H100 Group's Bitcoin Treasury Strategy: A Blueprint for European Corporate Resilience in Turbulent Times

- H100 Group, a Swedish healthtech firm, allocates 46% of reserves to Bitcoin ($108M) as an inflation hedge while advancing AI-driven longevity research. - Its Bitcoin treasury strategy, combined with $54M in 2025 financing, fueled a 40% stock price surge and funds blockchain-based healthcare innovations. - By linking Bitcoin's volatility to healthtech R&D, H100 creates a self-sustaining model where digital assets protect capital for long-term medical breakthroughs. - European peers like Sequans Communicat

In an era of relentless inflation, geopolitical uncertainty, and volatile markets, European corporations are scrambling to find new ways to preserve capital and future-proof their balance sheets. Enter H100 Group, a Swedish health technology pioneer that's rewriting the playbook with its bold Bitcoin Treasury Strategy. By allocating a significant portion of its reserves to Bitcoin while doubling down on AI-powered longevity research, H100 is not just surviving—it's thriving. For investors, this dual approach offers a masterclass in strategic capital preservation and long-term value creation.

The Bitcoin Play: A Hedge Against Fiat's Decline

H100's Bitcoin strategy is rooted in a simple yet profound insight: Bitcoin is the ultimate inflation hedge. As of July 2025, the company holds 957.5 BTC, valued at approximately $108 million, with an average acquisition cost of $110,500 per BTC. This isn't a speculative bet—it's a calculated move to protect shareholder value in a world where central banks are printing money at an unprecedented rate.

The company's capital raises have been equally aggressive. In July 2025, H100 secured $54 million through equity and debt financing, with $11.46 million from a directed share issue at SEK 7.82 per share. These funds are being funneled into Bitcoin purchases and healthtech R&D, creating a flywheel effect: Bitcoin's appreciation bolsters the company's financial flexibility, while R&D advancements drive operational growth. The result? A 40% surge in stock price following its first Bitcoin acquisition in May 2025—a clear signal that the market is rewarding this forward-thinking approach.

Healthtech as the Engine of Value Creation

While Bitcoin provides financial resilience, H100's core business—AI-driven longevity research—is where the magic happens. The company is leveraging its Bitcoin treasury to fund cutting-edge projects in personalized healthcare, including blockchain-based data control mechanisms and AI-powered wellness platforms. This isn't just about treating illness; it's about redefining how we age and manage chronic conditions.

The strategic link between Bitcoin and healthtech is symbiotic. By insulating its balance sheet from currency devaluation, H100 can invest more confidently in R&D without being shackled by short-term financial pressures. For example, the SEK 750 million convertible loan led by Blockstream CEO Adam Back allows the company to settle in Bitcoin, giving it flexibility to allocate capital where it's needed most. This hybrid model—digital assets + health innovation—positions H100 as a leader in the next wave of corporate finance.

A European Trendsetter in a Global Shift

H100 isn't alone in its Bitcoin ambitions. European firms like Sequans Communications (3,170 BTC, $352.89 million) and French Blockchain Group (2,218 BTC, $246.98 million) are following suit, signaling a broader institutional shift. However, H100's integration of Bitcoin with healthtech sets it apart. While others treat Bitcoin as a speculative asset, H100 views it as a strategic reserve that funds real-world innovation.

This approach is particularly compelling in the healthtech sector, where R&D cycles are long and capital-intensive. By diversifying its treasury into Bitcoin, H100 mitigates the risk of fiat currency erosion, ensuring that its investments in AI and longevity research remain viable even in a high-inflation environment. The company's 46% allocation of corporate reserves to Bitcoin as of July 2025 underscores its commitment to this model.

Risks and Rewards: A Balanced Perspective

No strategy is without risks. Bitcoin's volatility remains a double-edged sword—while its long-term appreciation is compelling, short-term swings could test investor patience. Additionally, H100's convertible loan structure carries the potential for 16.7% equity dilution if fully converted, a trade-off for securing capital. However, the company's disciplined approach—averaging $1.07 million per Bitcoin transaction and maintaining transparent weekly disclosures—mitigates these risks.

