The cryptocurrency market was recently taken by storm with the impressive performance of the ASTER project, which quickly captured the interest of traders. Since its launch, the token has appreciated by 2,587% and even recorded a 30% rise in a 24-hour period. This rapid surge is attributed to market-induced FOMO (fear of missing out) and a stringent supply constraint.

Data Supporting ASTER’s Rise

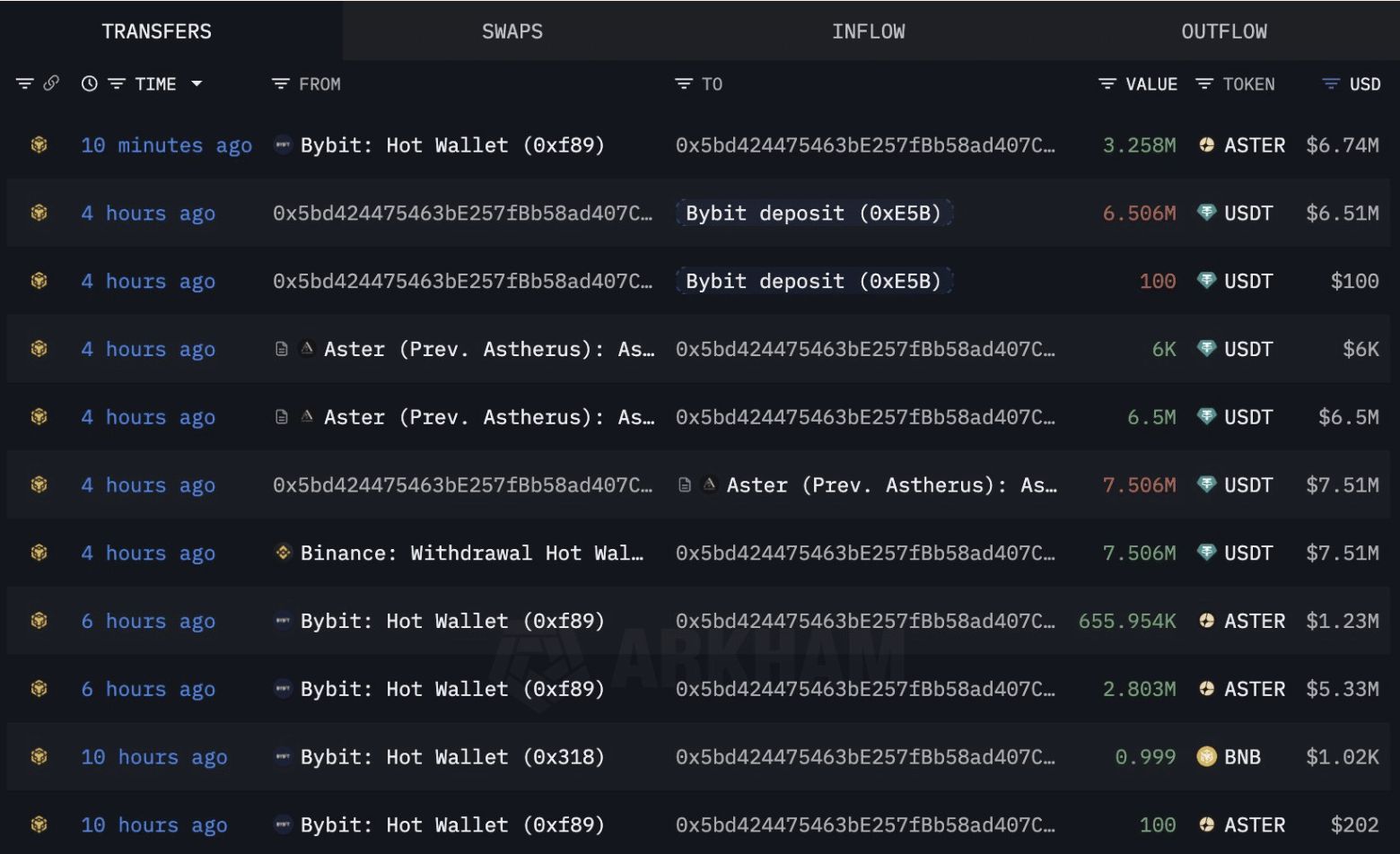

In addition to notable price movements, on-chain data for ASTER also portrays a compelling picture. The number of HODLers has increased by 7.3%, reaching 61,450, reflecting new capital’s confidence in the project. Moreover, the open positions in derivatives markets have surpassed $1.25 billion, with half concentrated within the Hyperliquid exchange. This indicates that liquidity is clustering in specific areas, suggesting channels through which short-term price fluctuations might occur.

Strategic Moves of the Whales

One of the most debated issues in the market is that 96% of the supply resides in just six wallets. This creates a risk where a single sell-off could trigger a chain of liquidations. However, interestingly, whales have leveraged this risk perception to their advantage. A whale accumulated 6.72 million ASTER during a decline from the $2 level, reaping over a million dollars in gains shortly thereafter, illustrating the successful implementation of a “buying the dip” strategy. Whales turned the FUD (fear, uncertainty, and doubt) into FOMO, causing the price to rise again.

The rapid ascent of ASTER has brought a new “whale game” scenario to the fore in the market. A similar situation had occurred recently with Solana $197 . Although large investors’ significant purchases supported Solana’s price, they also led to sharp short-term pullbacks. Therefore, ASTER investors need to be cautious, especially regarding whale movements. While the short-term potential for gains is strong, it is crucial not to ignore long-term risks.