The price of PUMP, the native cryptocurrency of the Solana-based launchpad Pump.fun, plunged over 20% on Wednesday, extending its two-week decline to more than 50%, after Pump.fun co-founder Alon Cohen confirmed that the project’s highly anticipated airdrop will not occur in the near future.

The token’s price dropped 23% below $0.0030, a steep reversal from its post-launch peak of $0.011. Daily trading volume cratered 66%, signaling a dramatic loss of confidence among holders.

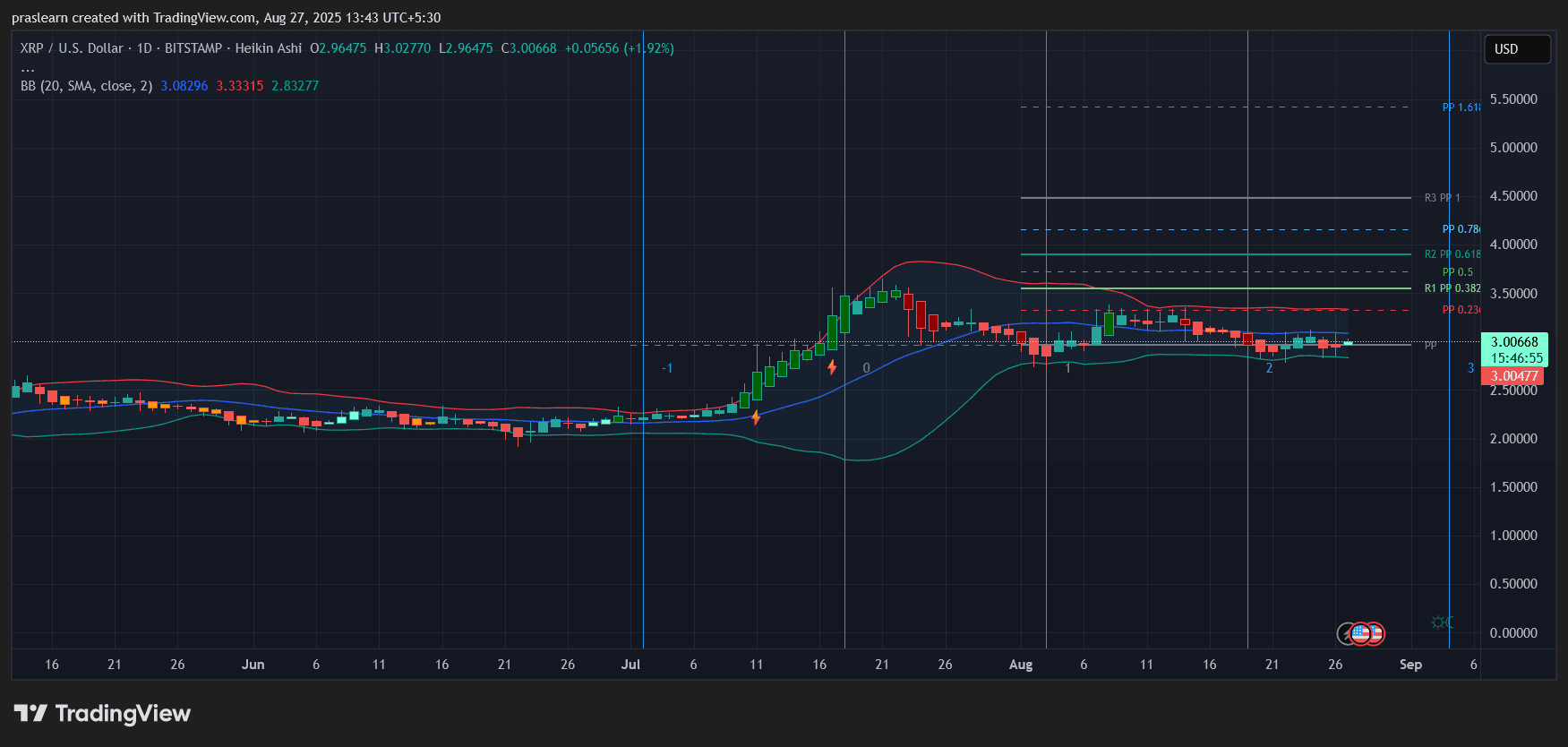

PUMP price drops following the airdrop cancellation announcement. Source: CoinMarketCap

PUMP price drops following the airdrop cancellation announcement. Source: CoinMarketCap

The market reaction was swift. Cohen’s July 24 interview, in which he emphasized the team’s focus on long-term development rather than immediate rewards, triggered a 17% intraday plunge and knocked PUMP out of the top 100 cryptocurrencies by market capitalization.

Sponsored

The liquidation locked in a combined $1.19 million in realized losses, further fueling panic.

But momentum has since evaporated.

Airdrop uncertainty, slowing platform activity, and mounting competition from rival launchpads like LetsBonk have pushed PUMP, and the broader meme coin sector into retreat. The meme coin market has declined by over 2.3% in the past 24 hours, according to CoinMarketCap.

Why This Matters

PUMP’s decline illustrates how delays in key events, such as airdrops, can quickly impact token prices. It also signals waning investor confidence in speculative meme coins and a potential shift in sentiment across Solana’s ecosystem.

Dig deeper into DailyCoin’s popular crypto news:

Ethereum Unstaking Queue Is Skyrocketing – Why?

Are NFTs Back? SoSoValue NFT Index Inks 300% Growth

People Also Ask:

PUMP is the native token of Pump.fun, a Solana-based meme coin launchpad focused on experimental and community-driven token launches.

An airdrop is a distribution of free tokens to wallet holders, usually as a reward or promotional effort by a project.

Yes, the team has stated an airdrop is planned, but there is no confirmed timeline for when it will occur.

Users can create a token with just a few clicks. The platform automatically generates a bonding curve and liquidity pool on Solana.

While the platform simplifies token creation, it’s highly experimental and speculative. Users should exercise caution and understand the risks.