XRP Holding $3… But For How Long if Bitcoin Keeps Falling?

XRP price is holding steady around the $3 mark, but storm clouds are gathering over the broader crypto market. Bitcoin has slipped below $109,000, and economist Peter Schiff is warning that a deeper slide toward $75,000 could be next. With U.S. political drama shaking confidence in the Federal Reserve and investors closely watching the September rate decision, XRP’s short-term outlook is tightly linked to Bitcoin’s fate. If BTC weakens further, XRP could quickly lose its current support zone.

XRP Price Prediction: Schiff’s Warning and Its Ripple Effect

Peter Schiff, one of Bitcoin’s most persistent critics, is once again warning that BTC may be on the verge of a deeper correction. In his latest remarks, Schiff said Bitcoin could fall as low as $75,000 after dropping below $109,000 this week, a 13% decline from its recent high. His logic is simple: with corporate buyers already heavily invested, such sharp pullbacks raise red flags about broader market stability. If Bitcoin follows that path, XRP and other altcoins will almost certainly feel the pressure.

Macro Backdrop: Political Uncertainty and Market Confidence

Adding to the uncertainty, U.S. politics has been heating up. President Trump’s removal of Federal Reserve Governor Lisa Cook created questions about central bank independence just as the Fed prepares for a possible rate cut in September. While equities brushed off the drama, with the Dow, S&P, and Nasdaq all posting small gains, crypto markets are far more sensitive to Fed credibility and interest rate expectations. A sudden policy shift could strengthen or weaken the dollar, and either scenario would ripple across XRP’s price action.

