JPMorgan's 100 million dollar investment plan in Ethereum has been launched, but the market is not buying it.

JPMorgan has taken another decisive step in the field of blockchain finance.

According to The Wall Street Journal, the world's largest bank by market capitalization has announced the launch of its first tokenized money market fund. MONY is built on the Ethereum blockchain.

The bank will use $100 millions of its own funds as seed capital for the fund. External investors are expected to begin subscribing from December 16.

This move demonstrates growing confidence in Ethereum [ETH] as an institutional-grade financial infrastructure.

Institutional Confidence Matches Cautious Market Flows

Although JPMorgan's move has boosted optimism about Ethereum's future, its short-term performance has triggered mixed signals.

Despite the increasing number of participating whales and institutions, net inflows into Ethereum ETFs remain negative, with $224 millions worth of ETH withdrawn from the market.

This means that even as new financial products continue to emerge on-chain, some large institutional wallets are still net sellers. In fact, this has led to short-term price optimism seemingly being curbed by risk management.

Ethereum Exchange Activity Triggers Various Complex Signals

On-chain exchange data adds another layer of meaning to the hesitant ETF inflow issue.

Over the past three days, funds flowing into exchanges for Ethereum have steadily increased, which is often a potential sign of an early accumulation phase.

However, in the past 24 hours, inflows have sharply dropped by $700,000, stabilizing at $382,000.

Overall, the inflow trend remains positive. CryptoQuant's average inflow data shows a positive development trend, with the average inflow rising from 35 ETH to 42 ETH over the same period.

Supply Continues to [Surge]

Meanwhile, Ethereum's circulating supply continues to trend upward.As of press time, the total supply of ETH stands at 121.44 million, reflecting ongoing issuance.

Unless demand also accelerates, the expanding supply may limit short-term price rallies.

Institutional issuances like MONY, coupled with the recent surge in whale activity, may help demand grow gradually rather than immediately.

Final Thoughts

- JPMorgan has injected $100 millions of internal funds into its first Ethereum-based tokenized money market fund.

- Despite institutional developments, on-chain indicators are sending ambiguous signals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lark Davis says Chainlink is "much better" than XRP.

Decentraland Price Prediction 2026-2030: Can MANA Finally Reach the Elusive $1 Milestone?

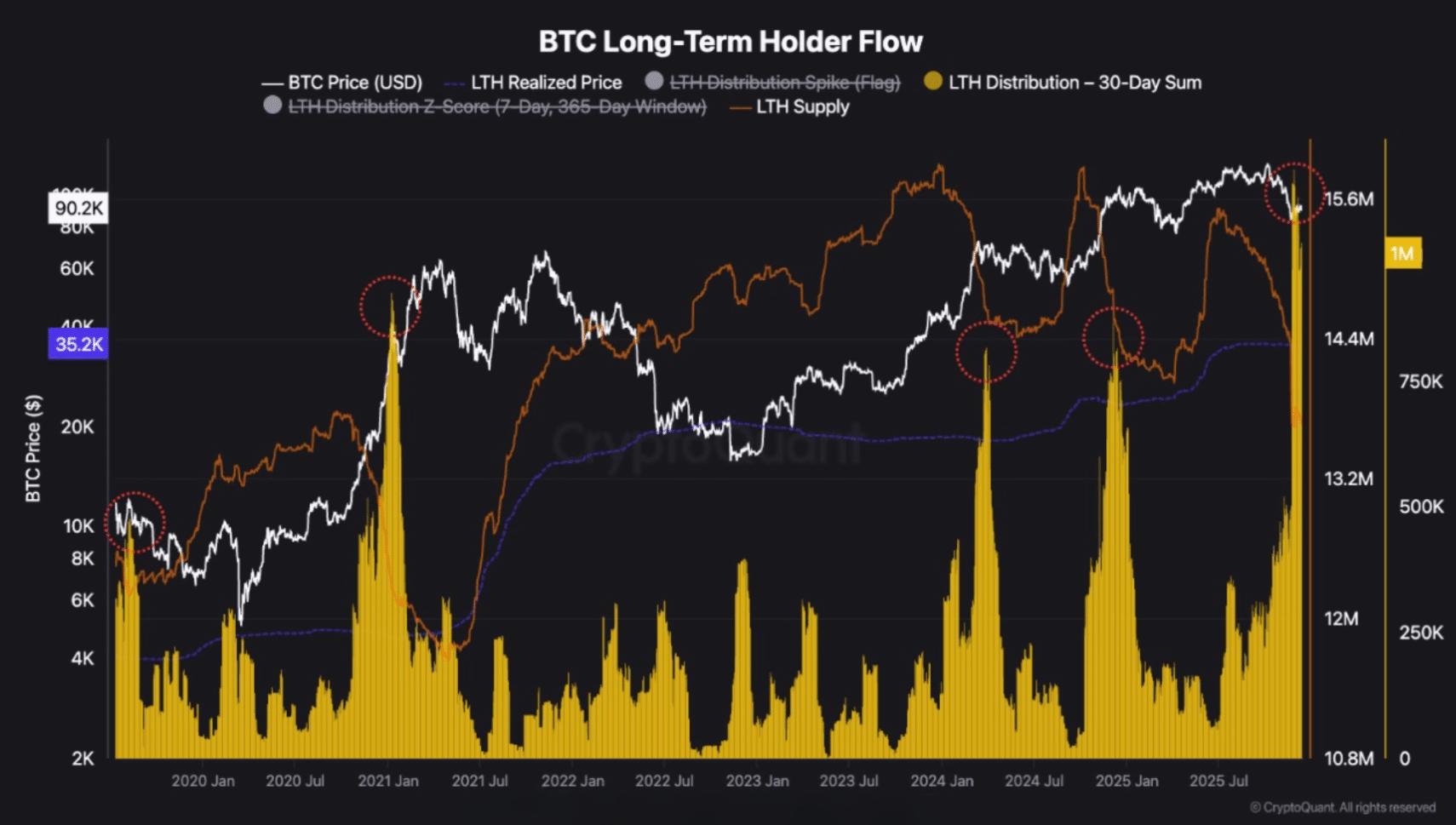

Bitcoin ETFs See Another $277 Million Outflow with Long-Term Holders Selling