Why Has Tron’s Significant Gas Fee Reduction Failed to Substantially Lower Actual User Costs?

Author: Chloe, ChainCatcher

Original Title: Tron Cuts Gas Fees by 60%—Can “Incremental Growth” Offset Lower Unit Prices?

On the 26th of last month, Tron implemented the largest fee reduction in its history. Justin Sun stated, “This proposal is a real benefit for users, with a 60% fee reduction. Most networks wouldn’t have the courage to do this.” He also mentioned that while this would impact Tron’s short-term profitability, as network fees are directly reduced by 60%, its long-term profitability would be enhanced because more users and more transactions would take place on Tron.

According to the latest gasfeesnow data, even after the fee reduction, the cost of transferring USDT on Tron remains as high as $2.02–$4.22, far exceeding other major blockchain networks.

The fee comparison makes this clear: even after optimization by TronCastle, with fees at $1.09–$2.21, this is still 15 times higher than Arbitrum ($0.10) at the time of writing, 302 times higher than Solana ($0.0036), and even 3,633 times higher than Polygon ($0.0003), while Aptos is as low as $0.0001.

Why Were Fees So High Before the Reduction?

Tron does not use Ethereum’s gas model; instead, it employs a unique bandwidth + energy model. This means bandwidth gives users a daily free quota to support simple transfers, while energy is used for contract execution resources, such as transferring USDT (TRC-20), which requires energy.

Suppose a USDT transfer consumes about 130,000 units of energy. If the user’s wallet has no resources, the system can only directly burn TRX, resulting in high transaction fees.

In contrast, Ethereum’s Layer 2 solutions like Arbitrum and Optimism use a simpler gas model, offering a more user-friendly experience. Solana, with its unique Proof of History (PoH) and parallel execution architecture, achieves a processing capacity of 2,600 transactions per second while maintaining ultra-low fees.

After lowering fees, Tron plans to use “incremental growth” to successfully counteract the “decline in unit price.”

