Bitcoin Price Drops Amid Tariff Tensions and Fed Silence

- Bitcoin drops under $115K as Trump’s new tariff order sparks broad investor risk aversion.

- Over $600M in crypto liquidations hit the market amid Fed silence and macro uncertainty.

- Market volatility increases as Bitcoin dips, spooked by macroeconomic policy uncertainty.

Bitcoin slipped below $115,000 on Friday morning after investors reacted to trade tensions and monetary policy uncertainty. The drop came hours after U.S. President Donald Trump signed an executive order on global trade tariffs while simultaneously, the U.S. Federal Reserve held back from signaling any rate cuts, adding to market anxiety.

Bitcoin fell to $114,418 during early trading in Asia, its lowest level since June 11. This marked a 2.6% daily loss and pushed Bitcoin 6.3% below its July 14 all-time high of $122,800. The decline also broke Bitcoin’s three-week consolidation channel, signaling a possible shift in short-term momentum.

Source: TradingView

Trade Tensions and Policy Silence Add Pressure

President Trump’s executive order formalized several new tariffs on countries that failed to reach trade agreements. Countries like South Africa, Switzerland, Taiwan and Thailand face 19% to 39% tariff rates while Canada’s tariff rate jumped from 25% to 35%.

Although agreements were finalized with Japan, South Korea, the UK and the EU, global investors still reacted cautiously. Asian equity markets declined in response and crypto markets followed suit. The tariff rollout also arrived alongside silence from the Federal Open Market Committee (FOMC) on interest rate cuts.

The lack of clear monetary policy direction contributed to the unease of the investor in both the traditional and digital markets. Adding to the pressure, the U.S. dollar index (DXY) fell, which indicates a high uncertainty in the macroeconomic situation. The downturn in a dollar did not favor risk assets such as Bitcoin which on the contrary, thrives on a weaker dollar.

Regulatory uncertainty is another factor weighing on the market. Despite the release of a crypto-friendly policy report this week, clear timelines for ETF approvals remain elusive. The SEC’s new listing standards could open the door for altcoin ETPs, but investors remain cautious. Stablecoin framework legislation is also stalled in Congress, adding to broader uncertainty for institutional participation.

Related: Bitcoin’s Power Shift: Whales Exit, Institutions Step In

$630M in Liquidations Signal Market Shakeout

The sell-off triggered widespread forced liquidations across crypto markets. According to CoinGlass data, over 161,000 traders were liquidated in the last 24 hours, totaling $632.6 million. Most of the liquidations were long positions, highlighting how leveraged bullish bets were wiped out as prices slid.