For investors, the key is to focus on the long-term horizon. H100's Bitcoin holdings have grown from 4.39 BTC in May 2025 to 957.5 BTC today, a trajectory that mirrors the company's operational progress. As AI and blockchain continue to disrupt healthcare, H100's dual strategy could unlock exponential value.

The Investment Case: A Model for the Future

H100 Group's Bitcoin Treasury Strategy is more than a financial tactic—it's a blueprint for corporate resilience in the 21st century. By combining Bitcoin's inflation-hedging properties with healthtech innovation, the company is creating a self-sustaining ecosystem where digital assets fund real-world impact.

For investors seeking exposure to both the digital asset revolution and the healthcare boom, H100 offers a unique opportunity. Its transparent capital allocation, institutional backing (including Adam Back's SEK 492.3 million investment), and alignment with macroeconomic trends make it a compelling addition to a diversified portfolio.

In a world where traditional treasuries are losing ground to inflation, H100's approach proves that strategic diversification isn't just possible—it's necessary. As Europe's first publicly listed company to embrace Bitcoin as a core treasury asset, H100 is not just surviving the storm—it's building an ark.

Final Takeaway: H100 Group's Bitcoin Treasury Strategy is a masterclass in capital preservation and long-term value creation. For investors with a 5–10 year horizon, this is a company to watch—and potentially own. The future of corporate finance is here, and it's being written in Bitcoin and AI.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

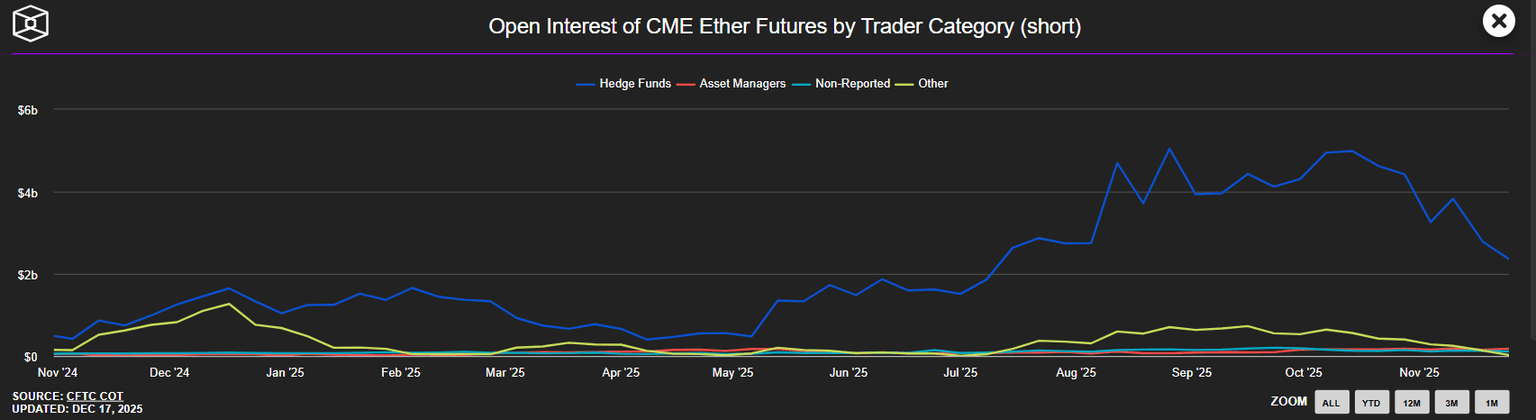

Ethereum Price Prediction: Liquidations Increase, ETH Short Positions Decrease

Revolutionary Move: Brazil’s B3 Exchange to Launch Major Tokenization Platform in 2026

Traders ponder a bottom as Bitcoin falls back to this week's lows below $86,000