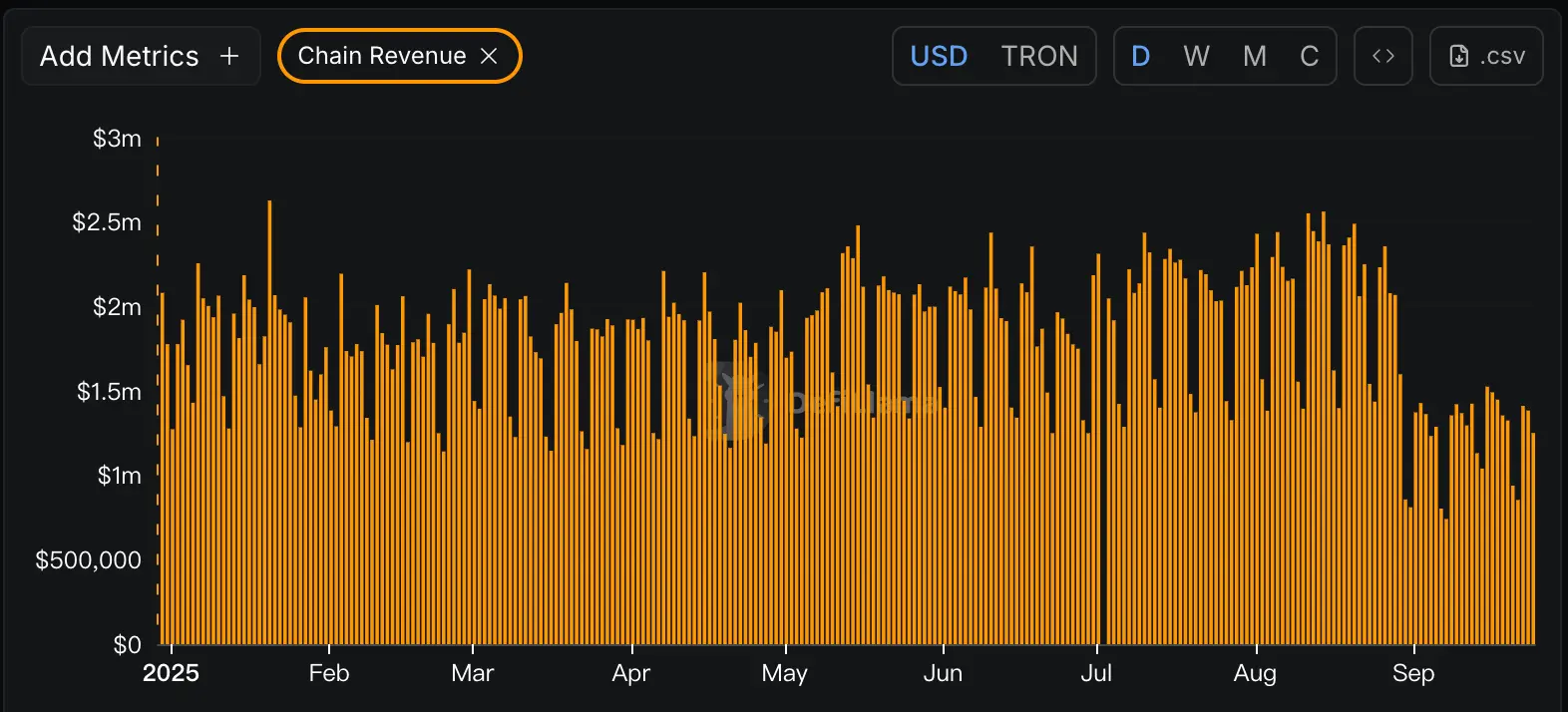

This 60% fee reduction by Tron is a major market adjustment and a proactive decision by the project team to drive explosive user growth. According to CryptoQuant, on September 7, Tron’s daily network fee revenue dropped to $5 million, the lowest level in a year. Before the reduction on August 28, daily revenue was still $13.9 million.

According to on-chain data from DeFi Llama, Tron’s average revenue in September saw a cliff-like drop compared to the previous month, with a decrease of nearly 50%.

But even as revenue decreased, on-chain activity actually increased. Daily transaction volume and the number of active wallets surged, and the number of new smart contracts added each day also showed that users and dApp developers continue to flock to the network.

