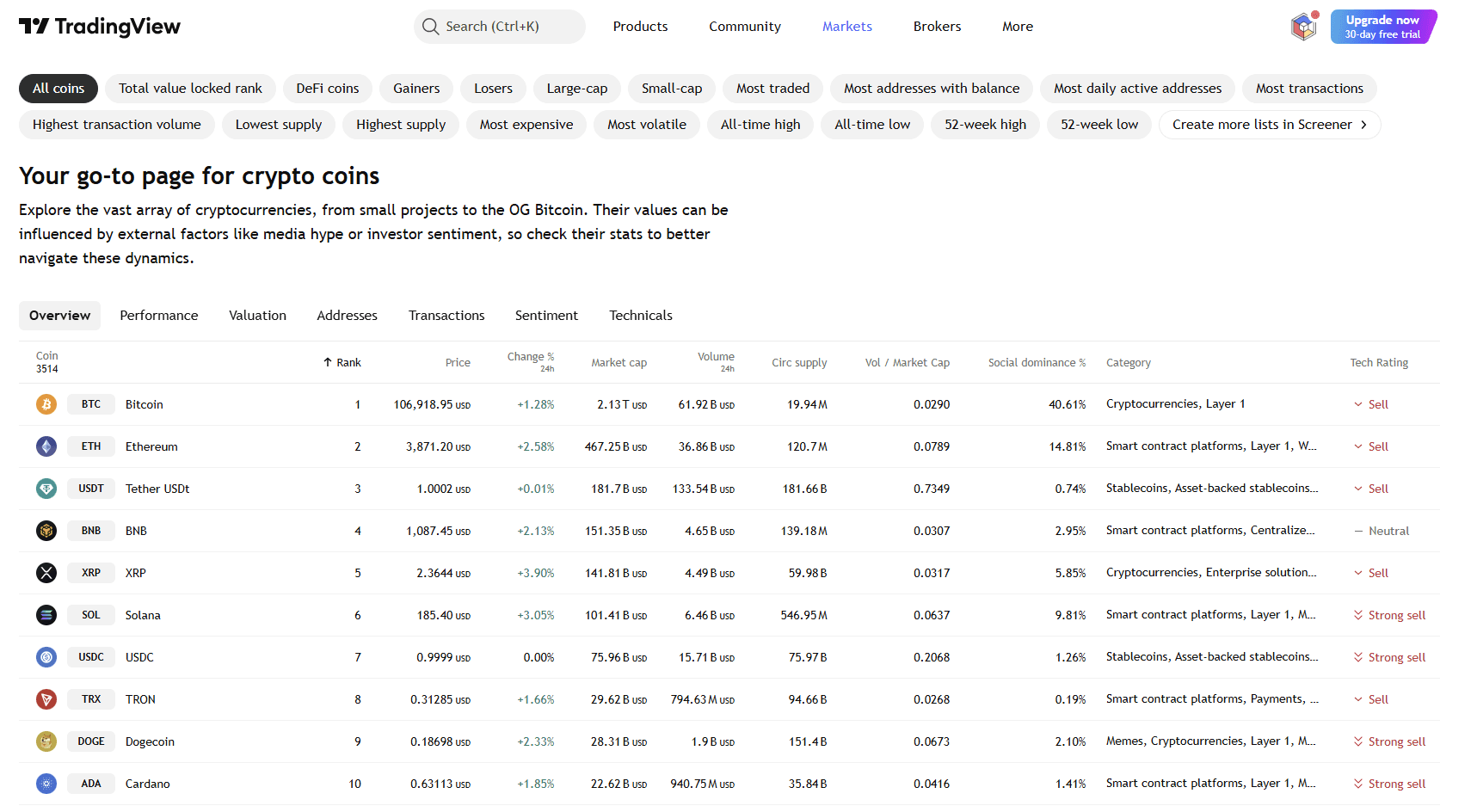

Bitcoin Surges to $107,000 Amid Market Volatility

Coinlineup·2025/10/18 20:12

Flash

- 20:59The UK tax authorities have sent 65,000 letters to suspected cryptocurrency tax evaders.According to a report by Jinse Finance, the UK tax authority has sent 65,000 so-called "reminder letters" to individuals suspected of owing cryptocurrency taxes, more than double the number from last year, according to the Financial Times. In the UK, selling, exchanging, or spending cryptocurrency typically incurs capital gains tax, while staking rewards and airdrops are generally considered income.

- 20:40Retail investors lost about $17 billion by attempting to invest in bitcoin indirectly through asset management firms.According to Jinse Finance, citing Bloomberg, retail investors have lost about 1.7 billions USD by indirectly investing in bitcoin through fund management companies such as Metaplanet and Michael Saylor's Strategy. 10X Research stated that these losses stem from excessively high equity premiums, causing share prices to be much higher than the actual bitcoin holdings.

- 20:15Ripple CLO refutes claims that cryptocurrency is merely a tool for "crime and corruption"Jinse Finance reported that Stuart Alderoty from Ripple stated in an X post that The New York Times has published a "guest article" for the second time in just a few weeks, portraying cryptocurrency as a tool for crime and corruption. This narrative may seem convenient, but it is lazy and inaccurate. Cryptocurrency is a technology used by more than 55 million Americans, with over three-quarters saying it has improved their lives; it helps them remit money, prove ownership, and build new forms of business on transparent, traceable ledgers. Corruption and crime do not thrive in the open. The real story is about how ordinary Americans use digital assets to save time, reduce costs, and achieve financial freedom. This story deserves to be told. That is exactly what we are doing.