XRP Price Prediction: Range-Bound but Vulnerable

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

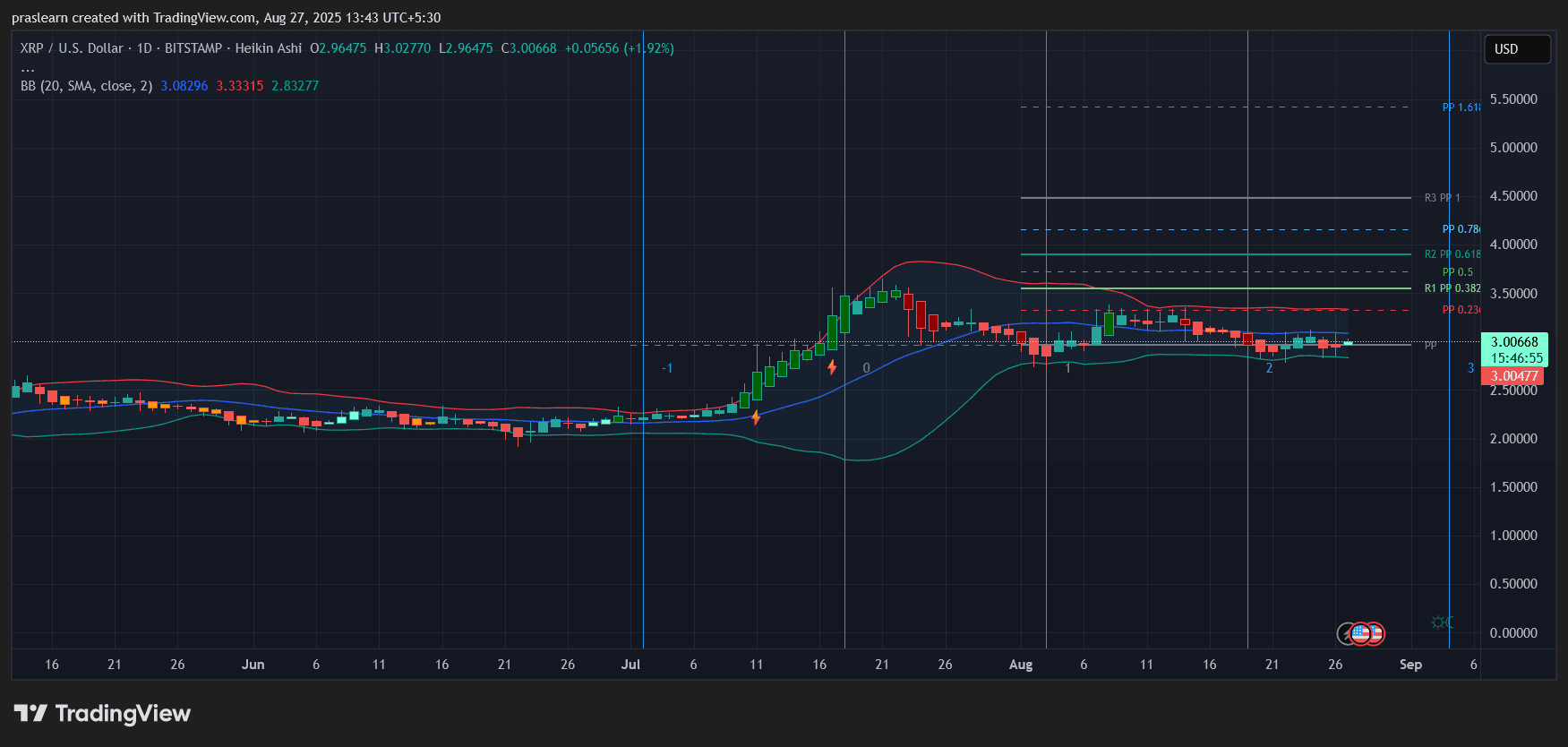

Looking at the daily XRP chart, the price is hovering just above $3.00, consolidating after its July rally. The Bollinger Bands are tightening, showing reduced volatility, while the mid-band at $3.08 is acting as short-term resistance. The recent attempt to climb higher failed near $3.33, a key barrier that also aligns with the R1 Fibonacci pivot.

If Bitcoin keeps sliding, XRP price could break below its $2.80–$3.00 support zone, opening the door to deeper retracements around $2.50. On the upside, bulls would need a breakout above $3.35 to retest the $3.80 zone, with $4.00 as the next psychological milestone.

Short-Term Outlook: Bitcoin Dictates the Trend

The truth is, XRP’s near-term trajectory is tethered to Bitcoin’s behavior. If BTC finds support above $100,000 and stabilizes, XRP may defend the $3.00 level and gradually recover. But if Schiff’s $75,000 target materializes, $XRP will likely revisit sub-$3.00 levels and struggle to regain momentum.

The current macro and technical setup favors caution. While stocks are climbing, crypto markets remain fragile under the shadow of Fed politics and Schiff’s bearish warning on Bitcoin. For $XRP holders, the $3.00 support is the line in the sand. A confirmed $BTC rebound could fuel another leg higher, but another sharp Bitcoin drop will almost certainly drag XRP down with it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain-Driven GDP Reporting: A New Era for Economic Forecasting and Fintech Innovation

- U.S. Department of Commerce plans to publish GDP data on blockchain, leveraging its tamper-proof, decentralized architecture to enhance transparency and data integrity. - Blockchain-enabled real-time GDP reporting reduces data lag and noise, enabling dynamic forecasting models and faster policy responses compared to traditional delayed reports. - The initiative creates investment opportunities for fintech firms (e.g., IBM, Snowflake) and MLaaS providers (e.g., AWS, Google Cloud) in blockchain infrastruct

AI Agent Platforms: The Next Frontier in Search Disruption and Recall's Strategic Edge

- Recall.ai disrupts traditional search by transforming real-time meeting data into contextual intelligence via its "Meeting Bots as a Service" platform. - The API-first model enables enterprises to integrate AI-driven transcription, sentiment analysis, and interactive features like Output Media for automated workflows. - With $10M ARR and 300+ enterprise clients, Recall's usage-based pricing and vertical-specific solutions position it as a scalable AI infrastructure leader in the $12B transcription market

Solana's $300 Target Amid Volatility and Emerging BlockDAG Competition: A Contrarian Play on High-Growth Crypto Assets

- Solana (SOL) faces a critical juncture in 2025 amid volatility, with a $195.99 price and 24.80% annual gain despite regulatory risks and BlockDAG's 15,000 TPS challenge. - Institutional adoption ($1.72B invested by 13 firms) and upcoming Firedancer upgrades aim to boost scalability, while a potential 2025 ETF approval could drive SOL toward a $300 target. - BlockDAG's $385M presale and 2,900% early returns highlight disruption risks, but Solana's 4,500+ developers and 65,000 TPS edge maintain its DeFi/NF

Meta's Political Playbook in AI Regulation: Reshaping Tech's Competitive Landscape and Investment Horizons

- Meta's 2025 political strategy leverages super PACs and lobbying to weaken AI regulations, targeting California bills like SB 53 and SB 942. - The company's $64-72B AI infrastructure spending and NVIDIA partnerships drive 50% revenue growth for hardware suppliers. - Google and Microsoft pursue similar deregulatory goals but emphasize ESG commitments, creating sector-wide sustainability gaps. - Federal investigations and state transparency laws pose risks, while infrastructure investments position Meta to