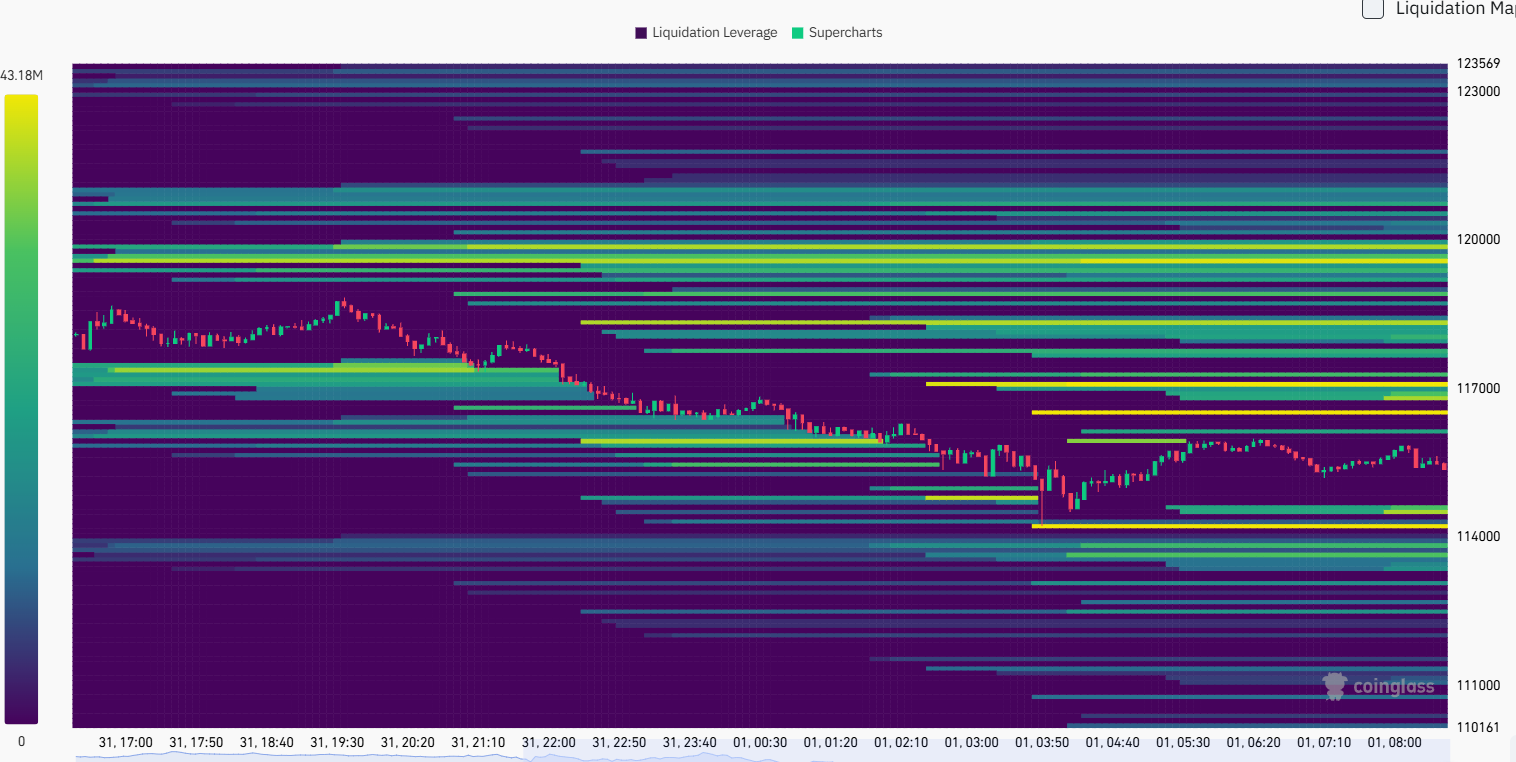

Binance’s liquidation map showed strong long liquidation pressure between $113,000 and $115,000. A large concentration of leveraged positions between $117,000 and $123,000 adds further downside risk if no recovery follows.

Meanwhile the support zones are currently around $111,000 and $114,000, where the liquidation risk is less concentrated. The price of Bitcoin is stuck in a narrow range, trading around $115,300, with the resistance at around $117,000.

Source: Coinglass

The market outlook is still tense in the short term as volatility persists. Altcoins fell also as the sentiment shifted towards risk assets. Ethereum, Solana and BNB posted losses between 3% and 5% over the same period. Total crypto market cap dropped by more than $110 billion over the last 12 hours.

Despite Friday’s drop, Bitcoin closed July with its highest monthly close ever at $115,790, according to TradingView. The largest monthly candle is notably around Trump’s victory for his second innings as President, and that surge contrasts with today’s cautious tone, even amid strong long-term momentum.

The current sell-off could be a shakeout. Market participants are likely to remain defensive until more macro and regulatory clarity emerges. The leverage is also high and it remains probable to expect more volatility in the days to come. The path forward may depend on how quickly trade and monetary policy stabilize in the coming weeks.

The post Bitcoin Price Drops Amid Tariff Tensions and Fed Silence appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

NEAR Price Up 3.97% as Network Upgrades Spur Short-Term Optimism

- NEAR token surged 3.97% to $2.527 on Aug 28 2025, but remains down 666.67% in 7 days and 4870.75% year-over-year. - Price rebound driven by new smart contract tools and cross-chain upgrades, set for full deployment by mid-September. - Partnership with enterprise software firm aims to expand NEAR's identity verification use cases beyond traditional blockchain. - 15% weekly rise in dApp users from gaming/social platforms suggests short-term stabilization, though long-term recovery remains uncertain.

LINK +159.8% in 24 Hours Amid Strategic Ecosystem Expansion

- Chainlink (LINK) surged 159.8% in 24 hours on Aug 28, 2025, amid ecosystem expansion plans for cross-chain smart contract execution. - The Q4 2025 initiative aims to enhance oracle network accuracy and latency by integrating new data feeds and off-chain sources. - Technical analysis links the price breakout to completed validator node upgrades improving scalability and transaction costs. - Analysts highlight VRF integration in DeFi apps as a key driver for increased LINK demand in insurance and supply ch

H100 Group's Bitcoin Treasury Strategy: A Blueprint for European Corporate Resilience in Turbulent Times

- H100 Group, a Swedish healthtech firm, allocates 46% of reserves to Bitcoin ($108M) as an inflation hedge while advancing AI-driven longevity research. - Its Bitcoin treasury strategy, combined with $54M in 2025 financing, fueled a 40% stock price surge and funds blockchain-based healthcare innovations. - By linking Bitcoin's volatility to healthtech R&D, H100 creates a self-sustaining model where digital assets protect capital for long-term medical breakthroughs. - European peers like Sequans Communicat

Pendle Finance's $10B TVL Surge: A Strategic Inflection Point in DeFi Yield Markets

- Pendle Finance's $10B TVL surge reflects institutional-grade yield innovation via PT/YT tokenization and v2 AMM upgrades, attracting both retail and institutional capital. - Cross-chain expansion to Solana/TON and Citadels' TradFi alignment create $3.36B USDe pools, bridging DeFi with structured returns and regulatory compliance. - Boros' $183M notional volume and 14.5% stablecoin yields demonstrate Pendle's paradigm shift in tradable yield markets, outperforming CD20 by 340% in 7 days. - Analysts projec