M2 Capital invested $20 million in Ethena’s governance token ENA as Ethena’s TVL nears $15 billion, signaling stronger institutional backing. The capital will support product integration into M2’s wealth services and may accelerate adoption of USDe and yield-bearing sUSDe.

-

M2 Capital invests $20M in Ethena’s ENA governance token

-

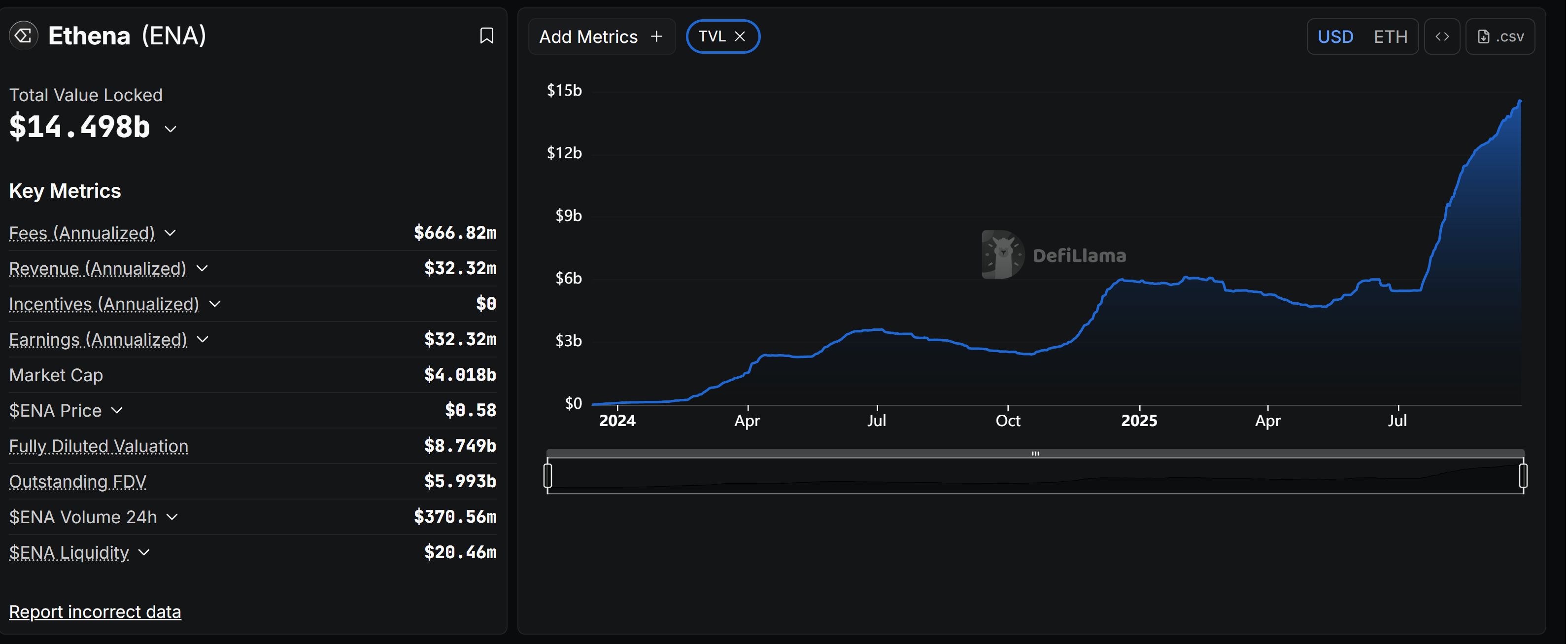

Ethena TVL is near $14.5B with $666.82M fees generated over the past year

-

Ethena’s sUSDe APY is 6% today, down from a 2024 average of 19% and serving 811,000 users

Ethena ENA: M2 Capital invests $20M as Ethena TVL nears $15B. Institutional backing alters sUSDe APY and adoption outlook — read the full analysis now.

