Pendle Finance's $10B TVL Surge: A Strategic Inflection Point in DeFi Yield Markets

- Pendle Finance's $10B TVL surge reflects institutional-grade yield innovation via PT/YT tokenization and v2 AMM upgrades, attracting both retail and institutional capital. - Cross-chain expansion to Solana/TON and Citadels' TradFi alignment create $3.36B USDe pools, bridging DeFi with structured returns and regulatory compliance. - Boros' $183M notional volume and 14.5% stablecoin yields demonstrate Pendle's paradigm shift in tradable yield markets, outperforming CD20 by 340% in 7 days. - Analysts projec

The decentralized finance (DeFi) landscape has long been a theater of innovation and volatility, but Pendle Finance's recent Total Value Locked (TVL) surge to $10 billion marks a pivotal moment. This leap—21% in just two weeks—reflects not merely a technical feat but a strategic redefinition of how yield markets operate in a world increasingly shaped by institutional-grade infrastructure and cross-chain scalability. For investors, the question is no longer whether Pendle can sustain this momentum but how it will reshape the broader DeFi ecosystem.

Institutional-Grade Yield Innovation: Bridging TradFi and DeFi

Pendle's core innovation lies in its yield tokenization model, which splits yield-bearing assets into Principal Tokens (PTs) and Yield Tokens (YTs). This mechanism allows users to trade or lock in fixed yields, addressing a critical pain point in DeFi's historically volatile environment. The v2 upgrade to Pendle's automated market maker (AMM) further enhanced capital efficiency and reduced impermanent loss risks, making it a magnet for both retail and institutional capital.

The Ethena Labs' USDe stablecoin pool, with a TVL of $3.36 billion, exemplifies this shift. USDe offers a 14.5% annualized yield on stablecoins, a proposition that has attracted capital from Aave's expanded deposit caps and institutional players seeking structured returns. This is not speculative gambling—it is the institutionalization of DeFi, where yield is no longer a byproduct of risk but a structured, tradable asset.

Pendle's Citadels initiative, a layer-2 solution aligned with regulatory standards, has further accelerated this trend. By enabling seamless integration with TradFi systems, Citadels have attracted capital from entities wary of DeFi's regulatory ambiguity. This alignment with compliance-ready infrastructure is a game-changer, positioning Pendle as a bridge between the two worlds.

Cross-Chain Scalability: Expanding the Capital Pool

Pendle's cross-chain expansion to Solana , HyperEVM, and TON has unlocked new capital pools and improved composability with other DeFi protocols. The EIP-5115 standardization, which enhances interoperability, has allowed Pendle to tap into non-EVM ecosystems, broadening its user base and liquidity sources. This is not just about technical compatibility—it is about creating a network effect that transcends chain boundaries.

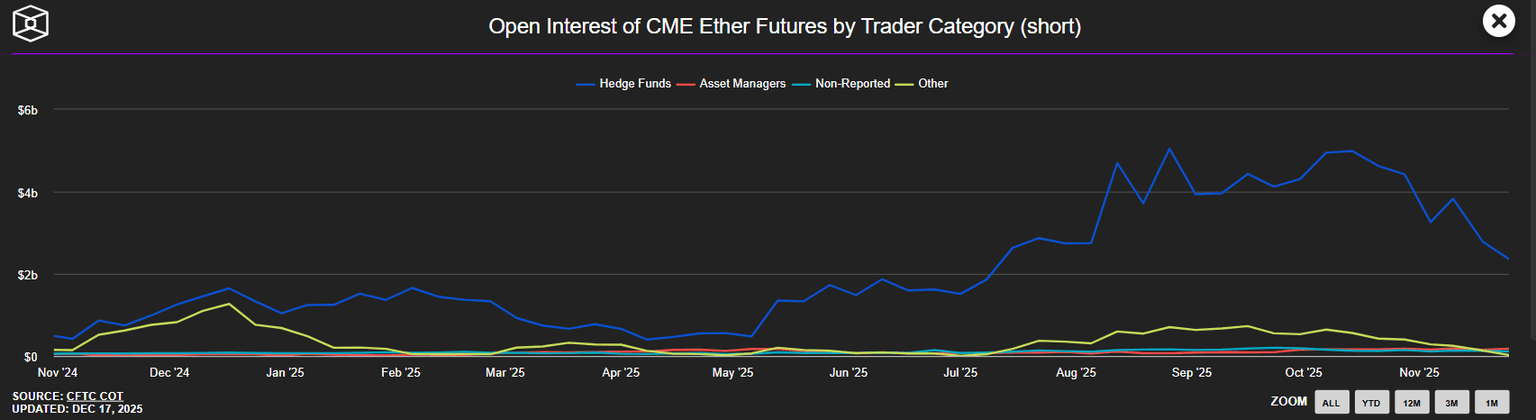

The Boros platform, launched in August 2025, underscores this vision. By introducing Yield Units (YUs) for interest rate trading, Pendle has tapped into a $150 billion+ market in perpetual futures. Early metrics—$35 million in daily open interest and $183 million in notional volume in its first week—highlight the platform's rapid adoption. This innovation is not incremental; it is a paradigm shift in how yield is traded, hedged, and leveraged.

Macro Tailwinds and Market Dynamics

Pendle's TVL surge coincides with a $198 billion perpetual futures market and rising demand for fixed-income alternatives. As macroeconomic volatility persists, investors are increasingly seeking structured returns, and Pendle's tokenomics—55 million staked tokens, 600,000 weekly emissions, and a 5% revenue share for vePENDLE holders—create a flywheel effect that incentivizes long-term participation.

The native token, PENDLE, has surged 45% to $5.6 in the past week, outperforming the CoinDesk 20 (CD20) index, which rose 13.15% over the same period. This disparity suggests undervaluation, as the platform's infrastructure supports a growing share of DeFi's yield market. Analysts project a $15 price target by year-end, implying a 175% return from its August 2025 peak.

Risks and Rewards: A Calculated Bet

While Pendle's trajectory is compelling, risks remain. Regulatory uncertainty and the sustainability of high-yield pools are valid concerns. However, the platform's strategic alignment with TradFi standards and its focus on utility-driven tokens mitigate these risks. For investors, the key is to balance exposure: Pendle should constitute 60–70% of a diversified DeFi portfolio, prioritizing tokens with clear utility over speculative assets.

Conclusion: A New Era in DeFi

Pendle's $10 billion TVL milestone is more than a number—it is a testament to the maturation of DeFi. By combining institutional-grade yield innovation with cross-chain scalability, Pendle is redefining the boundaries of decentralized finance. For investors, the opportunity lies in recognizing this inflection point and positioning for a future where yield is not a gamble but a structured, tradable asset. The question is no longer whether Pendle will succeed but how quickly it will consolidate its leadership in a market primed for evolution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Price Prediction: Liquidations Increase, ETH Short Positions Decrease

Revolutionary Move: Brazil’s B3 Exchange to Launch Major Tokenization Platform in 2026

Traders ponder a bottom as Bitcoin falls back to this week's lows below $86,000