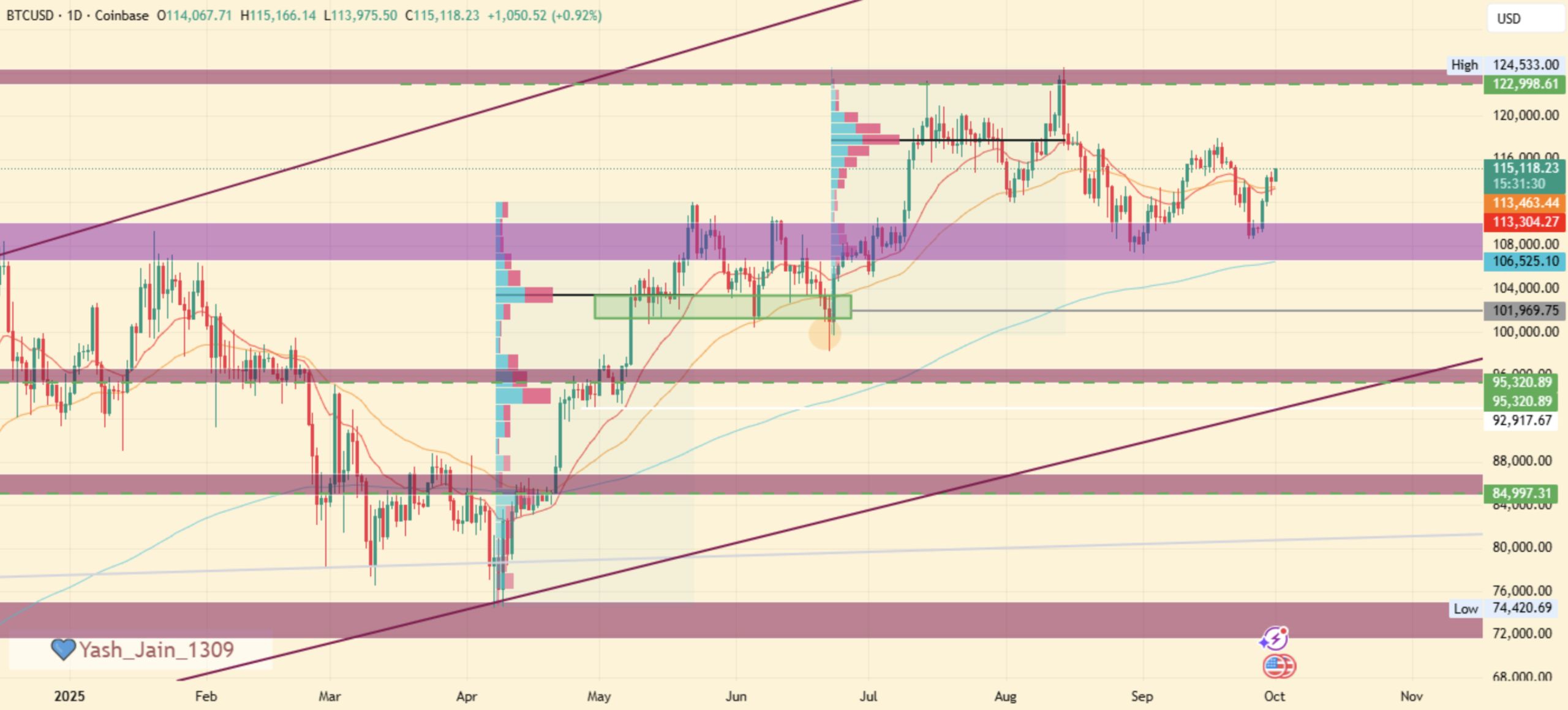

In the early part of the week, Bitcoin $118,959 made a swift breakthrough, climbing from $114,000 to over $118,700. Early today, it breached the $119,000 threshold and is now stabilizing around $118,500. Previously, the daily chart showed oversold signals, and fear-based sentiment indicators have reversed. Global liquidity conditions are supporting risky assets, while Bitcoin’s correlation with gold, which set new records earlier this year, is being revisited. Blockchain data indicates that large wallet addresses have been increasing their purchasing weight, and the reserves of stablecoins flowing back into exchanges are accompanying the rise.

Dynamics Driving Bitcoin’s Breakthrough

As buying depth increased in both spot and derivative exchanges, a weakening negative trend in the weekly MACD indicates eased pressure. In the monthly timeframe, the RSI is far from the warming levels seen in previous cycle peaks. Analysts highlighted that a close above $118,000 sets the stage for a $120,000 test, with the 132,000–135,000 range being the next major resistance zone.

With liquidity conditions broadening throughout the year and gold gaining value as a safe haven, demand for digital scarce assets is being supported. Within the blockchain , high-balance wallets adding more and increasing stablecoin inflows are providing tangible clues about the demand profile behind the breakthrough.

The timing of the rise coincides with the opening of the fourth quarter. Among market participants, individual investors, professional traders, and institutional intermediaries are prominent. The process advanced through technical confirmation triggered by the price settling above $118,000, improved sentiment, and increased cash inflows.

Altcoins Begin to Follow the Surge

Following Bitcoin’s rise, the total market cap has returned to the $4 trillion threshold. Ethereum $0.000083 has surpassed $4,300, XRP has recovered to $2.96, BNB crossed the $1,000 threshold, and Solana $226 has settled above $221. Cardano $0.853 has entered a gradual improvement mode following end-of-summer weakness.

In line with the model highlighted in past cycles, it is expected that capital flow will shift from Bitcoin’s strengthening to select large altcoins and then to mid-segment coins. During the fourth quarter, where transactions are concentrated, the market may attempt a broad-based rally.

In the short term, profit-taking and a possible test of the breakout around $120,000 are conceivable. For sustainability, the continuation of stablecoin inflows, balanced funding rates, and the liquidity of the order book not falling apart is important. From a risk management perspective, proceeding with gradual trading strategies and clear levels is prominent.