- Stellar’s price dropped under its 10-day SMA, signaling bearish sentiment unless the level is reclaimed soon.

- XLM’s early July breakout above the 10-day SMA sparked a sharp rally, but momentum is fading fast.

- The 10-day SMA now acts as resistance, creating pressure for Stellar to regain upward structure or face deeper pullbacks.

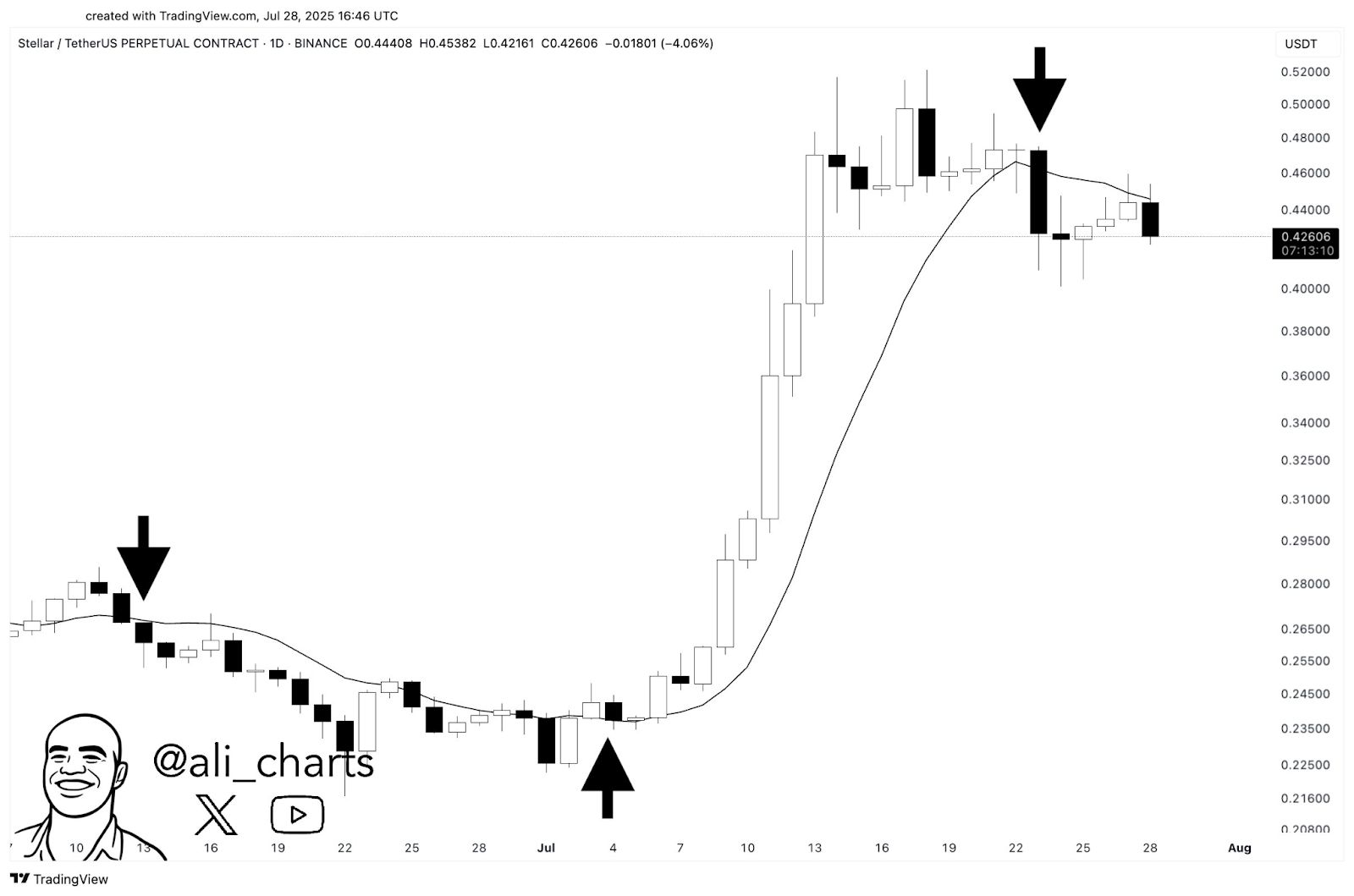

The Stellar (XLM) asset has fallen below its key 10-day Simple Moving Average (SMA) and with it has come doubts over its recent uptrend. The shift comes after a strong rally through July that now faces pressure as price action weakens.

XLM Loses 10-Day SMA Support, Raising Bearish Risk

Stellar has breached its 10-day SMA, a level that held firm during its powerful rally earlier this month. This drop introduces potential short-term downside risks unless bulls regain control and push above the moving average.

The current chart, shared by @ali_charts, shows a sharp candle close below the 10-day SMA after a steady uptrend. This shift suggests selling pressure is intensifying, and bullish momentum may be fading. If price remains below this level, further corrections are likely.

Source: ali via X

Source: ali via X

July Rally Fueled by SMA Breakout Could Face Reversal

In early July, XLM surged after breaking above the 10-day SMA, a move that triggered rapid gains and market optimism. Price moved from $0.25 to over $0.50, signaling strong accumulation and technical strength.

The trend has now reversed with a breakdown below the same moving average. This development shifts sentiment to cautious, as traders await confirmation of either recovery or extended pullback. The breakout zone now becomes the battleground for bulls and bears.

Current Market Position Reflects Uncertainty Amid Support Loss

The most recent close below the 10-day SMA implies resistance now stands at this moving average level. Historical behavior during similar breaks suggests further downside unless price reclaims the level soon.

XLM is trading at $0.4361 as of writing, on Raydium CLMM, slightly down by 0.12% over the past 24 hours. While price holds within the upper range of July, this move below dynamic support leaves the trend vulnerable to deeper retracement.