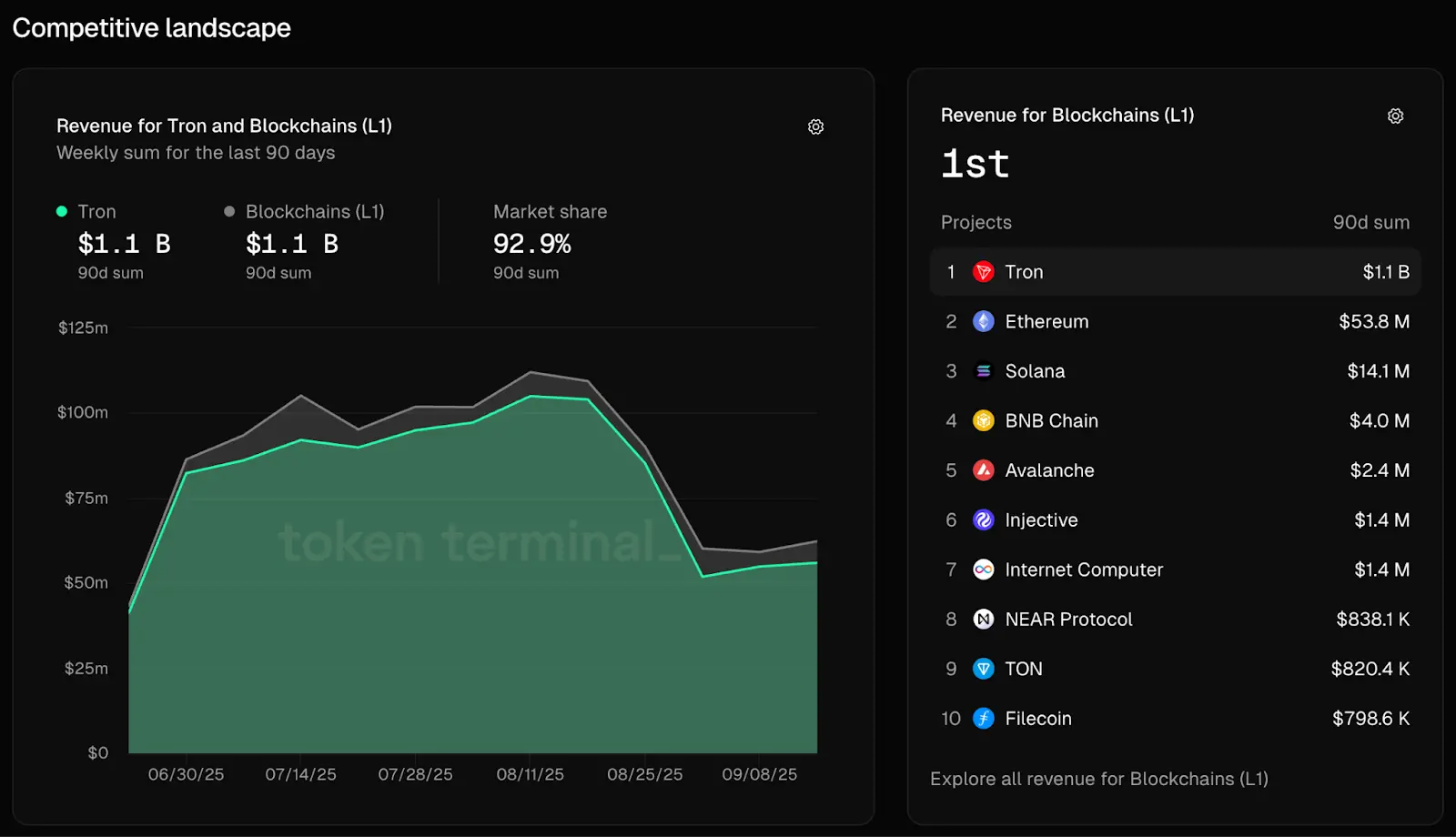

According to Token Terminal data, in the past seven days, Tron still accounted for 92.9% of total L1 public chain revenue. Over the past 90 days, Tron’s total fee revenue still far exceeded that of Ethereum, Solana, BNB Chain, and Avalanche during the same period.

Justin Sun and Tron’s initial expectation was that as long as user and transaction volume continued to grow, revenue would eventually rebound and become more sustainable—essentially using “incremental growth” to offset the “decline in unit price.”

Although Tron currently still appears to have an advantage in terms of revenue, with the GENIUS Act passing in July this year, the competitive landscape of the on-chain market is undergoing a fundamental restructuring. Stablecoin issuers, facing stricter registration, auditing, and reserve requirements, may reassess the cost-effectiveness of deploying assets on Tron, which could indirectly affect the network’s stablecoin trading volume and ecosystem activity. This change poses a significant barrier for Tron.

Wall Street Giants Enter the Market, CBDCs Mature

The passage of the GENIUS Act has received both praise and criticism, and it brings both advantages and disadvantages to the crypto market. Supporters believe this milestone brings greater credibility to stablecoins, making financial institutions and consumers more willing to use them. Opponents argue that the act allows the president and related institutions to profit, creating a conflict of interest with the crypto market.

Currently, Wall Street giants such as BlackRock and JPMorgan have already begun building their own blockchain empires. BlackRock’s BUIDL tokenized money market fund has reached $2.2 billion in scale, deployed across Ethereum, Avalanche, Aptos, Polygon, and other networks. JPMorgan’s Kinexys platform focuses on institutional-grade DeFi and programmable digital cash, providing on-chain lending and digital asset collateral services for enterprise clients.

The advantages of these traditional financial institutions are: 1. Regulatory compliance: deep cooperation with financial regulators in various countries; 2. Financial strength: BlackRock manages over several trillion dollars in assets; 3. A large base of enterprise clients: a mature institutional client network and trust relationships, as well as the technical integration capability to seamlessly incorporate blockchain into existing financial infrastructure.

Tron’s compliance gap is absolutely incomparable to BlackRock and JPMorgan’s regulatory relationships. In addition, its adoption rate among Fortune 500 companies is extremely low, not to mention the ongoing SEC lawsuit, which affects institutional trust.

Supplement: Last week, two U.S. Democratic lawmakers sent a letter to the SEC, asking why it suspended enforcement actions against Justin Sun and suggesting that the SEC’s decision may be related to Sun’s “substantial investment” in crypto projects associated with President Trump. Meanwhile, the lawmakers questioned Tron’s recent listing on Nasdaq, believing it could pose financial and national security risks, and urged the SEC to ensure the company meets strict listing standards.

In addition, 98% of global GDP is now covered by central bank digital currency (CBDC) projects, with 19 G20 countries developing or piloting CBDCs. Major economies’ CBDC projects, such as China’s digital yuan (e-CNY), the EU’s digital euro, and India’s digital rupee, will directly compete with Tron in cross-border payments and large-value settlements.

McKinsey research shows that 2025 will be a turning point for stablecoin development, with the stablecoin market expected to grow from the current $150 billion to $3 trillion by 2030. However, this huge incremental growth will mainly be captured by compliant institutional-grade stablecoins and CBDCs.

The market believes that Tron must complete its transformation within this critical time window, or it will face the fate of being marginalized. The crypto market is clearly shifting from experimental technology to core infrastructure, and only a few platforms will survive this transition.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts Say Dogecoin Could Rise 195% Toward $0.74, Patterns Suggest Possible $1.30–$1.60 Target

XRP Price Recovery Stalls – Traders Watching If Bulls Can Overcome Resistance

European Banks Issue Stablecoin Creating Wave in the Crypto World

In Brief Nine major European banks collaborate to issue Euro-indexed stablecoin. The stablecoin launch targets the second half of 2026 after regulatory approval. The initiative reinforces Europe against U.S.-based stablecoin market dominance.