M2 Capital invested $20 million in Ethena’s ENA token as the protocol’s TVL nears $15 billion, with growing institutional backing from global crypto investors.

M2 Capital, the investment arm of UAE-based M2 Holdings, has invested $20 million in ENA, the governance token for Ethena, a crypto-native synthetic dollar protocol built on Ethereum.

M2 Holdings, a conglomerate with digital asset exposure across custody, investment and wealth management, plans to integrate Ethena (ENA) products into client offerings through its affiliate, M2 Global Wealth Limited, according to the announcement.

“M2’s investment in Ethena marks another important step forward for the Middle East’s most sophisticated digital asset investors,” said Kim Wong, managing director and head of treasury at M2 Holdings.

Ethena joins M2’s strategic portfolio, which includes earlier investments tied to SUI and related PIPE support for Nasdaq-listed SUI Group Holdings (plain text reference).

What is Ethena’s ENA and why did M2 Capital invest?

Ethena ENA is the protocol’s governance token used to align incentives for Ethena’s synthetic dollar system. M2 Capital’s $20M investment aims to accelerate product integration into its wealth services and to signal confidence from institutional investors in Ethena’s stablecoin model.

How is Ethena performing on metrics like TVL, fees and users?

Ethena’s total value locked (TVL) is reported at nearly $14.5 billion (DefiLlama, plain text). Over the past 12 months the protocol generated $666.82 million in fees, with $32.32 million in revenue and earnings. The project reports more than 811,000 users across 24 blockchain networks.

Ethena TVL reaches $14.5 billion. Source: DefiLlama (plain text)

How does Ethena maintain USDe price stability?

Ethena combines crypto-backed collateral with delta-neutral hedging strategies to keep USDe price-stable. The protocol issues USDe as a stablecoin and sUSDe as a yield-bearing variant. Risk is managed via collateralization and hedging layers designed to limit directional exposure.

What are the recent yield trends for sUSDe?

According to Ethena’s public data (plain text), sUSDe currently offers about 6% APY, down from a 2024 average of 19%. The decline reflects market rate normalization and adjustments in yield source economics.

YZi Labs and broader institutional momentum: what else is happening?

Investment firm YZi Labs (linked to Changpeng Zhao in public reporting, plain text) recently increased its backing of Ethena to help scale USDe on BNB Chain and advance USDtb, a treasury-backed stablecoin, plus Converge — Ethena’s institutional settlement layer for tokenized real-world assets.

In parallel, payments and fintech deals continue to attract capital. For example, RedotPay announced a $47 million strategic investment round (plain text reference), underscoring renewed interest in stablecoin payments.

Cointelegraph (plain text) reached out to M2 Holdings for comment but had not received a response by publication.

Comparison: Key protocol metrics

| TVL | $14.5 billion (approx.) |

| Fees (12 months) | $666.82 million |

| Revenue / Earnings | $32.32 million |

| sUSDe APY (current) | 6% |

| User count | 811,000 across 24 networks |

Frequently Asked Questions

How much did M2 Capital invest in ENA and what will the funds be used for?

M2 Capital invested $20 million in ENA. The funds will support integration of Ethena products into M2 Global Wealth Limited’s client offerings and back further protocol development and adoption initiatives.

Is Ethena audited and who audits its contracts?

Ethena publishes security and audit information on its official channels (plain text reference). Readers should verify the latest audit reports and formal attestations provided by the project for up-to-date details.

Key Takeaways

- M2 Capital backing: $20M investment in ENA signals growing institutional interest.

- Strong on-chain metrics: TVL near $14.5B with $666.82M in fees over 12 months.

- Yield normalization: sUSDe APY at 6% today; monitor yield sources and adoption for future shifts.

Conclusion

The $20 million M2 Capital investment in Ethena ENA strengthens institutional validation for Ethena as its TVL approaches $15 billion. Continued support from firms like YZi Labs and rising on-chain metrics suggest growing adoption of USDe and sUSDe. Watch protocol revenues, APY trends and integration into wealth products for the next indications of institutional-scale utility.